Silver continues its strong upward momentum in the final session of the week, a phenomenon that cannot be attributed to a single factor. Currently, speculative demand is rising very sharply, although it is primarily visible in the ETF options market. Bloomberg suggests that investors holding short positions in options will be forced to generate additional speculative demand for silver in order to limit their losses.

The main factors driving silver’s rally this year include another year of severe deficit caused by strong demand from the photovoltaic sector, stimulation from ETFs, and ongoing problems on the silver mining side, as it is often a byproduct of copper, gold, or zinc extraction. Additionally, monetary factors and concerns related to the appointment of a new Fed Chair are increasing demand for precious metals.

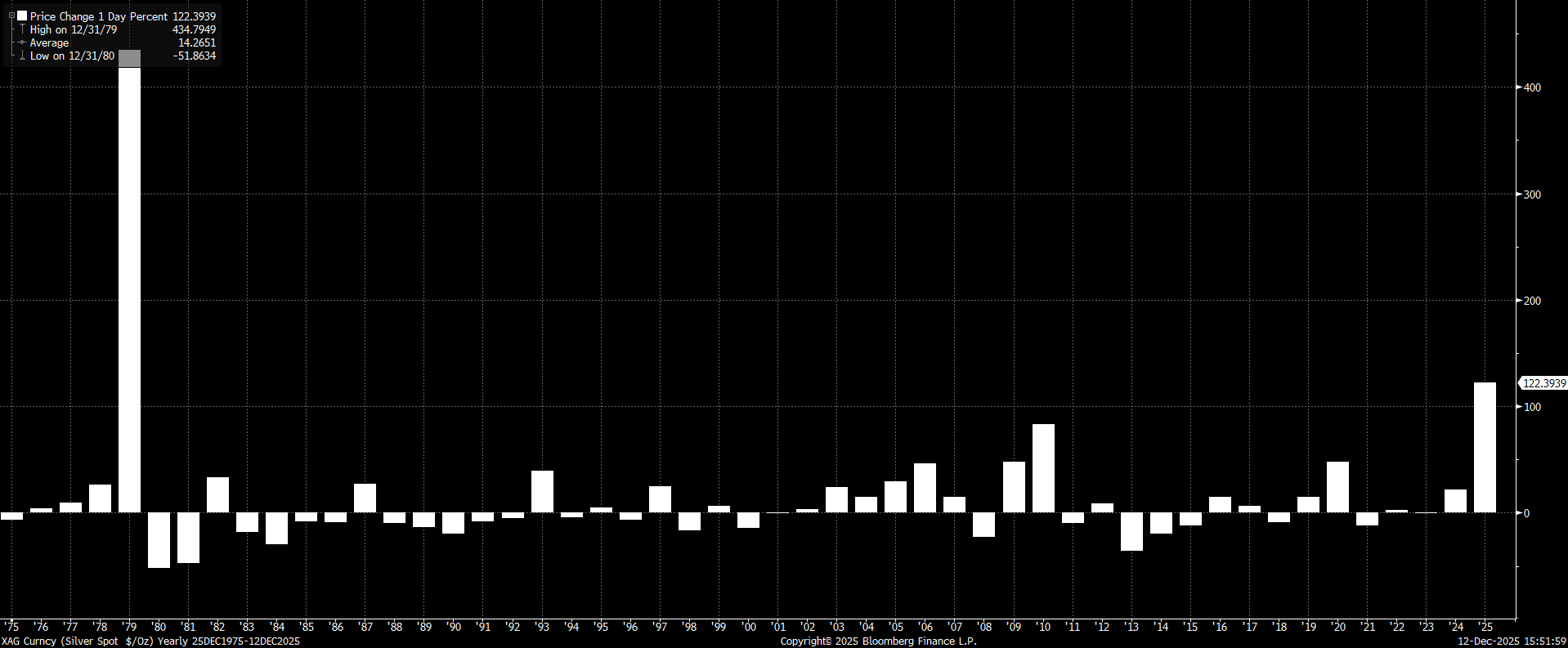

The price increase for silver this year already amounts to 120%, with this week alone contributing over 10%. There is now growing talk that the demand for silver is primarily speculative. Source: Bloomberg Finance LP, XTB

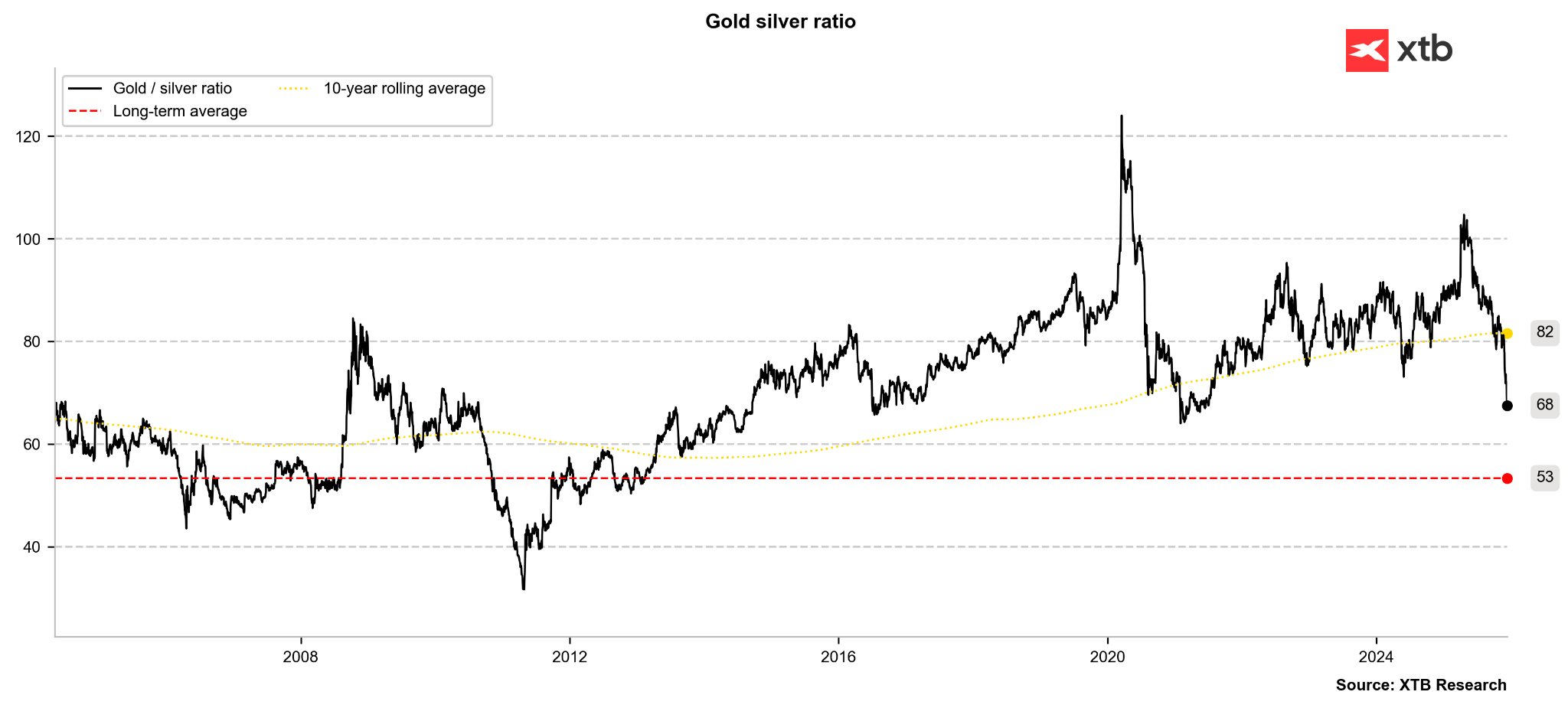

The gold-to-silver price ratio is experiencing a similar dynamic decline to that seen in 2020. The ratio itself is at its lowest level since 2021. If it were to fall to the long-term average of 53, it would imply a breakthrough above the $80 per ounce level. Source: Bloomberg Finance LP, XTB

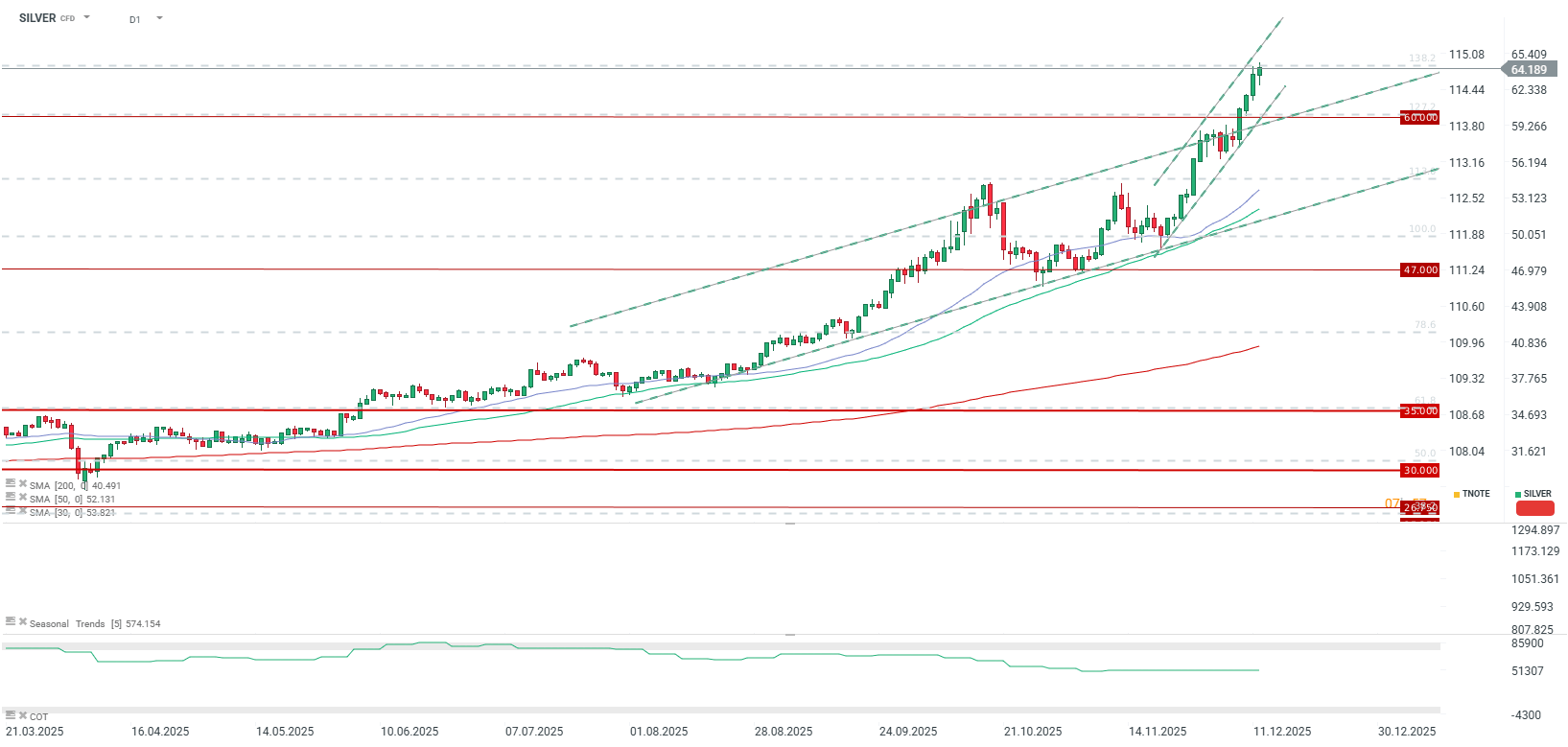

Silver marks its fourth consecutive day of gains, reaching the vicinity of potential technical resistance. Nevertheless, the $60 per ounce level could currently serve as strong support for the price. Source: xStation5

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

🚨 EURUSD deepens decline, falls to key support zone