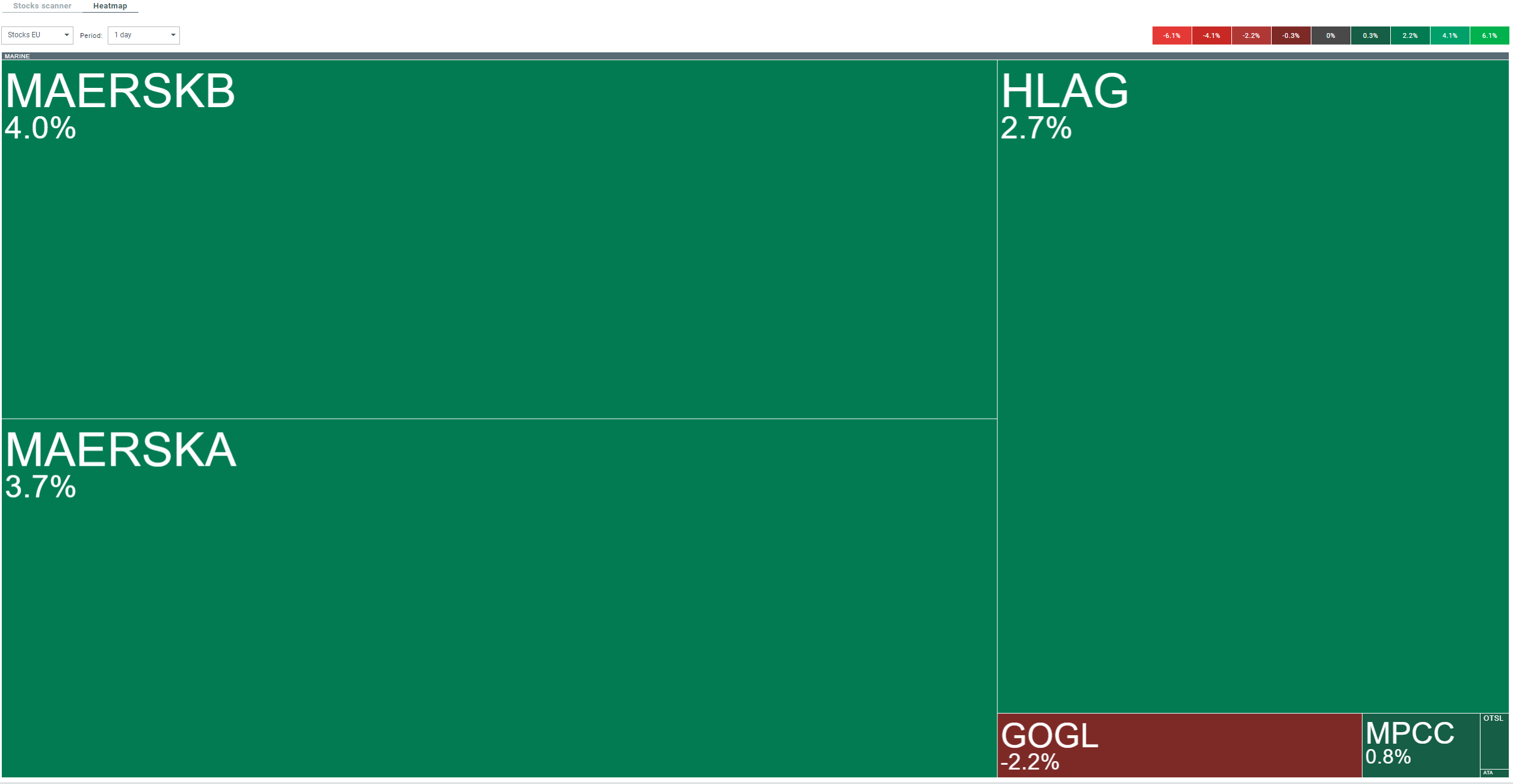

The shares of global freight giant A.P. Moller - Maersk (MAERSKA.DK) are gaining more than 4% in today's session following Goldman Sachs' upgrade of the company's rating. The recommendation raised the previous "sell" rating to "neutral" in the face of rising global freight prices due to problems in the Red Sea.

Moreover, the company decided today to stop its ships from sailing through the Red Sea. GS analysts estimate that spot rates for the East-West route will almost double from pre-disruption levels. "While we previously forecast negative FCF of around $4 billion in 2024/25, we now expect Maersk to generate around $1 billion in 2024." - Goldman Sachs analysts write. The upgraded recommendation also supports other companies in the sector.

A.P. Moller - Maersk was the world's largest freight company by revenue.

Source: Bloomberg Financial LP

Source: Bloomberg Financial LP

Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street