- Although it doesn't design chips or manufacture finished components, none of them would exist without its technology. Lam is the quiet hero of the semiconductor revolution—a company that provides the essential equipment for the precise processing of silicon wafers, the foundation of modern electronics.

- Growing investments in AI infrastructure and the automation of IT processes are driving demand for advanced technological solutions, and Lam Research is seizing this moment to strengthen its position as a key supplier to the data center and semiconductor sectors.

- Although it doesn't design chips or manufacture finished components, none of them would exist without its technology. Lam is the quiet hero of the semiconductor revolution—a company that provides the essential equipment for the precise processing of silicon wafers, the foundation of modern electronics.

- Growing investments in AI infrastructure and the automation of IT processes are driving demand for advanced technological solutions, and Lam Research is seizing this moment to strengthen its position as a key supplier to the data center and semiconductor sectors.

In an era where AI presents new technical challenges for chipmakers, Lam Research not only supplies the tools but also helps set the direction of change. Its technological solutions are essential for giants like TSMC, Samsung, and Micron, and the growing investments in advanced lithography and chip packaging offer it tremendous growth potential.

In this article, we’ll explore Lam Research’s position in the semiconductor supply chain, analyze its financial performance, and assess whether its current valuation reflects its market potential.

Lam Research’s Products and Technologies – The Invisible Heart of the Chip World

Although Lam Research rarely makes headlines in tech media, no modern chip could be made without its machines. The company supplies advanced systems for semiconductor manufacturing, covering everything from forming transistor structures to the final cleaning of wafers. These stages are critical for determining chip performance, density, and energy efficiency.

Etching – Carving Precision into Silicon

Etching is a key step in chip manufacturing, allowing for the precise “carving” of microscopic patterns into the material layers on a silicon wafer. Lam is a leader in etching technologies for 3D NAND and advanced transistor architectures.

Thin Film Deposition (CVD and ALD)

Lam provides systems for applying ultra-thin semiconductor material layers through Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD). These processes enable the creation of precise, uniform coatings essential for the performance of transistors and memory devices.

Wafer Cleaning

After each lithography and etching stage, wafers must be perfectly cleaned of chemical residues, photoresist, and other particles. Lam offers advanced cleaning systems that reduce defects and improve chip yields.

In the age of artificial intelligence and high-throughput data processing, chipmakers must adopt increasingly advanced manufacturing processes. With growing demands for higher density, energy efficiency, and data transmission speeds, traditional approaches are no longer sufficient. This is where Lam Research comes in—one of the few suppliers offering comprehensive solutions for producing AI chips, HBM (High Bandwidth Memory), and advanced semiconductor packaging.

However, Lam Research is more than just a hardware supplier. It’s a technology partner that co-develops production standards alongside the industry's biggest players. With deep know-how and close integration into customers’ processes, Lam helps shape entire generations of semiconductor devices. In a world where every nanometer matters, Lam delivers solutions that are not only precise but often critical for the industry's advancement.

Financial Analysis

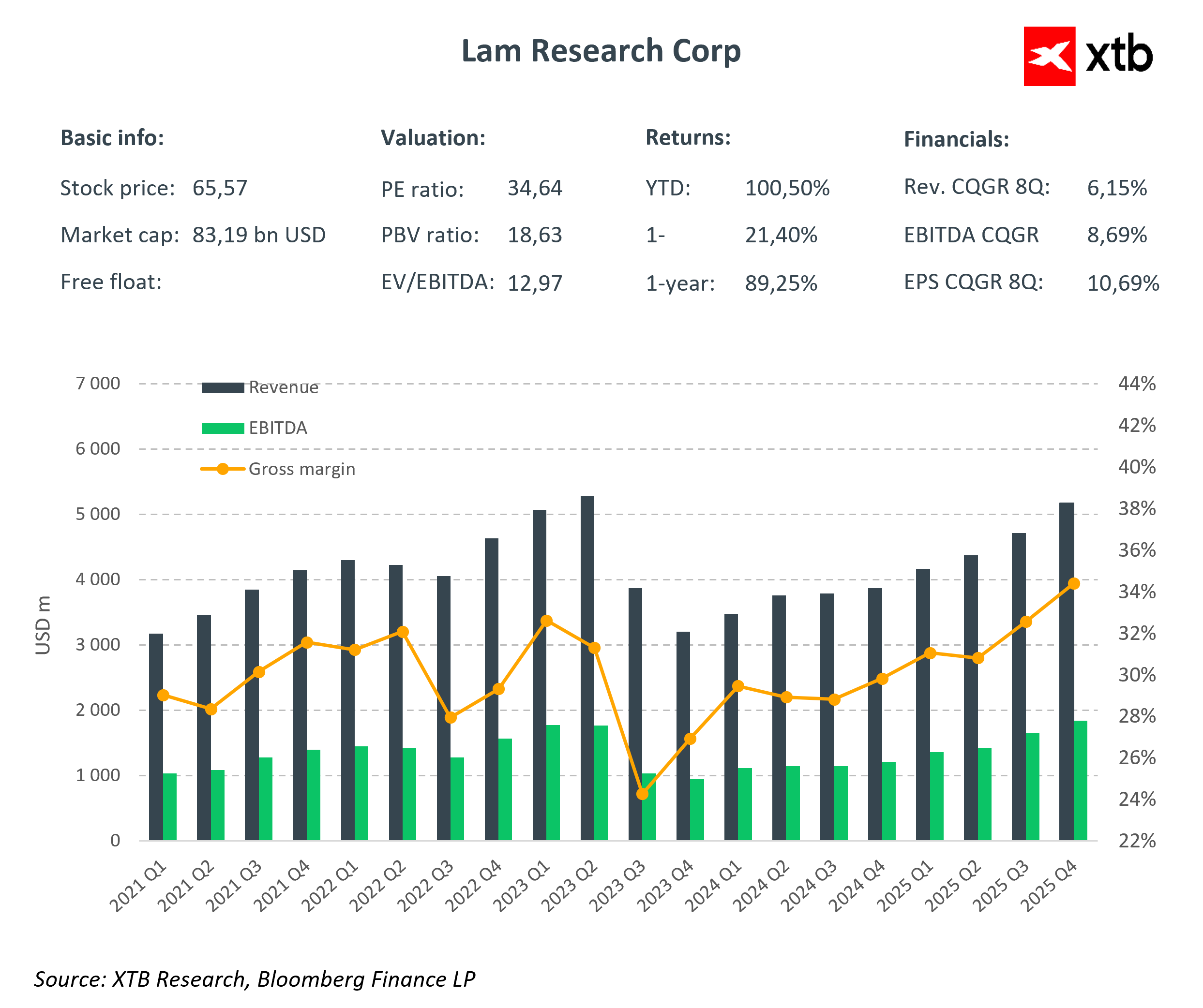

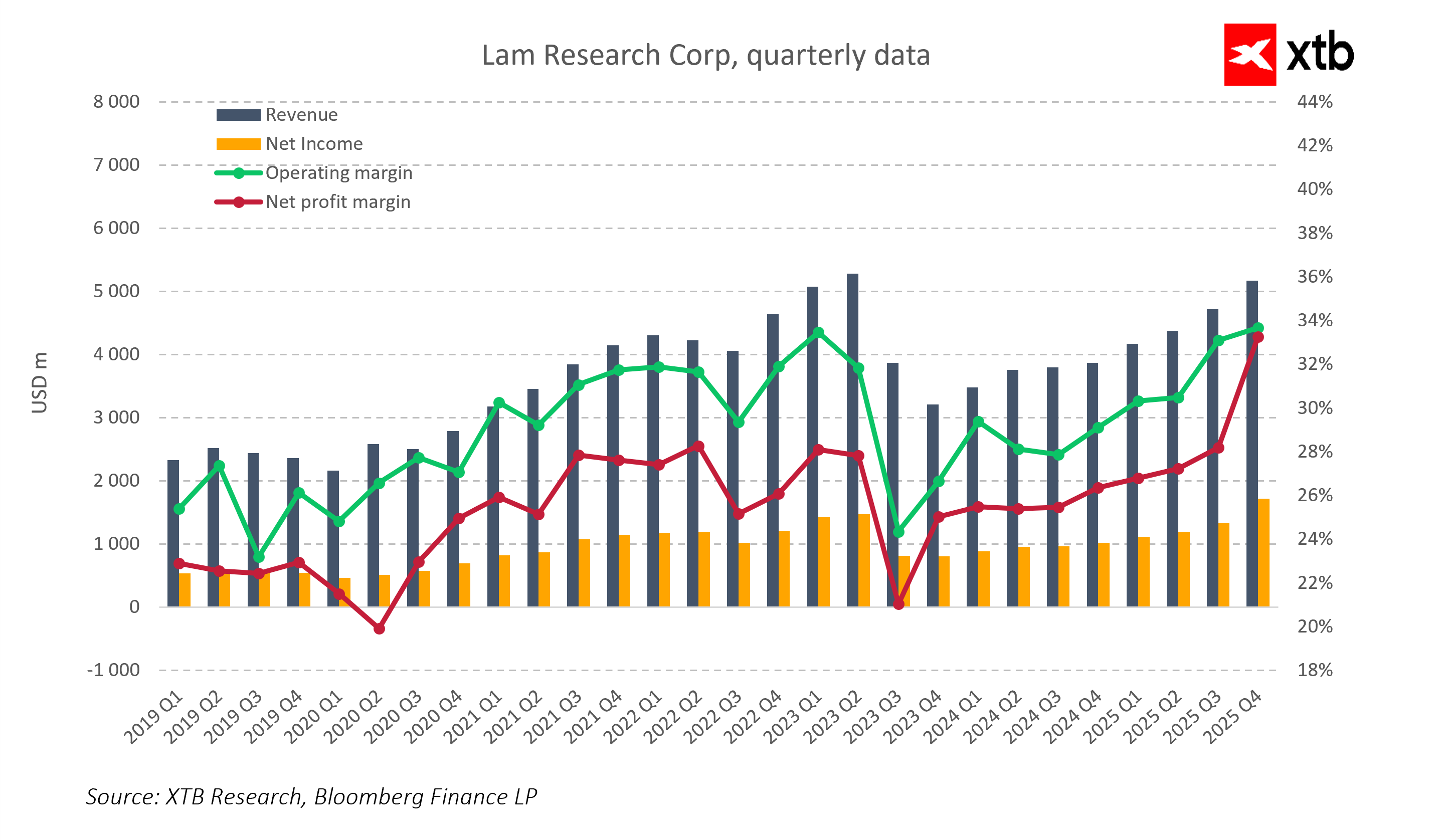

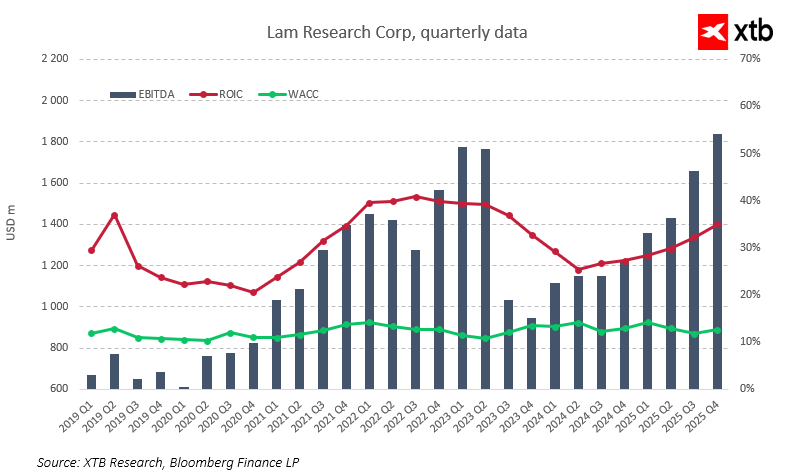

Over the past several years, Lam Research has consistently strengthened its market position, as evidenced by its growing revenues and operating performance. Despite a temporary dip in Q3 2023—mainly due to supply chain slowdowns and temporary investment reductions from some clients—the company quickly rebounded, posting consecutive quarters of growth in both revenue and EBITDA.

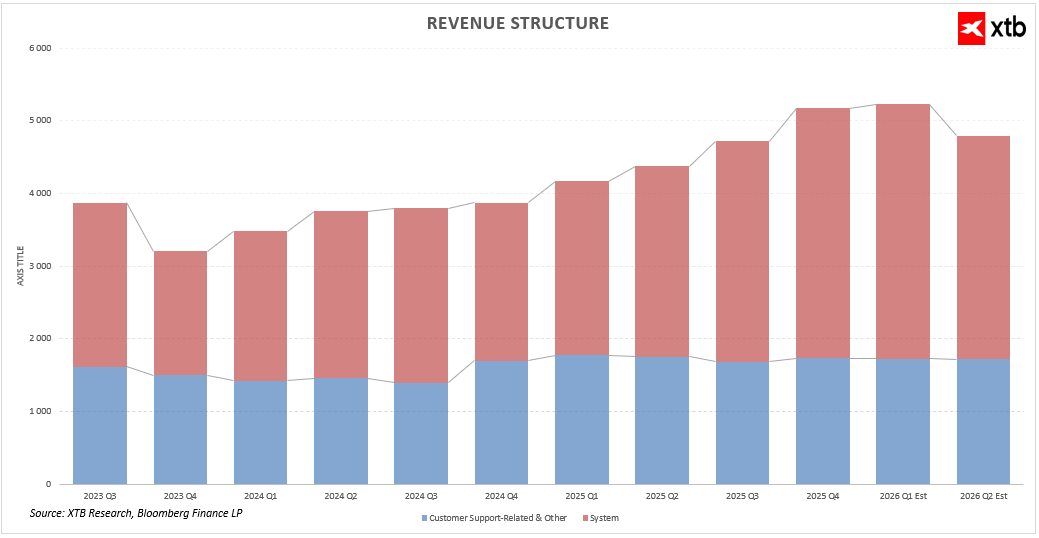

In recent quarters, the Customer Support-Related & Other segment has maintained stable revenues, providing a solid financial foundation and client support. This segment, while less dynamic, accounts for a significant share of total income.

The System segment, focused on advanced technological solutions, has shown a clear upward trend. After a brief decline at the end of 2023, revenues quickly rebounded and continue to grow, reflecting strong demand for modern chip manufacturing technologies, especially in the memory and other innovative solutions segments.

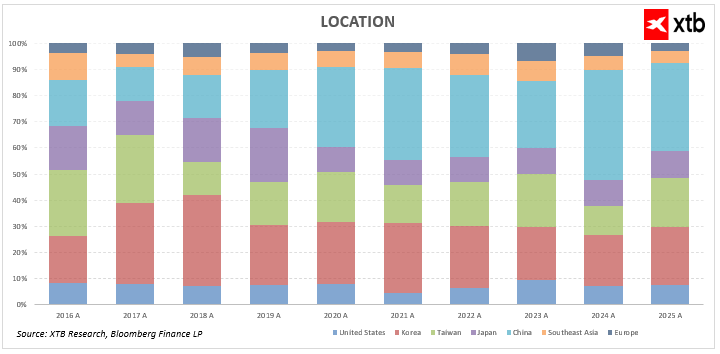

Geographically, Lam Research maintains a strong international presence, which generates most of its revenue. Key markets include South Korea, China, Japan, and Taiwan, where the company sees the highest inflows. While the United States accounts for a smaller portion of sales, its share is growing—indicating Lam’s increasing importance in its home market. The European market is the smallest, but it also remains stable.

The combination of stable customer support revenues, dynamic system segment growth, and a diversified, strong geographical presence gives Lam Research a solid foundation for further global expansion in the semiconductor market.

A particularly important aspect of Lam Research’s performance is its high and stable gross margin, currently hovering around 34%. For a company operating in the advanced semiconductor technology sector, maintaining a high margin is critical for several reasons:

-

First, it indicates a competitive advantage. Lam Research can offer unique and complex solutions that not only meet rising client demands but are also valued as premium products.

-

Second, the gross margin reflects production efficiency and cost control, which are essential in a capital-intensive industry to remain profitable and continue investing in innovation.

High profitability also gives Lam the flexibility to invest in R&D and expand into new market segments, such as equipment for AI chip production and advanced memory. It also acts as a buffer against short-term disruptions like raw material price fluctuations or economic slowdowns, ensuring financial stability and long-term strategic execution. Compared to other companies in the semiconductor space, Lam Research maintains one of the highest margins, further highlighting its strong market position and value creation ability.

Net income and operating margins are also steadily improving, reflecting a healthy financial condition and increasing profitability. Importantly, Lam Research generates returns on invested capital (ROIC) well above its cost of capital (WACC), meaning the company’s investments are creating real shareholder value.

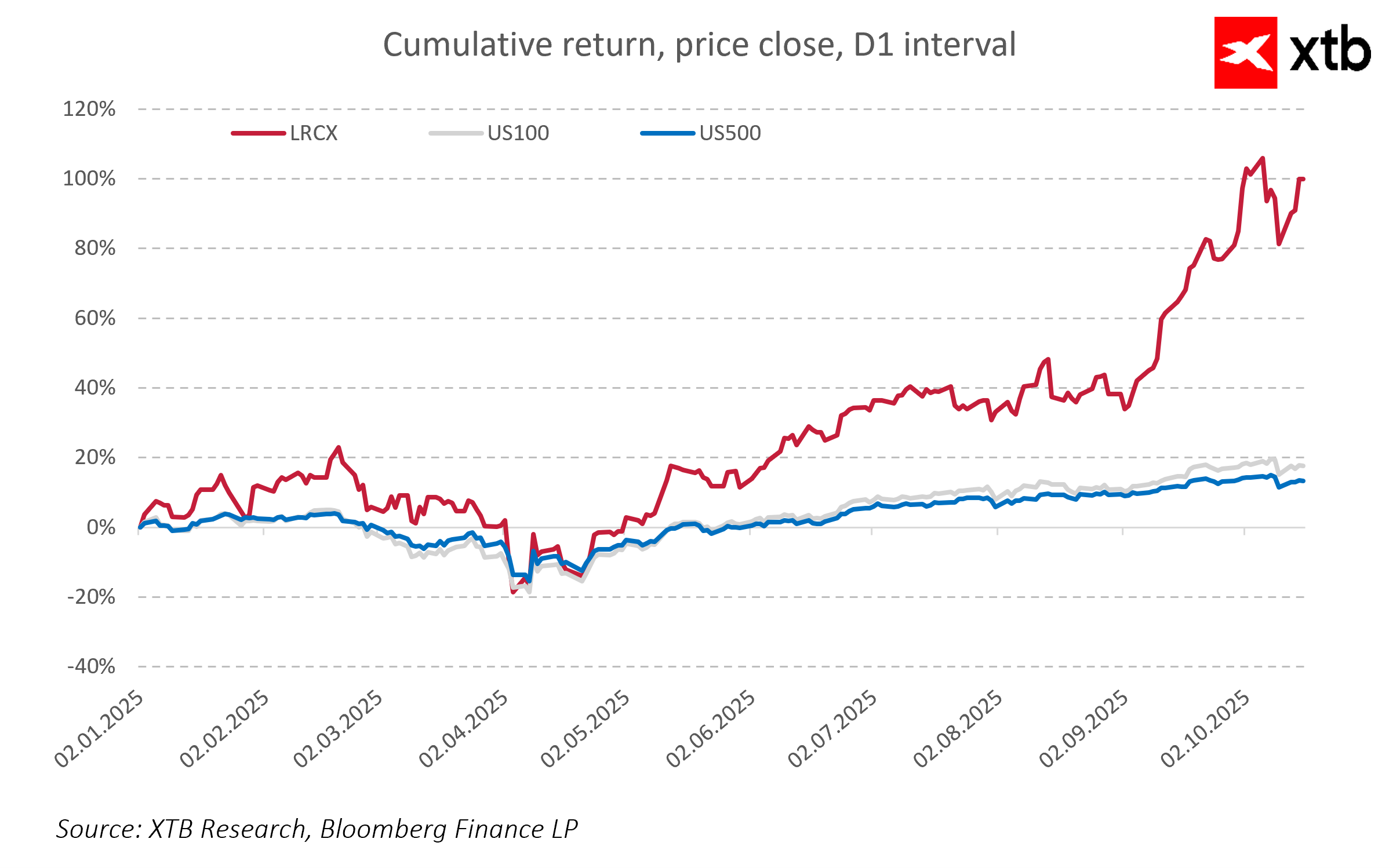

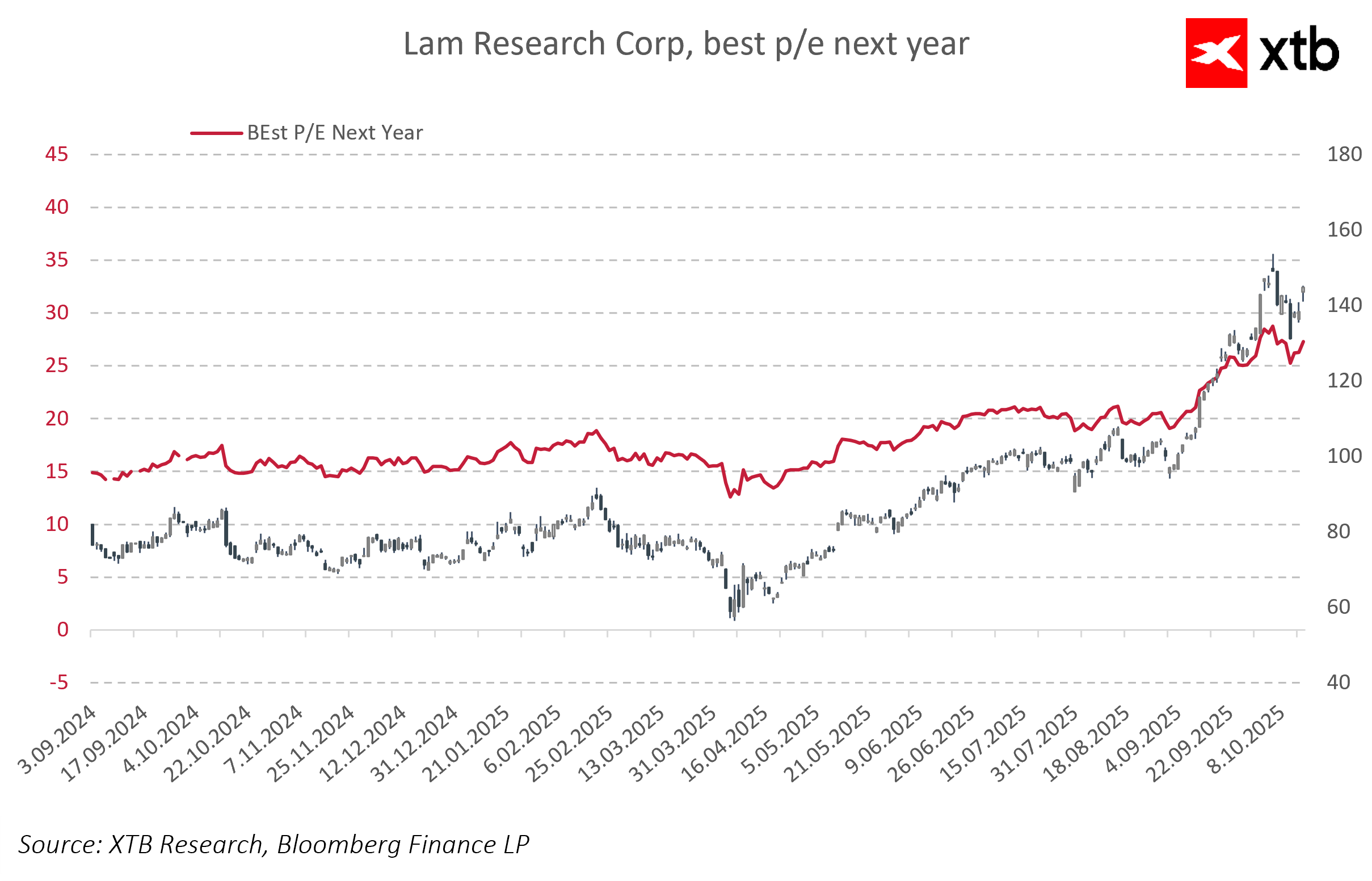

It’s also worth noting that Lam Research’s stock has nearly doubled since the start of the year—reflecting growing investor confidence in the company’s outlook. A high PE ratio (~34) indicates expectations of continued growth and expansion, though the market forecasts that this ratio will decline significantly next year, driven by strong earnings growth. Higher profits combined with stable or even rising valuations suggest that Lam will become more attractive to investors, strengthening its position in the industry. This scenario demonstrates that the company's growth is not only rapid but also sustainable, grounded in solid financial fundamentals.

These results are no coincidence. Demand for advanced semiconductor technology, fueled by AI, high-performance computing, and next-gen HBM memory, creates ideal conditions for Lam Research’s continued development. The company is well-positioned to meet rising industry needs, providing precise solutions for chip production and advanced packaging.

Revenue Forecasts and Market Outlook

The AI boom shows no signs of slowing—on the contrary, it's accelerating every quarter. The growing need for generative computing and machine learning is driving massive investments in new data centers, which could exceed $1 trillion in value over the next decade. This infrastructure build-out presents a massive growth opportunity for advanced semiconductor tech providers like Lam Research.

Additionally, more enterprises are automating IT processes with AI-based solutions. These trends are becoming the key drivers of the entire tech sector, increasing demand for modern production equipment and end-to-end technology solutions. All of this creates a strong foundation for Lam Research’s continued growth.

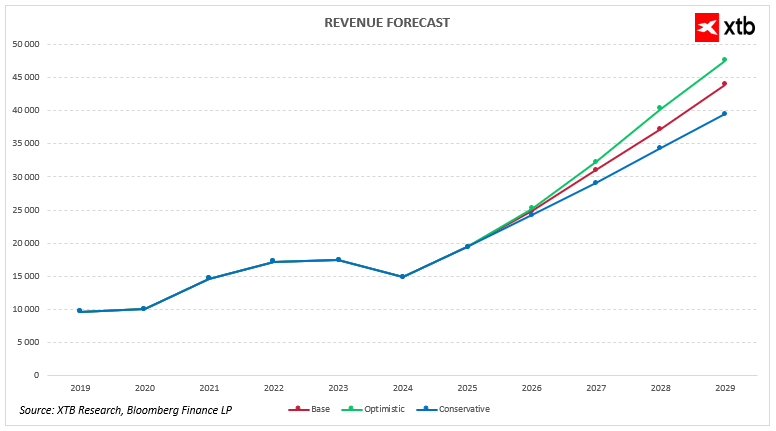

Given these strong trends and growing demand, let’s take a look at Lam Research’s revenue forecasts under three market scenarios: baseline, optimistic, and conservative.

In all cases, the first years of the forecast represent a period of dynamic growth, fueled by continued investments in AI infrastructure and data center expansion. Growth remains strong through around 2027, after which it gradually slows—naturally reflecting market saturation and increasing competition.

-

The baseline scenario assumes stable growth, with Lam effectively leveraging the rising demand for advanced technologies. While growth slows after 2027, Lam continues to scale and increase revenue—showing its resilient market position.

-

In the optimistic scenario, growth is even faster, driven by successful expansion and innovation, attracting new customers and strengthening relationships with key partners. As a result, Lam maintains high momentum even in the longer term.

-

The conservative scenario anticipates that, after an initial growth burst, momentum slows due to reduced investment and rising competition. Nevertheless, Lam continues to grow, proving the resilience of its business model, even under more challenging conditions.

Valuation Overview

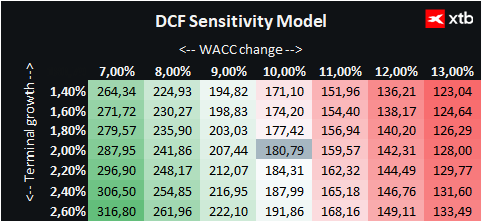

Below is a Discounted Cash Flow (DCF) valuation of Lam Research. Please note that this analysis is for informational purposes only and should not be considered investment advice or a precise valuation.

Lam Research Corp is one of the key players in the semiconductor industry, providing advanced solutions for chipmakers and data center infrastructure. The company is benefitting from increasing demand due to the AI revolution and IT process automation, creating a strong base for continued growth.

This valuation is based on the baseline revenue and financial projections, with a WACC of 10% and a conservative terminal growth rate of 2%. Financial parameters are based on average data from recent years, maintaining a realistic picture.

It’s worth noting that anticipated interest rate cuts in the U.S. may lower the cost of capital, enhancing the appeal of investing in the company. The valuation, however, remains cautious, accounting for **market and competitive

Chart Overview

Source: xStation

An analysis of the stock chart clearly shows that Lam Research shares are in a strong upward trend, supported by solid fundamentals and growing investor interest in the AI sector.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Does the current sell-off signal the end of quantum companies?