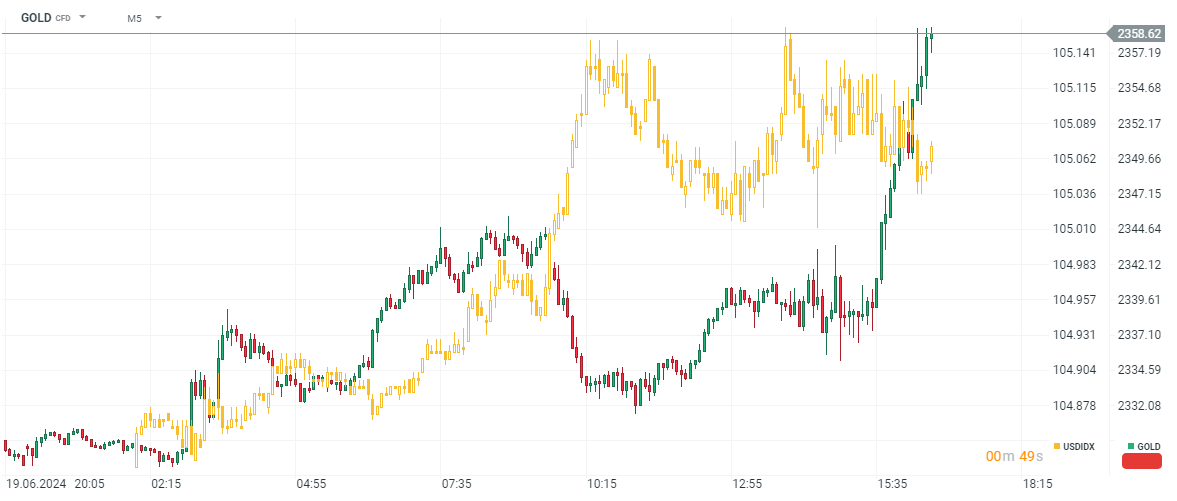

Still strong US dollar and 10-year treasuries yield doesn't stop rally on gold futures. President of the Federal Reserve Bank of Minneapolis, Neel Kashkari, commented today on the US economy and inflation. Today macro data from the US were mostly weak, but US jobless claims came in lower than expected, with surprisingly lower continued claims number.

Fed Kashkari

- I am optimistic that fundamentals of the economy are very strong.

- There is some evidence of some softening around the edges of the economy.

- We are getting disinflation despite remarkable economic growth.

- The interest rate outlook depends on the path of the economy.

- Wage growth might still be a bit too high to get back to 2% right now.

- It will probably take a year or two to get inflation back to 2%.

- The economy keeps throwing us curveballs, which are challenging

- I don't see the value proposition of CBDC for the US

GOLD vs USDIDX

Source: xStation5

Source: xStation5

SILVER (interval M30)

Silver gains 2.8% today and is now on the highest levels since 14-day, climbing above $30 zone.

Source: xStation5

Source: xStation5

Daily Summary: End of the week in the red, tech rally waning

🔝Silver Jumps 10% Weekly, up 120% YTD

Chart of the day - SILVER (12.12.2025)

BREAKING: UK GDP and manufacturing lower than expected 📉Final German CPI in line with expectations