Summary:

-

German and US inflation both come in below forecast

-

EURUSD builds on gains from Powell speech

-

Bullish engulfing on D1 but price remains shy of key resistance

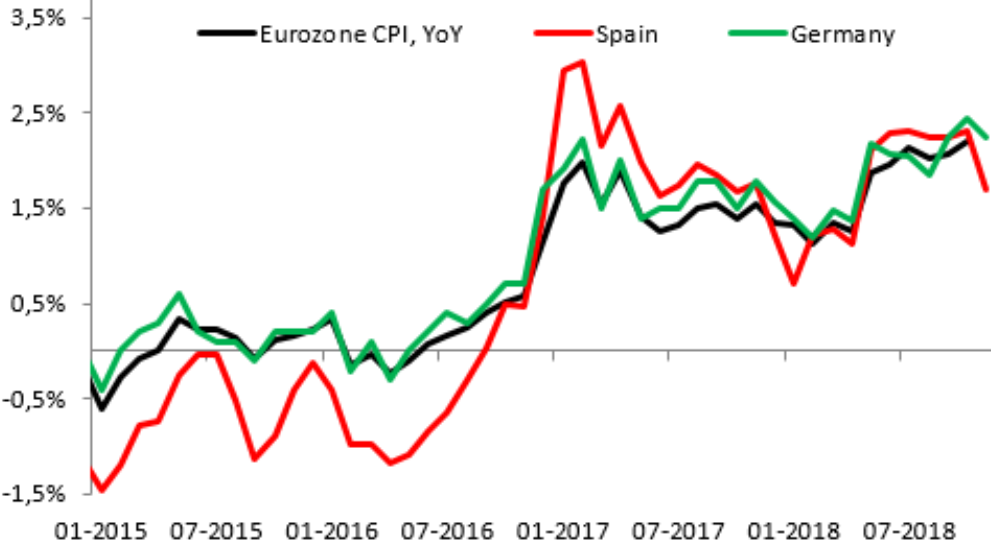

This afternoon has seen the release of the latest inflation figures from both sides of the Atlantic, with readings in both the US and Germany coming in below forecasts. First off, Germany saw the preliminary CPI print for November fall to 2.3% Y/Y from 2.5% previously, below the 2.4% expected. Looking at the core or harmonised numbers a similar pattern is evident with the 2.2% increase Y/Y vs 2.3% expected and 2.4% previously. Earlier today the latest information on price press pressures from Spain was released with a large drop to 1.7% from 2.3% seen against consensus forecasts for 2.0%. Tomorrow the Eurozone wide CPI is due out at 10AM and traders may well be preparing themselves for a disappointment given the figures seen from Germany and Spain today.

Both Spanish and German CPI fell this month in what could be seen as a strong indication that the Eurozone wide number due out tomorrow could be expected to soften. Source: XTB Macrobond

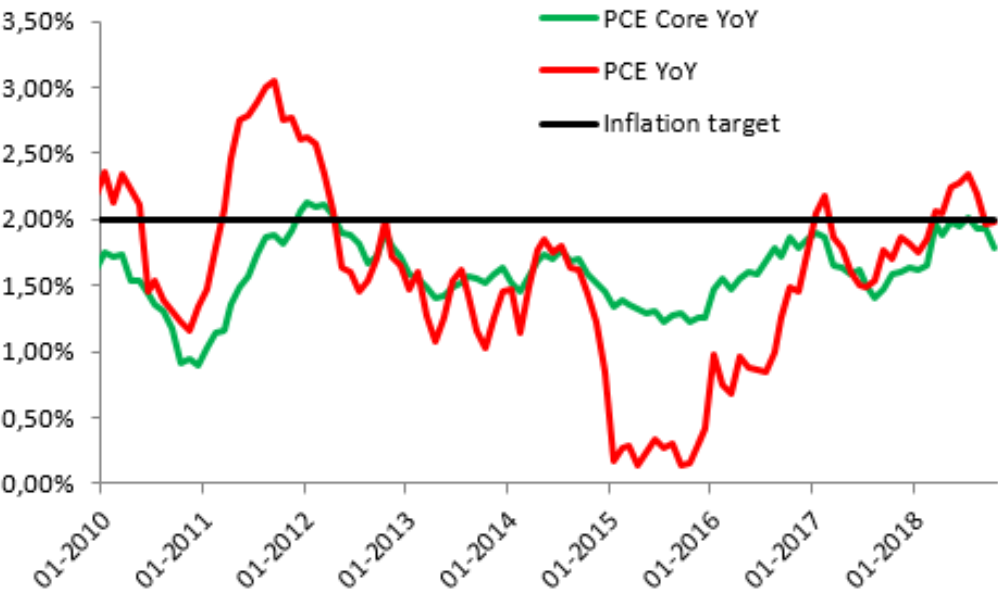

Not longer after the German data, we got the latest look at inflation from North America with the US October PCE core inflation falling to 1.8% compared to 1.9% expected. This was down on last month’s 1.9% which itself has been revised lower from 2.0%. This data seem to indicate that inflationary pressures in the US have eased of late. The PCE core is seen as the Fed’s preferred measure of inflation and you do have to wonder whether chair Powell saw these numbers before delivering his dovish speech in New York yesterday.

US inflation fell back lower in the latest release and this could well have played a role in Fed chair Powell delivering a decidedly dovish speech in New York yesterday. Source: XTB Macrobond

US inflation fell back lower in the latest release and this could well have played a role in Fed chair Powell delivering a decidedly dovish speech in New York yesterday. Source: XTB Macrobond

When Powell claimed that the bank were “just below” neutral levels in his speech it was clearly taken as a dovish surprise by the markets with the US dollar experiencing a swoon across the board. The EURUSD wa snot far from its lowest level of the day when the remarks hit the wires and promptly rallied around 100 pips. This led to a bullish engulfing candle printing on D1 and a longer term inverse head and shoulders may be developing. A possible neckline could be seen at 1.1475 and if the market breaches this to the upside then a symmetrical target would be found at 1.1735.

The EURUSD may be carving out a bottom after printing a bullish engulfing candlestick on D1 yesterday. Possible inverse S-H-S could be developing with a neckline at 1.1475. Source: xStation