EURUSD is trading around 1% lower on the day with EUR being one of the worst performing G10 currencies today. Common currency dropped following release of disappointing flash PMIs from France and Germany for June. French services PMI dropped from 52.0 to 48.0, meaning that the sector was contracting. Meanwhile, German manufacturing PMI dropped to 41.0 - the lowest level since May 2020. In both cases, readings were much weaker than expected.

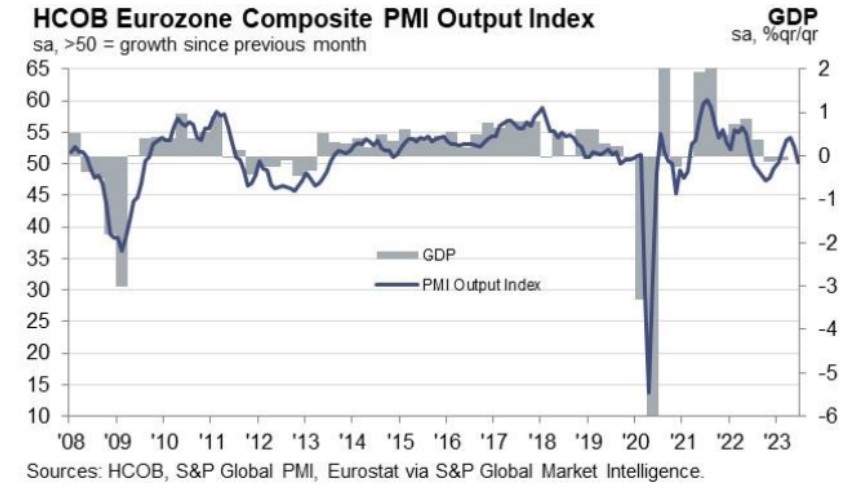

Composite PMI for the whole euro area dropped from 52.8 to 50.3 while the market expected a small drop to 52.5 pts. This means that euro area PMI is currently projecting a flat GDP growth and should it continue to slide further it may point to a risk of technical recession.

Should hard data like industrial production or retail sales start to reflect concerns of entrepreneurs, European Central Bank may have to rethink its hawkish stance, which currently suggests two more rate hikes this year. Moreover, US dollar is benefiting from hawkish comments made by Fed Chair Powell earlier this week, who has clearly hinted that two more rate hikes in the United States are the base case scenario for now.

Composite PMI for the euro area suggests that technical recession cannot be ruled out. Source: S&P Global, HCOB

EURUSD breaks below the upward trendline today and snaps a current uptrend structure by painting a lower low. The pair is also testing 50% retracement of the whole upward impulse launched at the beginning of June. The next important support in-line can be found in the 1.08 area. Source: xStation5

Economic calendar: Eurozone CPI and central bankers speeches in focus

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing