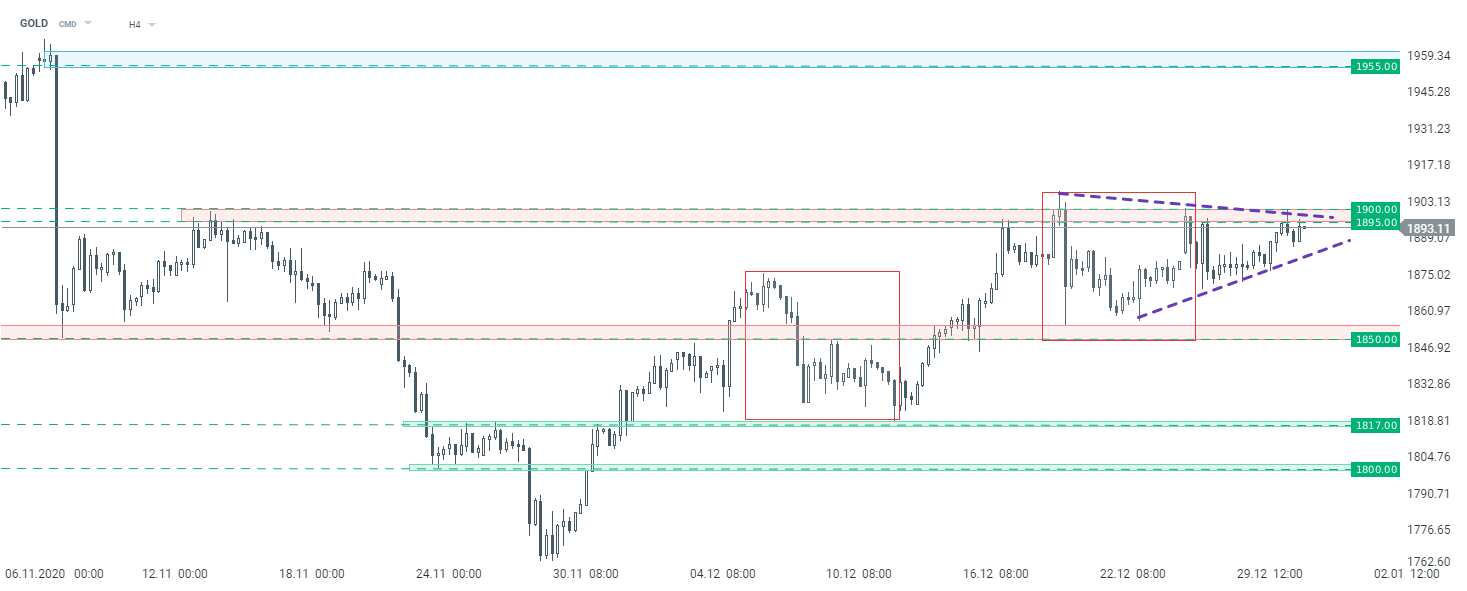

The volatility in the gold market has recently declined and the precious metal has been trading in a local sideways move. However, looking at the H4 interval, one can see that price is once again testing the major resistance at $ 1900, which increases the risk of a breakout. In such a scenario, a way towards further increases will be opened. Gold would then have a lot of room to strengthen as the next important resistance level is located at $ 1955,00. On the other hand, if sellers manage to halt advances here and break below the lower limit of the triangle pattern occurs, declines may deepen towards the $ 1,850,00 level, which is marked with earlier price reactions and lower limit of the 1: 1 structure.

Gold interval H4. Source: xStation5

Gold interval H4. Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?