Gold is down more than 1% today, but after mixed U.S. data, the metal initially reacted with a rise despite higher-than-expected ISM Services readings and mixed JOLTS data (quits fell from 1.2% to 1.1%, while total separations were 2% versus the previous 1.9% revision). The U.S. dollar is trading flat, but other metals, including silver, are also declining, with silver down 5%.

Published data, along with the latest final manufacturing PMI, support the narrative suggested by Trump that the U.S. is not currently facing a significant inflation risk, and the Federal Reserve may adopt a slightly more “aggressive” stance in the second half of the year.

Gold entered 2026 on a strong note, suggesting that investors still see potential for further gains amid expectations of Fed rate cuts (Stephen Miran has even suggested up to 100 bps this year), rising deficits, and geopolitical tensions that may accelerate gold purchases and reduce dollar exposure as a diversification strategy.

Gold CoT Analysis (CFTC) – December 30, 2025

By the end of December 2025, the structure of gold futures positions shows a clear contrast between Commercials and Managed Money (large speculators). Speculative capital remains bullish, while producers and direct market participants hedge deliveries at current prices, maintaining a net short position.

-

Commercials (Producer/Merchant/Processor/User):

-

Total short positions ≈ 67,000 contracts, representing ~14% of open interest.

-

Long positions decreased by 4,200 contracts last week, while shorts remained elevated, signaling moderate short-term pessimism.

-

-

Managed Money:

-

Long ≈ 149,000 contracts vs. 44,000 short, with longs representing ~31% of OI.

-

Last week, longs decreased slightly (-1,709 contracts) while shorts increased (+4,313 contracts).

-

The contrast between bearish Commercials and bullish Managed Money often drives dynamic price moves. Commercial positions can act as natural support, while speculative pressure supports upside potential. Recently, both groups appeared to align, using record gains to hedge deliveries or reduce bullish exposure.

Outlook

-

Gold remains in short-term consolidation, with the potential to break higher if Managed Money maintains or increases long positions. A sudden reduction in Commercial short positions could signal a bullish impulse.

-

Current CoT structure suggests a potential for short-term correction, while additional long accumulation by Managed Money could provide an upward push.

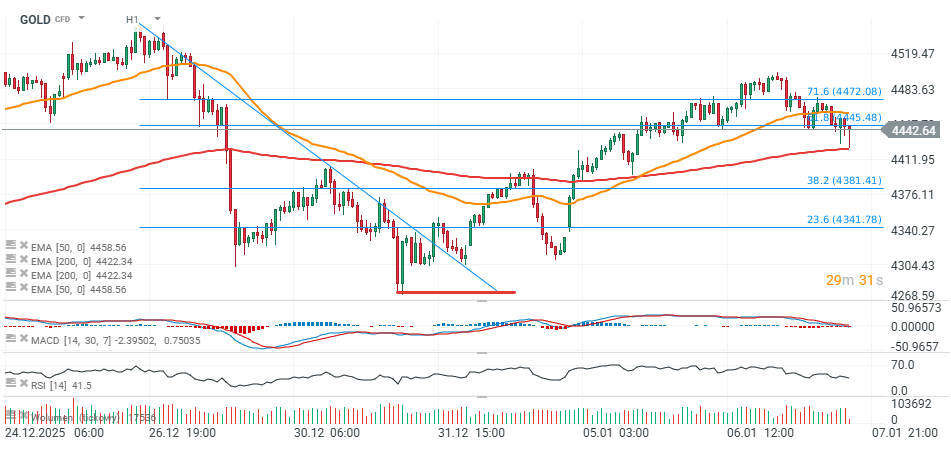

Technical Analysis (H1)

On the hourly chart, declines have halted around $4,420 (EMA200, red line), but prices remain below the 71.6% and 61.8% Fibonacci retracements of the late December down move. Immediate resistance appears near the EMA50 (orange line) at $4,460 per ounce.

Source: xStation5

Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)