Summary:

- Facebook drops 18% on the open; US100 under pressure

- US30 near 5-month high above 25500

- Durable goods orders miss forecasts

One of the biggest stories of late is Facebook after shares in the tech giant cratered last night, dropping over 20% in after-hours trade after the firm delivered its latest trading update. As we noted earlier, the figures themselves weren’t too bad but given the exceptionally high market expectations and a following earnings call which was cautionary to say the least the stock dropped sharply. This afternoon shares opened lower by around 18%, back in the mid 170s at a level not seen since April. The decline has wiped over $100b off the stock on the open and represents the largest ever valuation drop in nominal terms following an earnings update.

Facebook shares dropped heavily by almost 20% from last night’s record closing level after releasing the latest trading update. Price is now back at the 61.8% fib of the rally seen since the March low of 149. Source: xStation

It’s not hard to spot the impact of this drop in the US100, which fell more quickly due to the fact that it trades after 9PM. The US100 fell more than 100 points in little over an hour as not just the drop in Facebook, but also other tech shares declined. The FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks have been the real driving force behind the latest push to new highs, and concerns that their performance may not be as strong going forward clearly spooked the markets.

The US100 felt the drop in Facebook keenly with the market falling immediately after the firm reported its latest results. Source: xStation

While the weighting of Facebook is not as large in the US500 as it is in the US100, it is still weighing on the index a little and this can be easily seen if we look at the US30. The US30, which doesn’t contain Facebook, surged higher last night on the news that the US and EU were backing down from an all-out trade war and the market has moved higher since the Wall Street open this afternoon.

The US30 jumped higher on both the US-EU news regarding trade last night and the Wall Street open this afternoon. Source: xStation

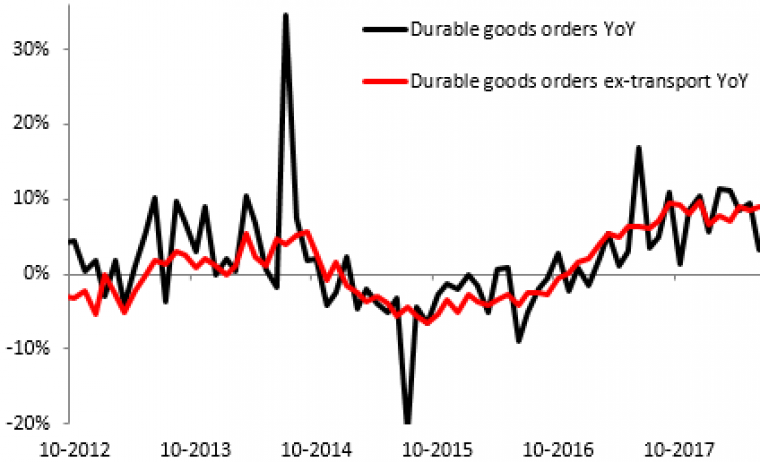

Today’s economic calendar was fairly light besides the ECB, which failed to deliver any great surprises. Tomorrow’s US GDP is now the main event for the rest of the week, but the latest durable goods figures are worth noting. The durable goods orders figure itself was something of a disappoint and missed consensus forecasts once more, with the M/M reading of 1.0% well below the 3.0% expected. The core reading was a little better and remains a brighter spot for this data point as you can see from the chart below.

Durable goods orders extended their decline in YoY terms but the core metric is holding up a little better. Source: XTB Macrobond

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.