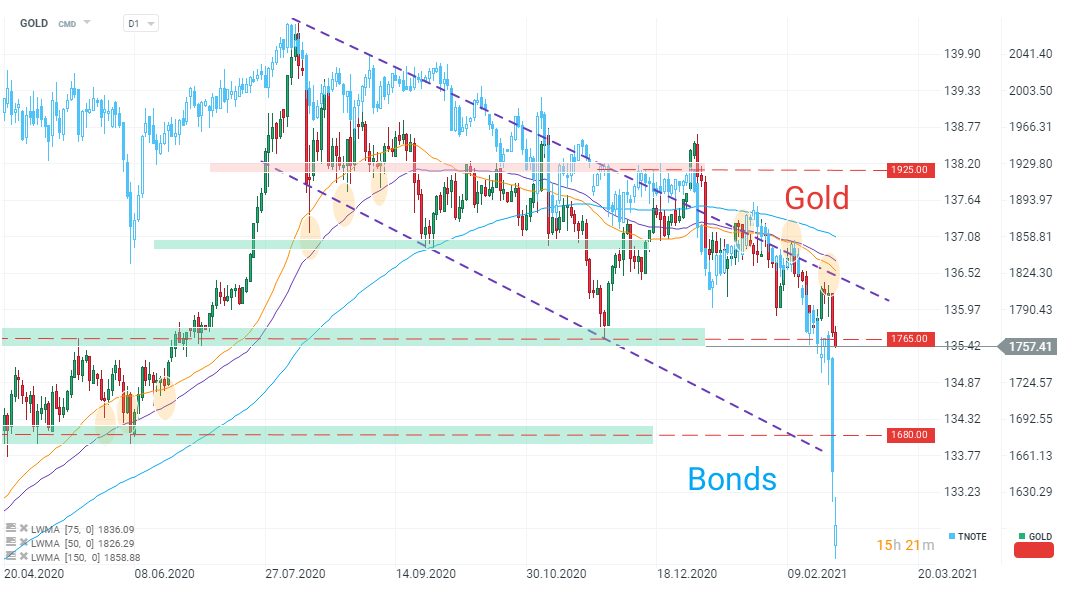

Bond yields continue their sharp rise as traders bet on a quick reflation scenario. One of the major victims is Gold – there is a strong negative correlation between yields and Gold prices as we were showing at the last weekly webinar. Gold prices were underpinned by $1765 level for a while but a surge in yields eventually was too much and now we can see prices moving towards the lower limit of a channel with still plenty of room and horizontal $1680 level along the way. Do notice how 50 and 75 LWMAs now work as a resistances – another sign of a possible trend reversal.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing