There were some dramatic moves in currency markets last night with the Japanese Yen spiking sharply higher across the board shortly after 10:30PM. There was no immediately obvious catalyst for such a sizable move which, due to the convention of using the Yen as the quote currency caused flash crashes in its most widely traded crosses (USD/JPY, GBP/JPY, EUR/JPY, AUDJPY etc). This wreaked havoc in the FX markets, with the AUDJPY the worst hit and slumping over 4% in just a matter of minutes before a semblance of calm returned. In addition, the variation in the size of these moves in different JPY pairs caused significant moves in unrelated markets such as the AUDUSD and GBPAUD.

The AUDJPY began to decline on the downbeat Apple update, but this gave little sign of the pandemonium to come as the market tumbled over 4% in just a matter of minutes. Source: xStation

Dour Apple update a contributory factor

Looking more closely at possible causes for the rapid appreciation it appears to have been a combination of things, with an unexpectedly dour trading update from Apple around 9:30PM the first in a series of contributory events. The tech giant cut its revenue outlook for the first time in almost two decades as CEO Tim Cook warned that company sales for the last quarter would be around $84B - down from earlier estimates of $89-93B. The official results will come at the end of this month, with Cook attributing the bulk of the revenue drop to China, where the economy has been slowing due in no small part to the implementation of US tariffs - although the iPhone hasn’t been directly affected thus far.

Apple drops starts Domino effect

The stock fell around 8% in after-hours trade, which due to it accounting for a roughly 10% weighting in the Nasdaq 100 index saw futures in the benchmark fall by nearly 2% and erase what had been a fairly impressive recovery into the closing bell on Wall Street. This started relatively small risk-off moves across other markets as the dominoes started to fall with the Japanese Yen beginning to rise as investors moved money into the perceived safe-haven currency. The move was relatively measured with the AUDJPY falling by around 0.75% in the hour that followed and there was little sign of the carnage that was about to ensue. Around 60 minutes after the Apple news, full-on pandemonium hit the markets as the Yen soared and the AUDJPY tumbled more than 4% in next to no time at all.

Blame the usual suspects (Algos)

The dramatic swoon was likely a result of stop loss orders being triggered and the usual suspect of algorithmic trading (algos) is copping a fair portion of the blame, as automated sell orders hit the market and no doubt exaggerated the move. The decline was also likely exacerbated by the time of day in which it occurred, with the window from around 10PM GMT to 1AM often seeing the least liquidity in markets (the Pound’s flash crash in 2016 also occurred in this window) as the US has just closed and it is before the Asian session begins in earnest. This was also compounded yesterday as Japan was closed for a bank holiday meaning even thinner markets.

Move a warning sign for GBP traders?

Taking a step back the move does seem to be a little overdone and a kind of capitulation with the bulk of the Yen’s gains having since been pared back. Having said that, the plunge does serve as a timely reminder of how markets are currently trading in a skittish manner with wild moves a fairly regular occurrence of late (not just in the FX space but also in indices and commodities) and traders will no doubt be increasingly concerned that a similar move could happen in the Pound in the not too distant future should there be a major shock on the Brexit front.

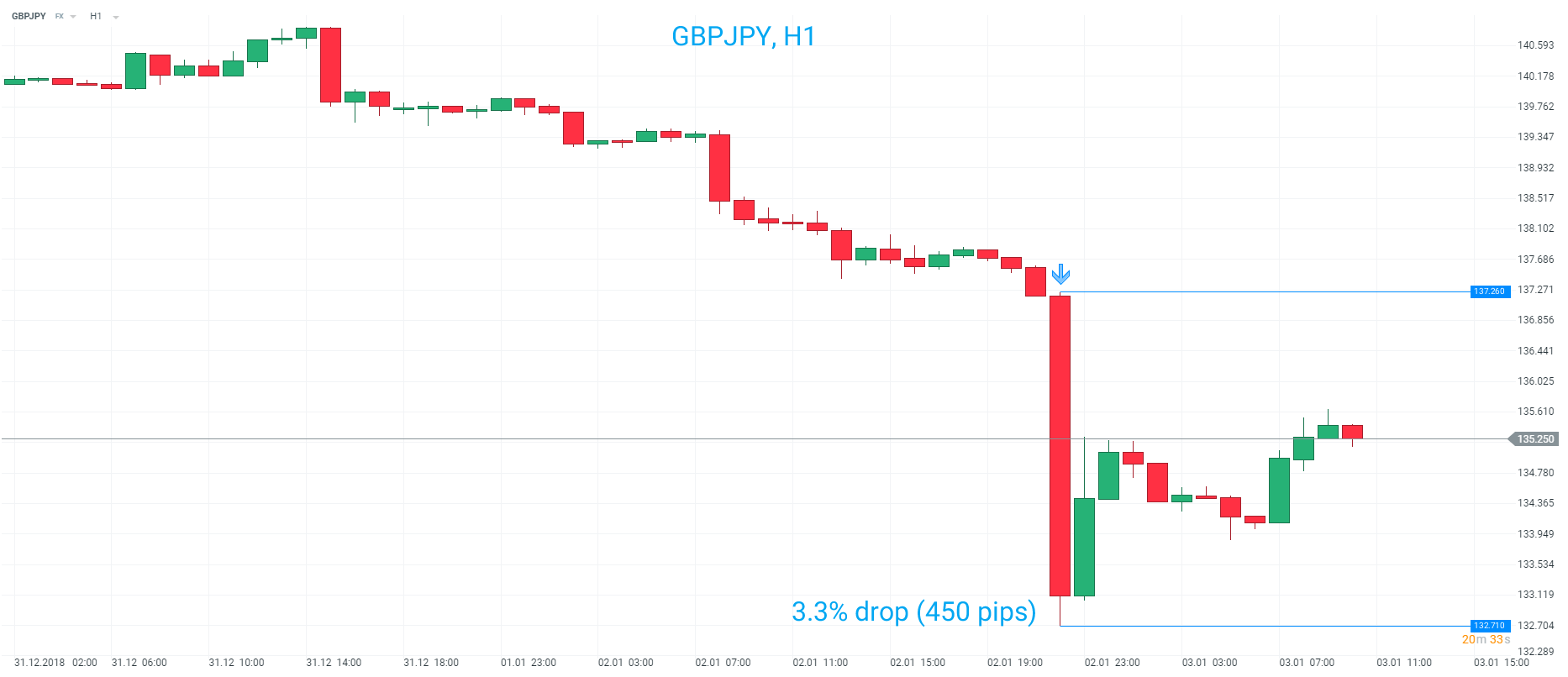

While not quite as dramatic as the AUDJPY, there was also a rapid plunge in the GBPJPY pair and this market could well be highly sensitive to any Brexit-related shocks in the coming weeks. Source: xStation