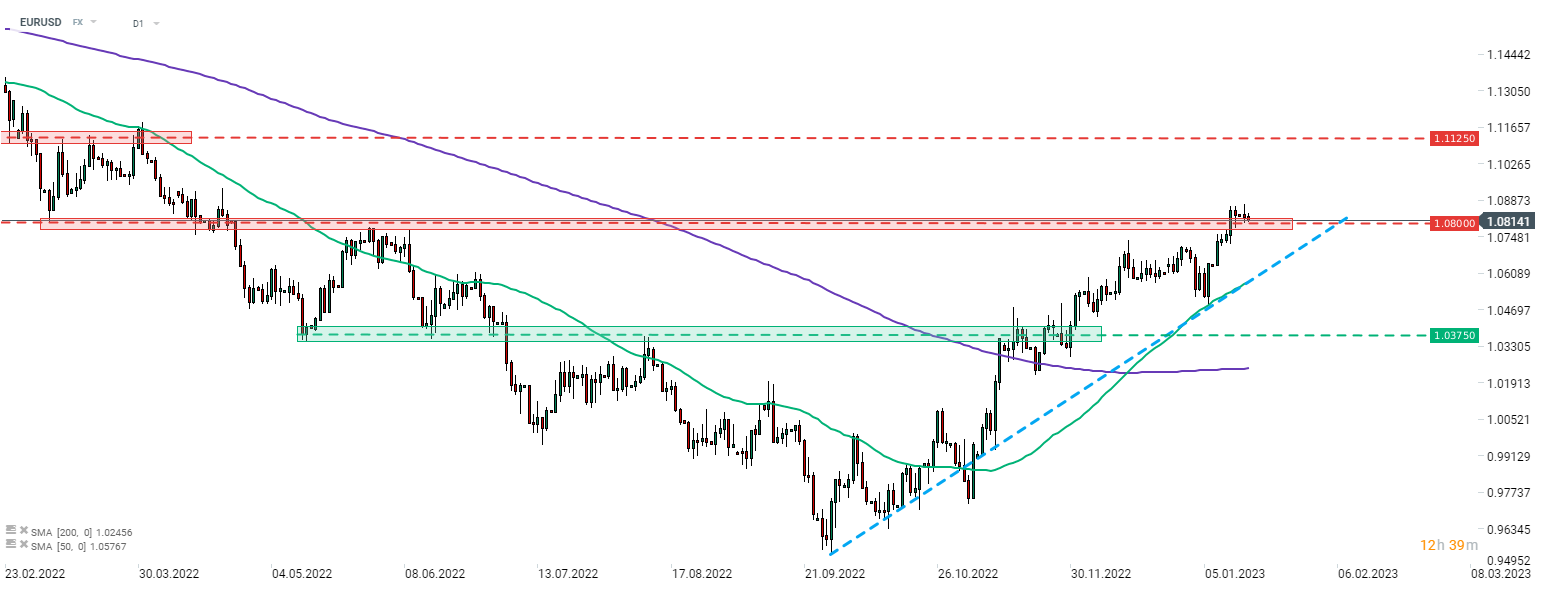

EURUSD climbed above the 1.08 mark last week, reaching the highest level since late-April 2022. However, the pair began to struggle after US CPI data release for December (Thursday, January 12) and has erased part of the previous gains. EURUSD continued to move lower in the following days and threatened to break back below the 1.08 mark. However, German ZEW data for January came to the rescue. ZEW expectations subindex leap from -23.3 to 16.9 (exp. -15.0). This was the fourth month of increases in a row and the expectations subindex is now sitting at the highest level since February 2022 (launch of Russian invasion of Ukraine). Situation looks less rosy when it comes to the Current Situation sub index as it has moved from -61.4 to -58.6 (exp. -57.0).

Solid beat in German ZEW expectations data helps EURUSD avoid a drop back below 1.08 mark. Source: xStation5

Solid beat in German ZEW expectations data helps EURUSD avoid a drop back below 1.08 mark. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)