European stock market indices are rallying today with all major benchmarks trading over 1% higher. UK FTSE 100 (UK100) is top performer with a 2% gain. German DAX and French CAC40 (FRA40) add 1.3% each while Spanish IBEX (SPA35) is a laggard with 0.8% gain. Meanwhile, EUR is taking a hit but the move is driven mostly by USD strength. There was no major news that could justify a strong upward move after the launch of the cash trading session. It looks like expectations of a significant slowdown in German inflation are driving equity markets higher, as it could allow the ECB to ease its hawkish stance. State-level readings from Bavaria, Brandenburg, Hesse and North-Rhine Westphalia all showed a significant deceleration in December with scale of drop suggesting that 9.1% median estimate for German release at 1:00 pm GMT is conservative and a downside surprise may be on the cards.

German state-level CPI readings for December

- North Rhine Westphalia: 8.7% YoY vs 10.4% YoY previously

- Bavaria: 9.2% YoY vs 10.9% YoY previously

- Brandenburg: 9.1% YoY vs 10.5% YoY previously

- Hesse: 8.1% YoY vs 9.7% YoY previously

- Saxony: 8.7% YoY vs 9.9% YoY previously

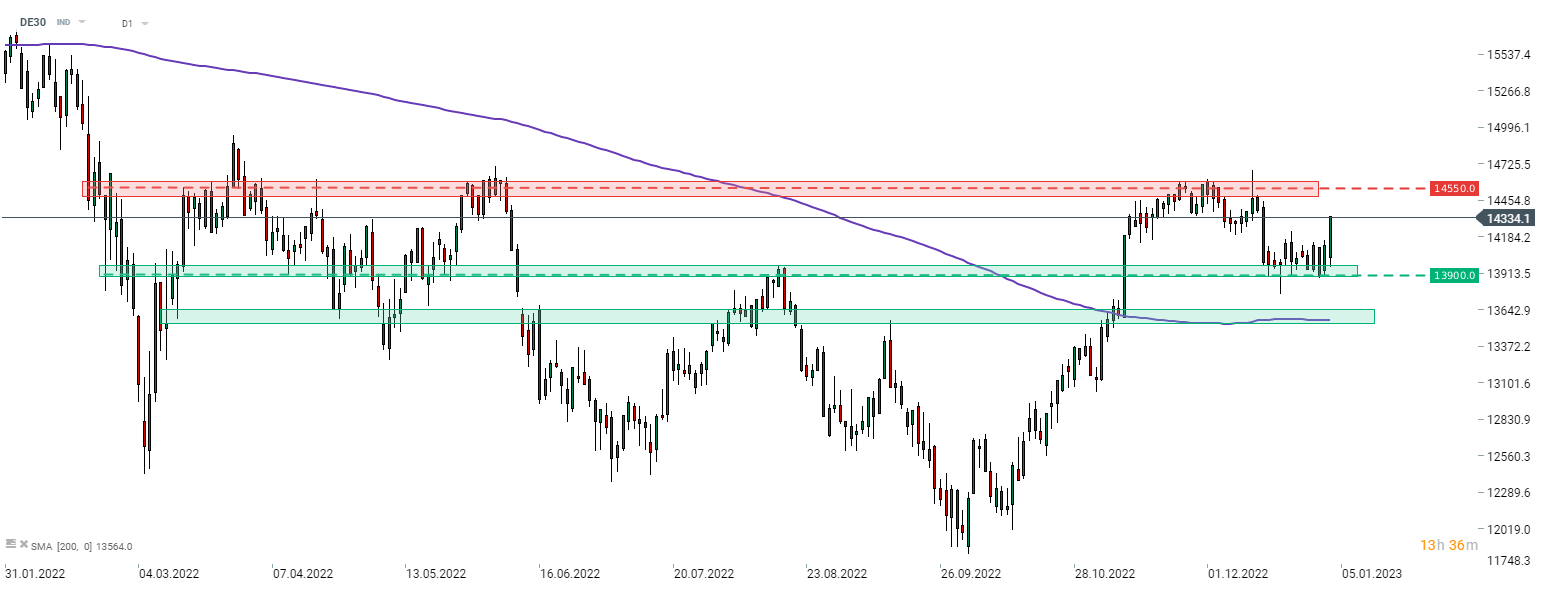

German DAX is rallying today with lower CPI readings from Germany helping support sentiment. DE30 bounced off the 13,900 pts support zone and is now looking towards a test of the 14,550 pts resistance zone, marked with recent highs as well as previous price reactions. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street