Oil giants Chevron (CVX.US) and Exxon Mobil (XOM.US) today presented excellent reports for the third quarter of the year. The results exceeded analysts' already very optimistic expectations. The stocks of both companies gained nearly 3% in pre-opening trade and are pushing to historic highs:

Exxon Mobil

Revenues: $112.07 billion vs. $102.96 billion forecasts

Adjusted earnings per share (EPS): $4.45 vs. $3.89 forecasts

Net income: $19.6 billion vs. $6.7 billion in Q3 2021

Cash flow (cash flow): $27.1 billion

Costs: $86.6 billion (up 35% y/y)

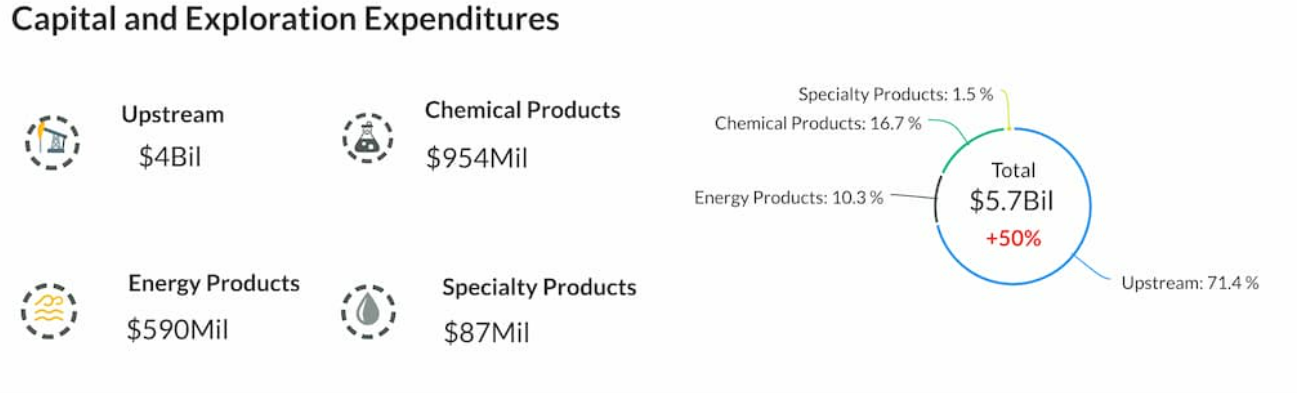

The company increased revenue from upstream (exploration and production) and downstream (production and supply) operations. Source: ExxonMobil

- The company's shareholders will receive a dividend of $0.91 per share on December 9, in the fourth quarter of FY 2022

Chevron

Revenues: $66.64 vs. $61.44 forecasts

Adjusted earnings per share (EPS): $5.56 vs. $4.94 forecasts

Net income: $11.2 billion vs. $11.6 billion in Q2

Downstream revenue: $2.53 billion vs. $1.95 billion forecasts

Upstream revenue: $9.31 billion vs. $8.13 billion forecasts

EPS year-over-year: $5.78 vs. $3.19 in Q3 2021

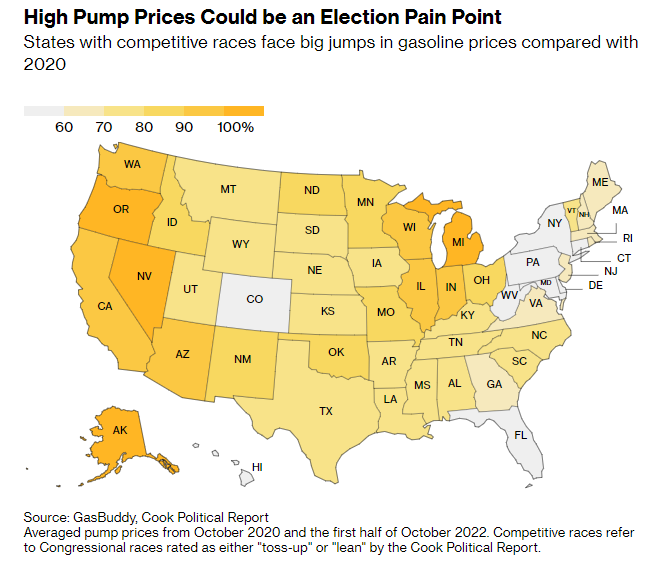

Cash flow: $15.3 billion The average increase in gasoline prices is a major concern for Democrats ahead of the midterms elections for Congress. In the first half of October this year, the scale of the increase exceeded 70% in most US states compared to October 2020. Gasoline became most expensive in the states of Michigan, Oregon and Nevada. Source: GasBuddy, Cook Political Report

The average increase in gasoline prices is a major concern for Democrats ahead of the midterms elections for Congress. In the first half of October this year, the scale of the increase exceeded 70% in most US states compared to October 2020. Gasoline became most expensive in the states of Michigan, Oregon and Nevada. Source: GasBuddy, Cook Political Report ExxonMobil (XOM.US) and Chevron (CVX.US) stock charts, W1 interval. Oil company stocks are highly correlated with oil prices. Higher GDP readings in the economies 'dismiss' to some extent the still lively fears around a global recession. The vision of an economic slowdown is limiting the growth of oil prices. Nevertheless, 'black gold' is already trading near $100, the latest DoE report indicated higher oil reserves and a surprising decline in gasoline and distillate stocks. OPEC+ production cuts may 'help' oil overcome the $100 resistance. The RSI relative strength index indicates levels at 64 points. These levels are far from the RSI's historical peaks, although both companies are trading at ATH. Source: xStation5

ExxonMobil (XOM.US) and Chevron (CVX.US) stock charts, W1 interval. Oil company stocks are highly correlated with oil prices. Higher GDP readings in the economies 'dismiss' to some extent the still lively fears around a global recession. The vision of an economic slowdown is limiting the growth of oil prices. Nevertheless, 'black gold' is already trading near $100, the latest DoE report indicated higher oil reserves and a surprising decline in gasoline and distillate stocks. OPEC+ production cuts may 'help' oil overcome the $100 resistance. The RSI relative strength index indicates levels at 64 points. These levels are far from the RSI's historical peaks, although both companies are trading at ATH. Source: xStation5

Adobe Faces AI and Leadership Change. Record Results, Real Challenges

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chubb to insure ships crossing the Strait of Hormuz 🗽 What does it mean for the company?

Rheinmetall earnings: Formidable growth, but the market expected more