- Fed's Williams gave dovish remarks to NYT

- NY Fed governor signals further rate cuts amid weakening US labor market

- Soft landing is still possible according to his remarks

- Fed's Williams gave dovish remarks to NYT

- NY Fed governor signals further rate cuts amid weakening US labor market

- Soft landing is still possible according to his remarks

New York Federal Reserve governor, John Williams commented today the US monetary policy giving an interview to New York Times. Here is the breakdown: Williams doesn't think the US economy is on the verge of recession, supporting further interest rates cuts in the US amid a weakening labor market.

- I don't see any signs of second-round effects or factors that could be amplifying the effects of tariffs on inflation

- It is appropriate for rates back to neutral setting

- Softening labor market would help limit inflation.

- The inflation outlook not as dire as earlier in the year. The slowdown in jobs is worth attention.

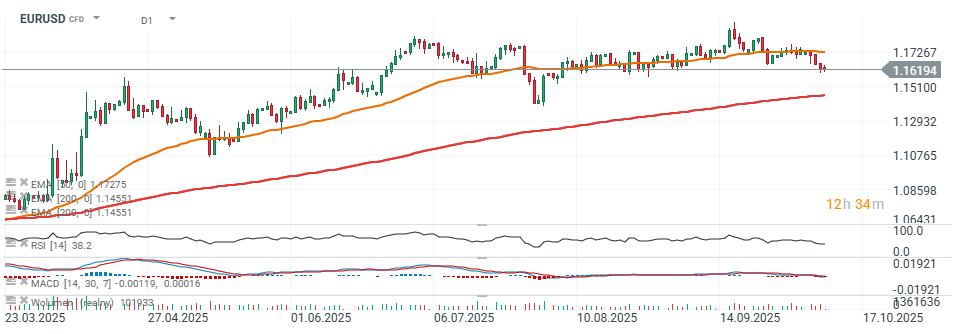

EURUSD dropped to 1.16 level again, however looking back on the chart we saw two similar corrections since April 2025.

Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨