FedEx (FDX.US), a US courier and logistics company, warned about deteriorating demand outlook yesterday. Mike Lenz, company's CFO, said that the company projects a lower demand in the foreseeable future. He added that demand trends started to reverse faster than expected and it is becoming visible in the business. While he said that grounding of some aircraft will allow the company to realize cost savings via delaying regular maintenance scheduled based on flight hours, it won't offset revenue lost due to lack of business.

Why is this important? FedEx is one of the biggest logistics companies in the United States and in the world so a warning about deteriorating demand outlook is a reflection of a deterioration not only in the company's business but also the economy as a whole. As such, FedEx is often seen as a bellwether and such warnings from the company used to hit risk assets in the past. We have not seen any major market move following yesterday's comments from FedEx CFO as it's not any kind of breaking news that the global economy is weakening.

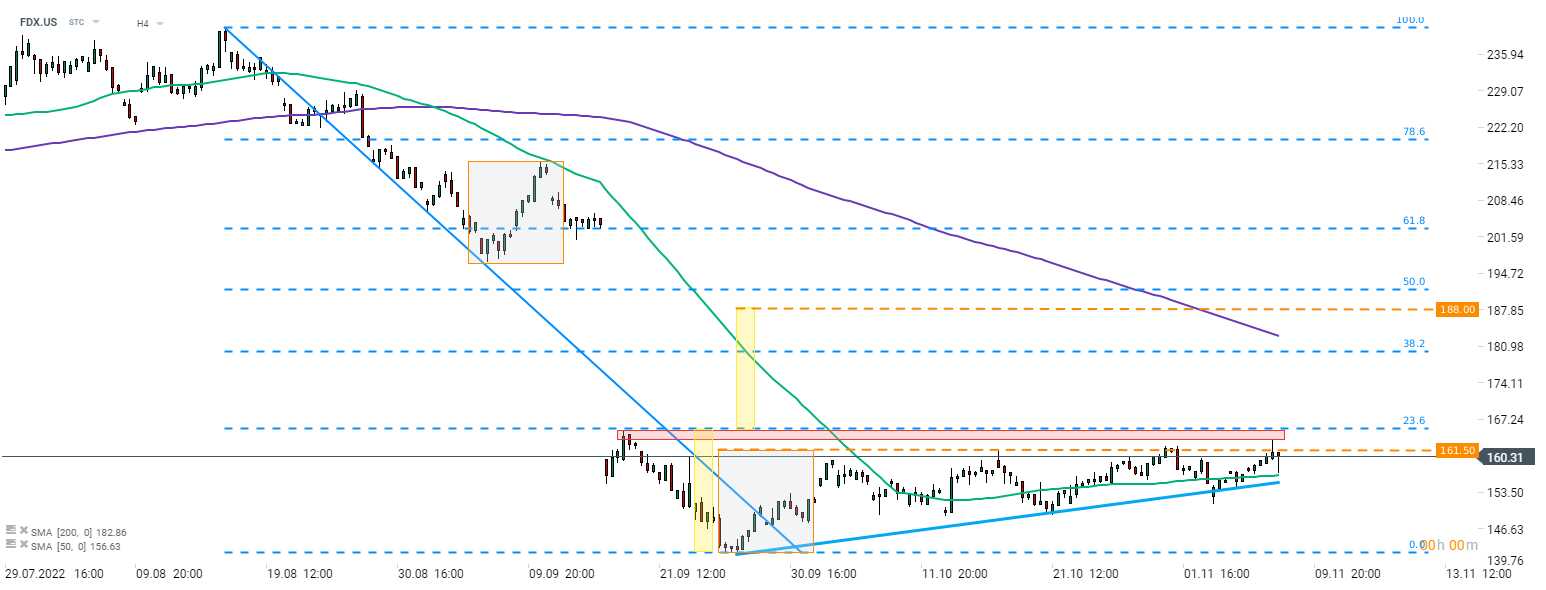

FedEx (FDX.US) is trading little change in US premarket trade today. Stock is set to open near $160 per share mark, slightly below the upper limit of a local market geometry. A break above would brighten technical outlook for the bulls. However, it should be noted that slightly above the upper limit of market geometry lies the upper limit of a triangle pattern. Upside breakout could trigger a bigger upward move with $188 mark being a textbook range.

Source: xStation5

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records