The Bank of England is widely expected to keep interest rates at 4% during today's meeting. It may also signal a reduction in the pace of its quantitative tightening (QT) program, from £100 billion to £65 billion annually. This move would be a response to excessively high government bond yields and persistent inflation that remains above the central bank's target. Decision will be announced at 12:00 pm BST.

High Yields a Risk to Markets

Since the last Monetary Policy Committee (MPC) meeting, the yield on 30-year UK bonds has risen significantly. While some of this increase is a reflection of global trends, domestic factors—including concerns over the fiscal situation and the composition of debt demand—have also contributed to the spike. The BoE estimates that QT could be adding 15-25 basis points to 10-year bond yields, which poses a threat to market liquidity and the effectiveness of its asset sales program. Consequently, there is a strong possibility of a slowdown in balance sheet reduction, with a complete halt to QT at a later stage.

Stubbornly High Inflation Remains a Problem

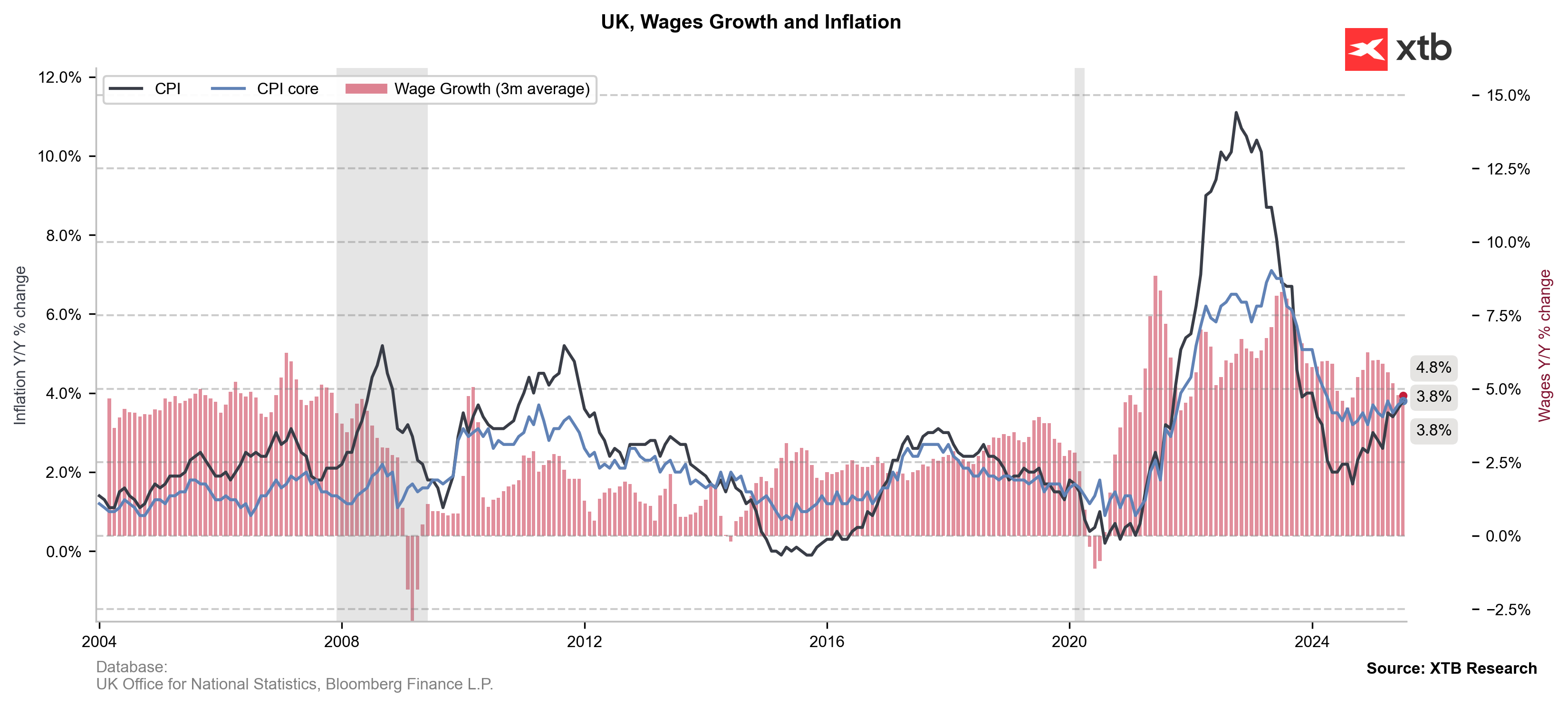

UK CPI inflation in August came in at 3.8%, in line with the MPC's projections but still well above its target. A positive development was the drop in services inflation to 4.7%, although this remains at a very high level.

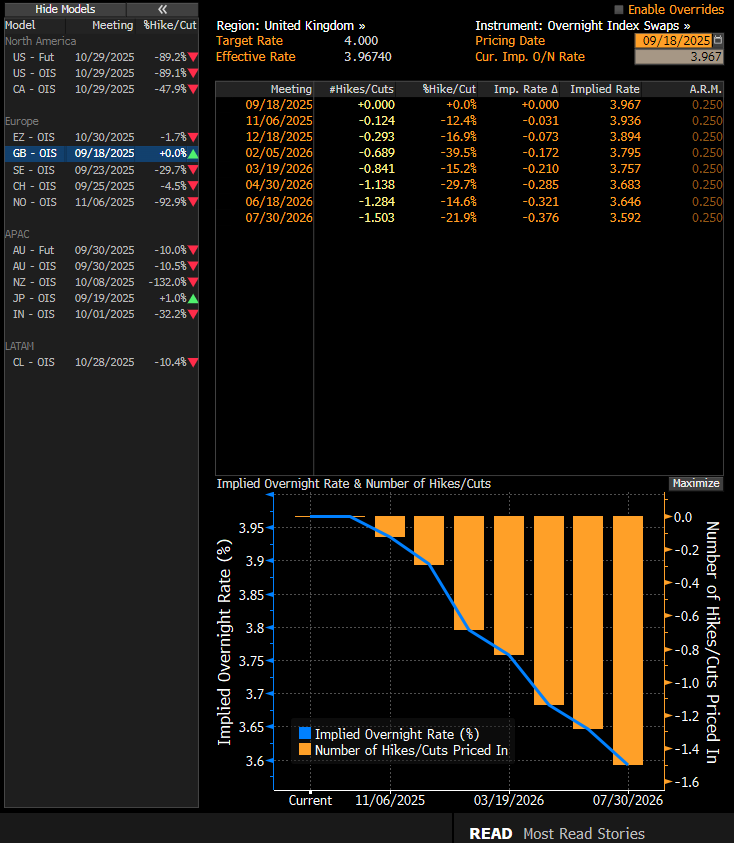

Despite signals of slowing growth (Q2 GDP at +0.3%), cumulative data suggest that the disinflationary process could be longer than previously assumed. This supports the policy of holding interest rates unchanged. According to Bloomberg, the next rate cut might not occur until the spring of next year, a prospect that could strengthen the pound.

UK inflation is rising and remains high, despite a slowdown in wage growth. Source: Bloomberg Finance LP, XTB

The first fully priced-in rate cut is expected in April of next year. Source: Bloomberg Finance LP

The first fully priced-in rate cut is expected in April of next year. Source: Bloomberg Finance LP

GBPUSD at a Key Technical Level

GBP/USD is testing the 1.3650 level today, its highest closing price since July 7. The pound is gaining along with the weakening dollar following yesterday's Fed decision. Further dollar weakness and a retest of 1.19 on EUR/USD could lead to a test of the local July highs near 1.3700. However, if the BoE's tone is perceived as dovish today, a drop back toward the 1.36 support level is possible.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause