Gold (GOLD) futures are trading close to 0.7% higher today, and although they have already retreated more than $10 from their intraday peak at $2142, we can still talk about a great session. The gold market's gains have been helped by a weaker dollar and the yield on the 10-year US Treasury bond, which is losing more than 0.06% today and has seen a very large drop from around 4.3 to 4.15% since 29 February.

- Friday's weaker-than-expected US manufacturing ISM was supported by today's services ISM reading, which also came in weaker than expected. The slowdown was evident in the sub-indexes of employment, new orders and, most importantly, prices, which, in the context of PCE inflation in line with forecasts, could be a 'dovish signal' for the Fed.

- Jerome Powell will deliver his semi-annual report on the US economy and monetary policy tomorrow and Thursday. Possible dovish comments could raise expectations of a mid-year rate cut, and the 'backdrop' to his speech seems somewhat warranted.Wall Street cannot be sure whether weaker macro data from the US is just a temporary surprise or a new trend showing the postponed effects of restrictive monetary policy.

- Also, the announcement from the Chinese parliament has put a big question mark over whether China's economy will recover from its economic problems, in the absence of a strong fiscal stimulus programme. China reiterated its GDP growth forecast of 'close to 5%'.

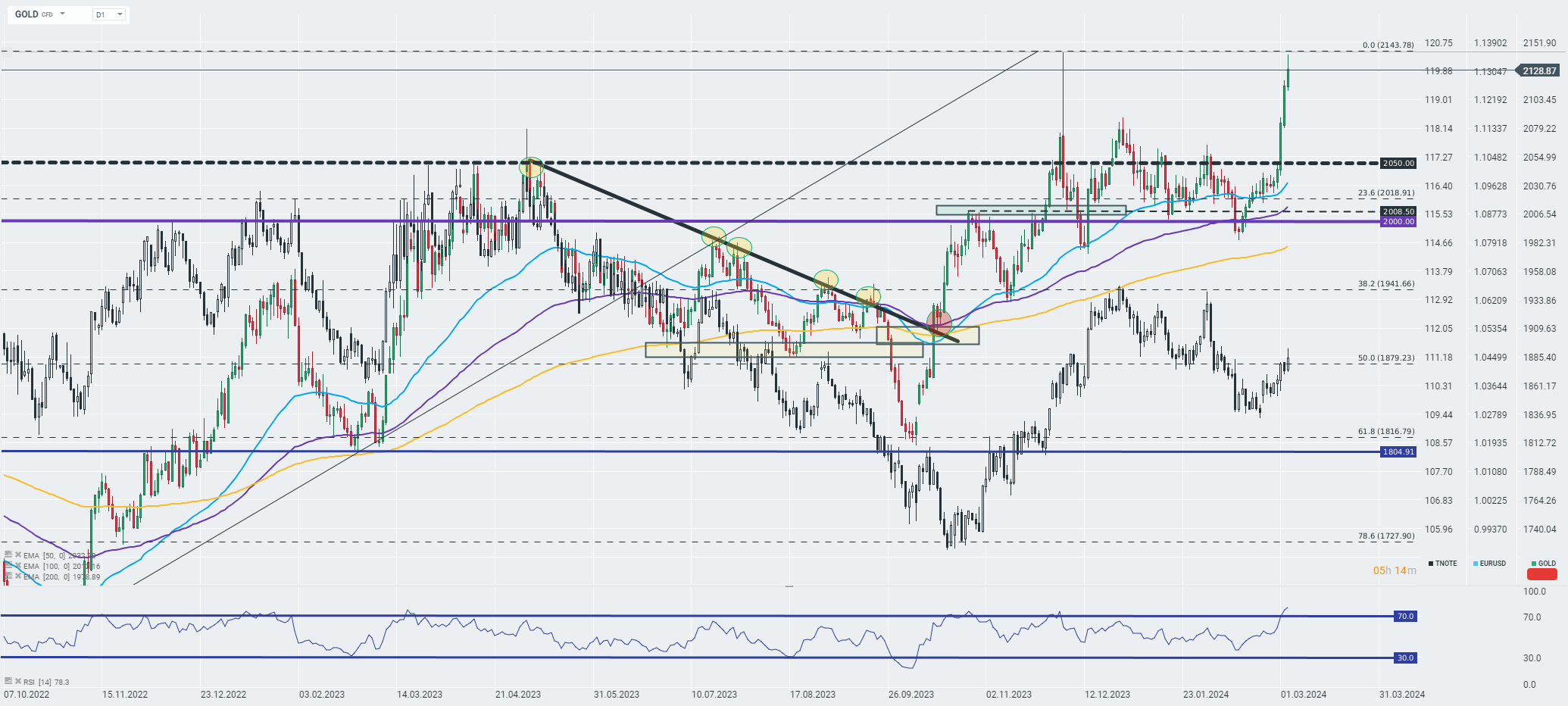

Gold tested historic highs today before initiating a downward correction. At the moment, however, the precious metal remains in the zone of the highest breakouts. Moreover, the commodity has a positive correlation with TNOTE quotations. Source: xStation

Gold tested historic highs today before initiating a downward correction. At the moment, however, the precious metal remains in the zone of the highest breakouts. Moreover, the commodity has a positive correlation with TNOTE quotations. Source: xStation

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?