At 7:00 PM BST, the Federal Reserve will announce its decision on U.S. interest rates. For weeks, the market has been aligned on a 25bp cut — the first since the last reduction from 4.75% to 4.5% in December 2024. Speculation around a potential “jumbo cut” of 50bp is also rising by the minute, though even such a move could be taken as a potentially hawkish signal for the final months of Powell’s term.

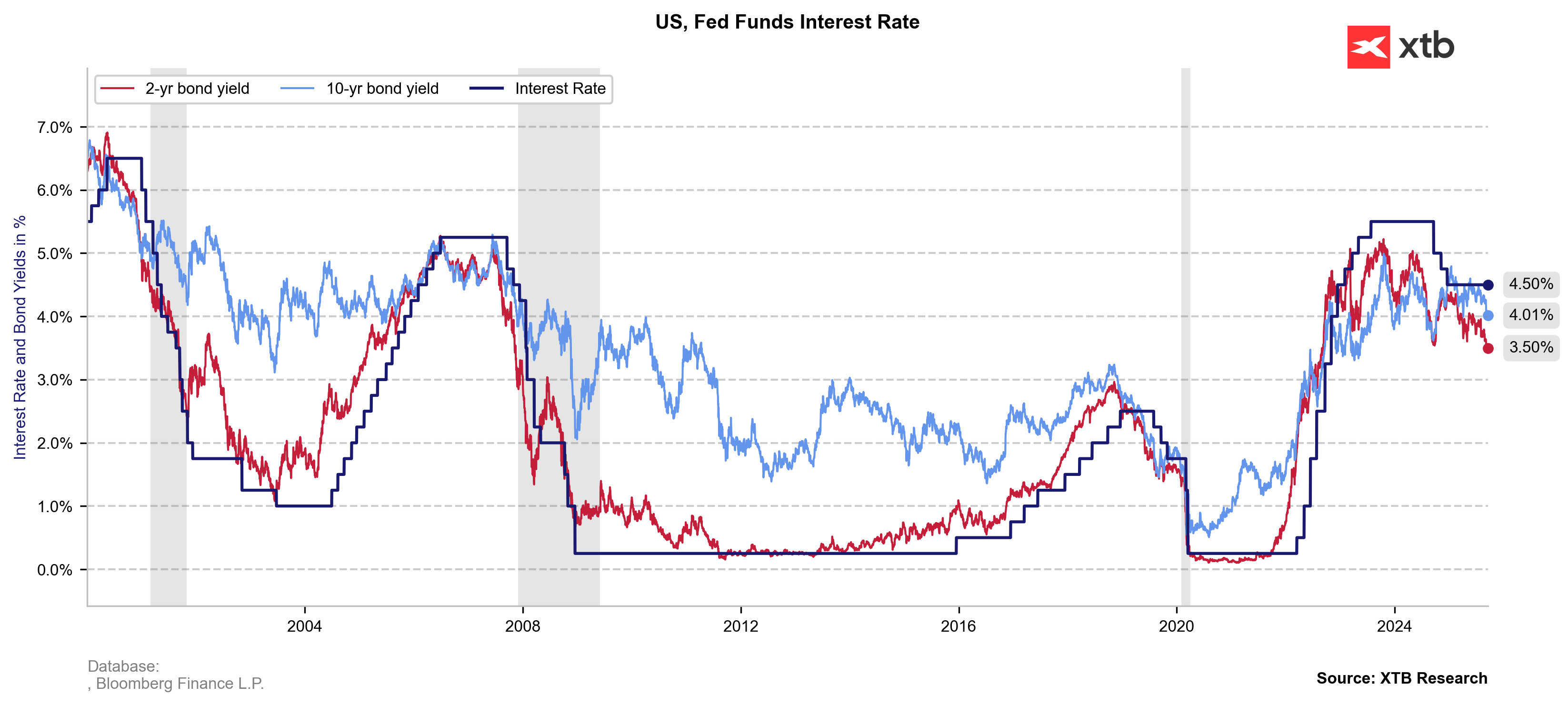

Bond yields have clearly moved into defensive mode, pointing to very strong expectations of a return to rate cuts in the U.S. Excluding the sharp drop after Liberation Day, U.S. 10-years are at their lowest since November 2024. Source: XTB Research, Bloomberg data

What to expect from today’s FOMC:

-

The Fed is likely to cut rates by 25bp to the 4.00–4.25% range for the first time since December 2024. The cut would come in response to a string of weaker labor market data that require recalibration of monetary policy to prevent rising unemployment amid elevated business uncertainty.

-

The September FOMC is also expected to show deepening divisions within the Fed. Donald Trump’s new nominee to the Board of Governors, Stephen Miran, will likely support a “jumbo cut” of 50bp, reflecting the president’s economic agenda. Meanwhile, Jeffrey Schmid of Kansas has voiced support for leaving rates unchanged, citing elevated food price growth that could strongly influence inflation expectations among low- and middle-income consumers. A first break from consensus in years occurred at the last meeting, when Michelle Bowman and Christopher Waller voted in favor of a cut.

-

The official monetary policy statement should acknowledge rising risks from employment. The current phrase “labor market conditions remain solid” is likely to give way to a mention of slower job growth. On the other hand, references to “somewhat elevated inflation” and “low unemployment” should remain unchanged, with the Fed remaining attentive to risks on both sides of its mandate.

-

Alongside the rate decision, the Fed will also release updated forecasts for key macro variables. Consensus calls for an upward revision of core PCE inflation from 3% to 3.1%, while keeping GDP (1.4%) and unemployment (4.5%) forecasts unchanged for 2025.

-

Despite dovish market expectations, the September cut could take on a hawkish tone, highlighting the distant goal of price stability and still historically low unemployment. If Powell does not emphasize labor market weakness more than he did in Jackson Hole (i.e., the risk that slower job growth could quickly turn into a crisis under an external shock), and if inflation is framed as still rising rather than a transitory problem, then even a 50bp cut could be seen as preemptive insurance for the months ahead.

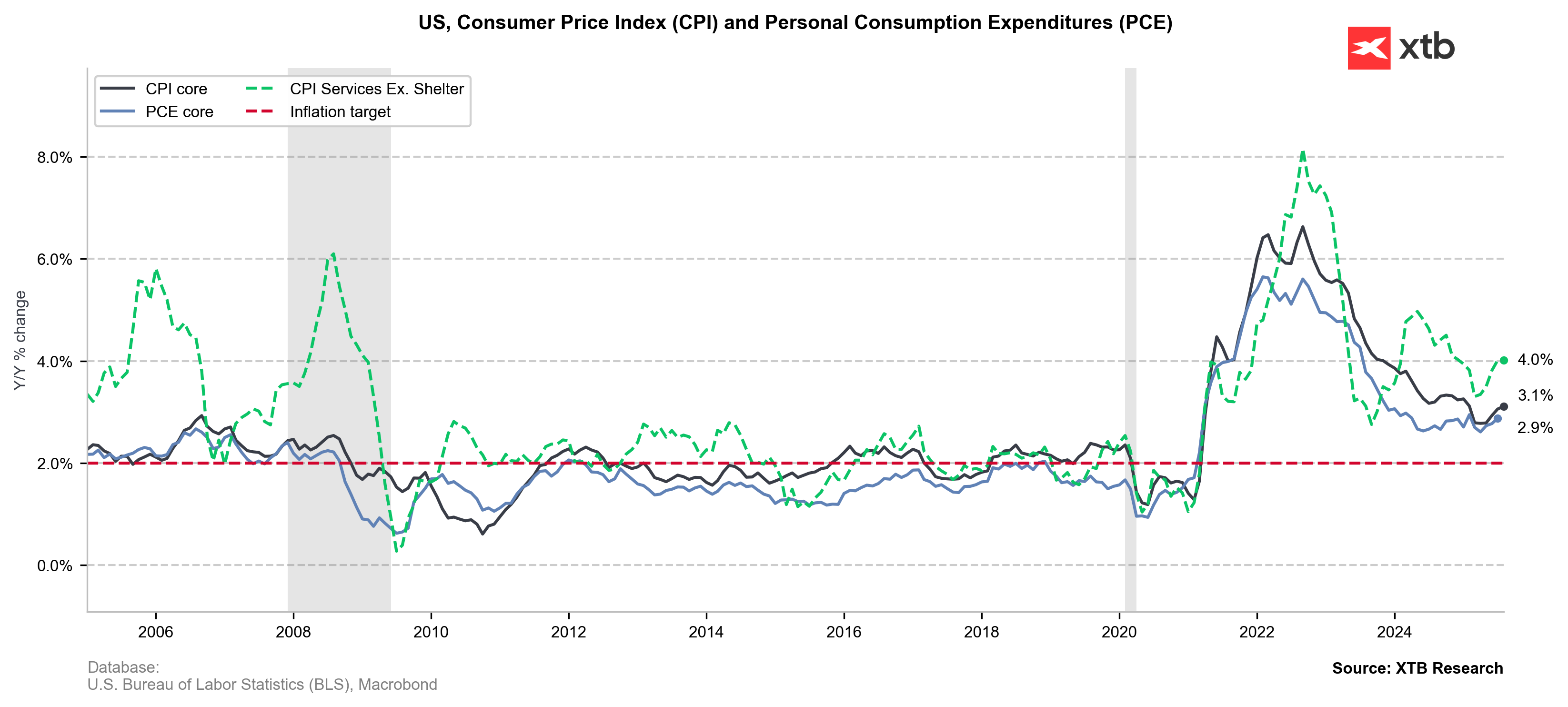

CPI inflation rose in August in line with expectations, driven largely by services price growth unrelated to tariffs. Source: XTB Research, Macrobond data

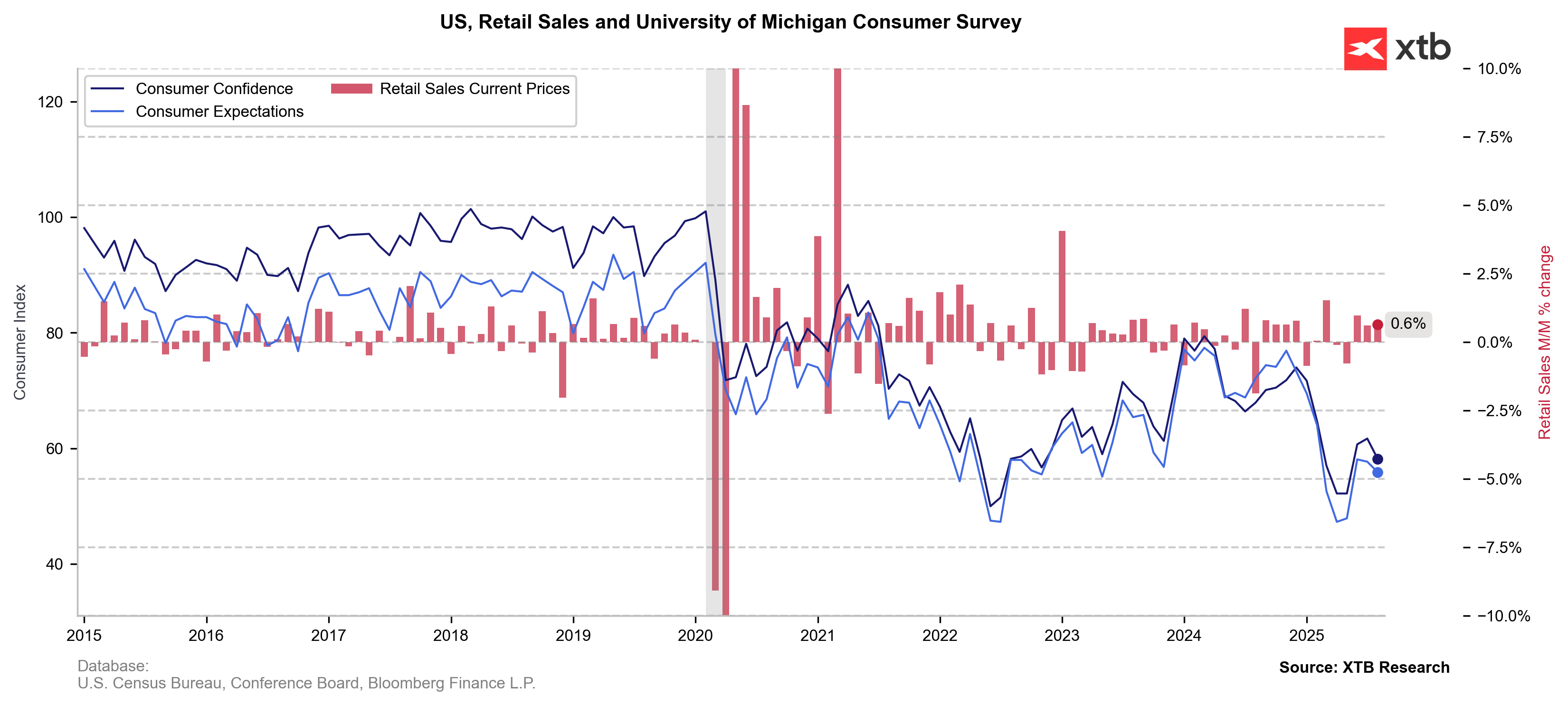

Yesterday’s retail sales data came in far above expectations (0.6% m/m vs. 0.1% forecast), pointing to surprising consumer resilience despite the clear drop in labor demand and the general trend of “fewer hires, more layoffs.” The sales increase spanned a wide range of sectors despite post-tariff price hikes, which should raise caution among the Fed’s hawkish members. Source: XTB Research, Macrobond data

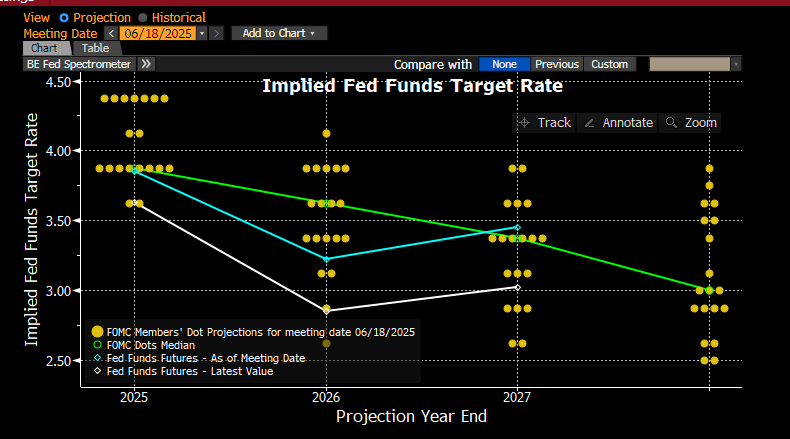

According to Bloomberg Economics, the September dot plot is expected to shift lower, though keeping the median 2025 cuts unchanged (another −50bp, rate at 3.75%). Out of 19 FOMC members, 12 are expected to support further cuts (1 cut: 9 votes, 2 cuts: 2 votes, 4 cuts: 1 vote — Miran). The chart shows the last FOMC dot plot with current futures pricing (gray). Source: Bloomberg

USDIDX (H1)

The dollar remains weak, with declines accelerating in recent days. Markets expect a Fed pivot and a return to monetary easing at upcoming meetings, starting today. The dollar is currently rebounding 0.16%, but this is a reaction to yesterday’s 0.75% selloff and support above 91.1000 points. Elevated volatility should be expected after today’s decision and during the press conference, with the tone of the press conference being key for the continuation or reversal of the current trend.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause