Gold is trading over 2% lower today, reaching its lowest level since May 9th at one point. Drop was initially triggered by release of data from China, which showed People's Bank of China halting gold purchases in May. Declines deepened further following release of US jobs data for May. NFP report turned out to be very good - employment increased by 272k, wage growth accelerated from 3.9% to 4.1%, and the unemployment rate ticked only slightly higher. Bloomberg's survey did not predict such a strong release, hence strong movements in the markets. We are observing an increase in 10-year US Treasury yields by more than 10 basis points, which is a negative factor for the entire precious metals market. Palladium and platinum are also losing over 2% along with gold, while declines of almost 5% can be spotted in the case of silver.

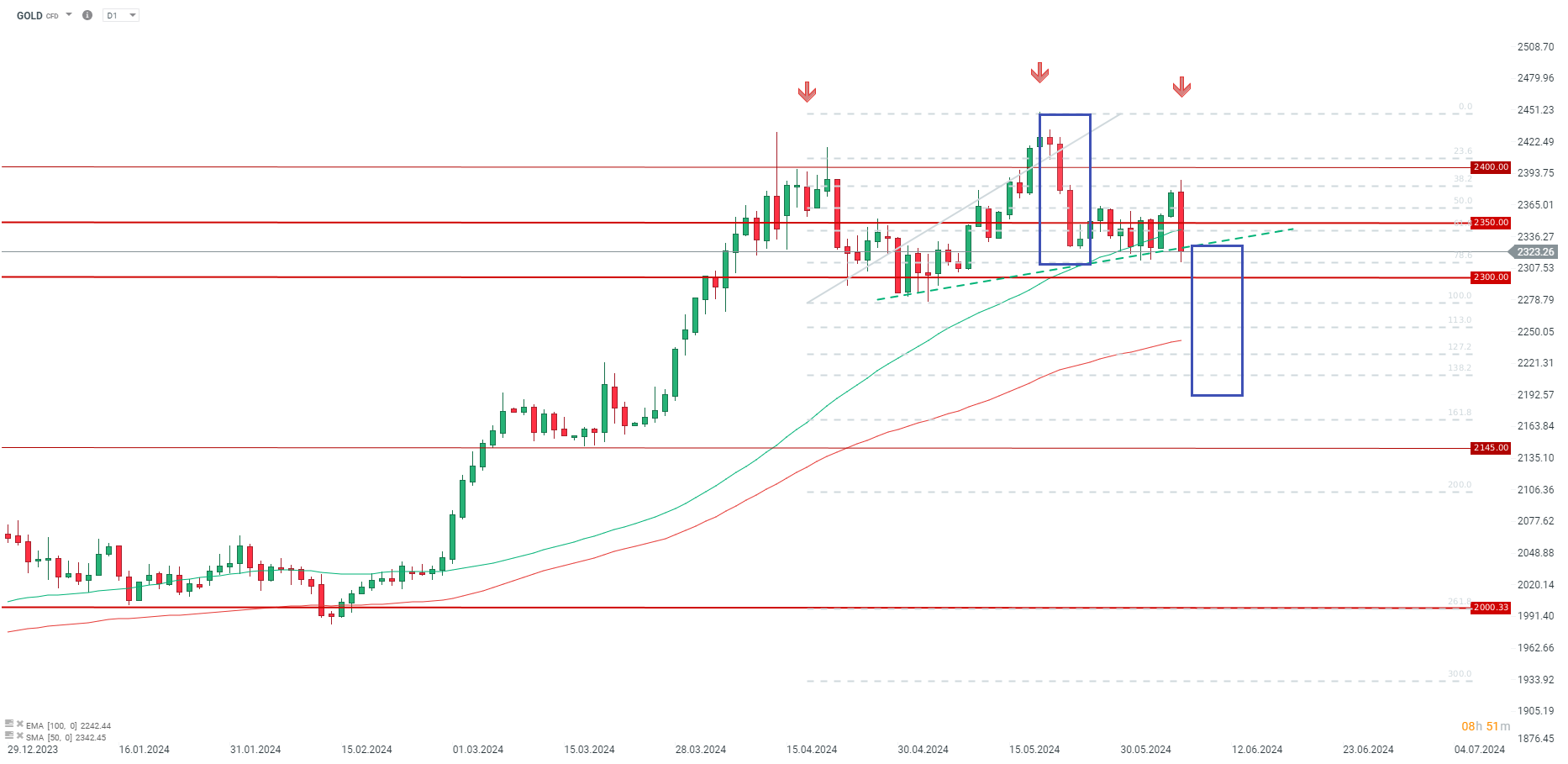

Gold dropped to the lowest levels since May 9th, although it rebounded from around $2,315 area per ounce later on. Potentially, we may be dealing with a large head and shoulders pattern, with a textbook target of around $2,200 per ounce. Source: xStation5

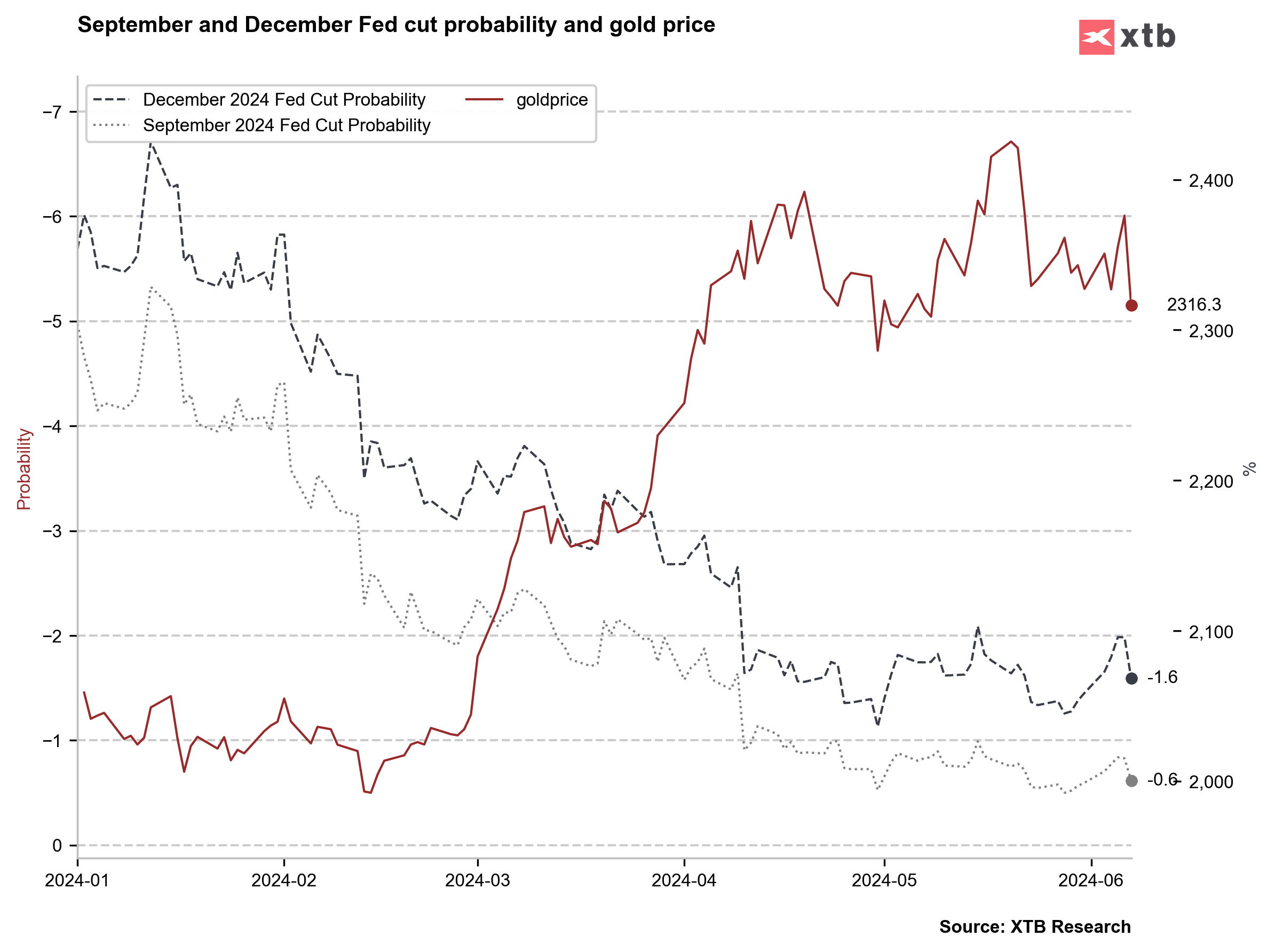

Expectations for interest rate cuts in the US have been declining for some time already. Hawkish NFP release lowered them further, and now the markets sees prices in around 1.6 rate cuts (around 40 basis points) by the end of this year. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30