Upbeat moods can be spotted all across the Old Continent on Tuesday with major stock market indices from Europe trading over 2% higher at press time. This comes after a solid Wall Street and Asian session, which saw major indices from those regions trade 2-3% higher as well.

Improvement in moods on the stock market is accompanied by drop in yields, with 10-year market rate dropping below 3.60%. A factor that may also be contributing to easing of market tensions is that we are past quarter's end, a period that often sees significant rebalancing flows from investment funds. Markets, at least for now, look past worrying media reports from the banking sector, that hint at a possibility of a failure of a global bank (Credit Suisse).

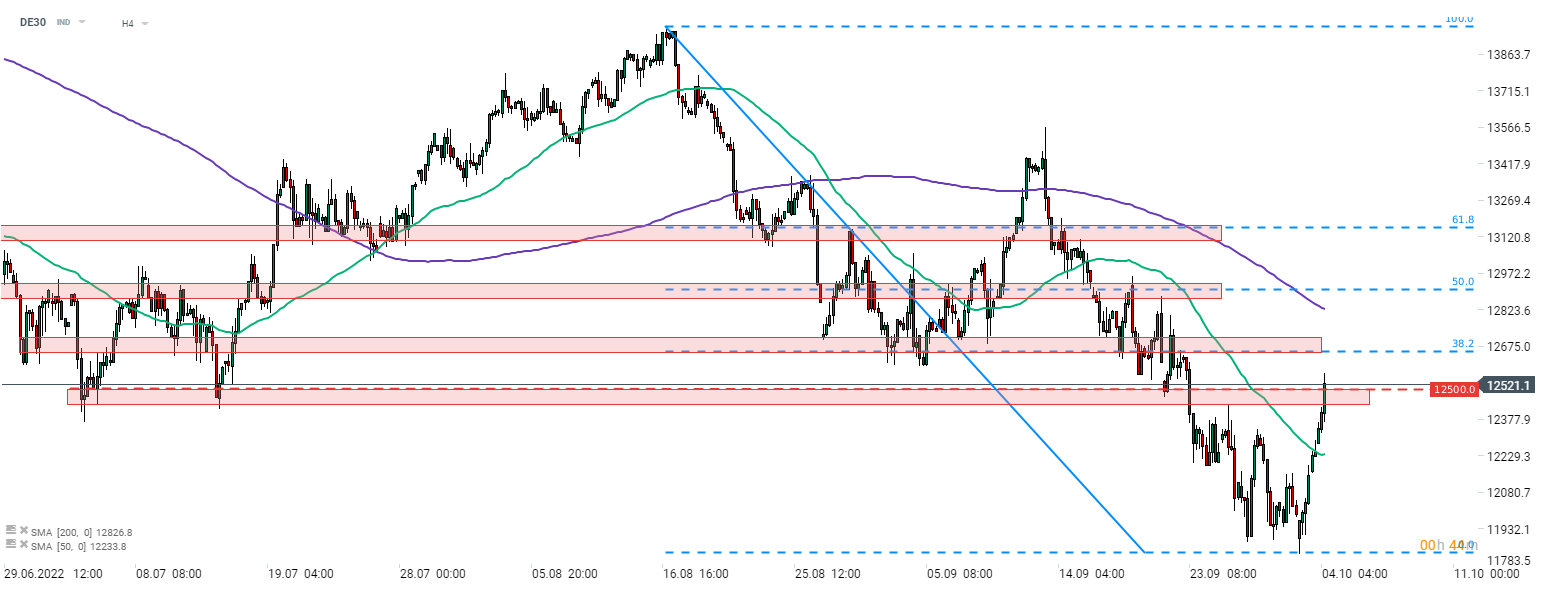

German DAX (DE30) is trading almost 2.5 higher today and is making a break above the 12,500 pts mark for the first time in a week-and-a-half. Source: xStation5

German DAX (DE30) is trading almost 2.5 higher today and is making a break above the 12,500 pts mark for the first time in a week-and-a-half. Source: xStation5

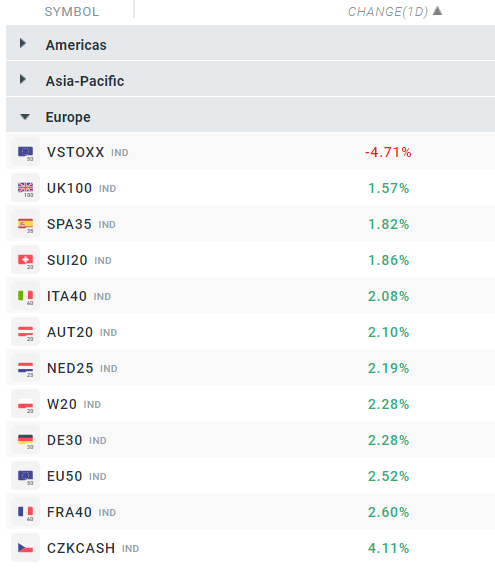

Strong gains can be spotted all across the Old Continent with a simultaneous drop in Euro Stoxx volatility index (VSTOXX). Source: xStation5

Strong gains can be spotted all across the Old Continent with a simultaneous drop in Euro Stoxx volatility index (VSTOXX). Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes