Crude oil is benefiting from good market sentiment. WTI (OIL.WTI) and Brent (OIL) prices are posting close to 2% gains today following news yesterday afternoon that China plans to increase and extend its property support programme to boost the economy. The news is a positive factor for demand creation in the world's key economy, which supports oil prices.

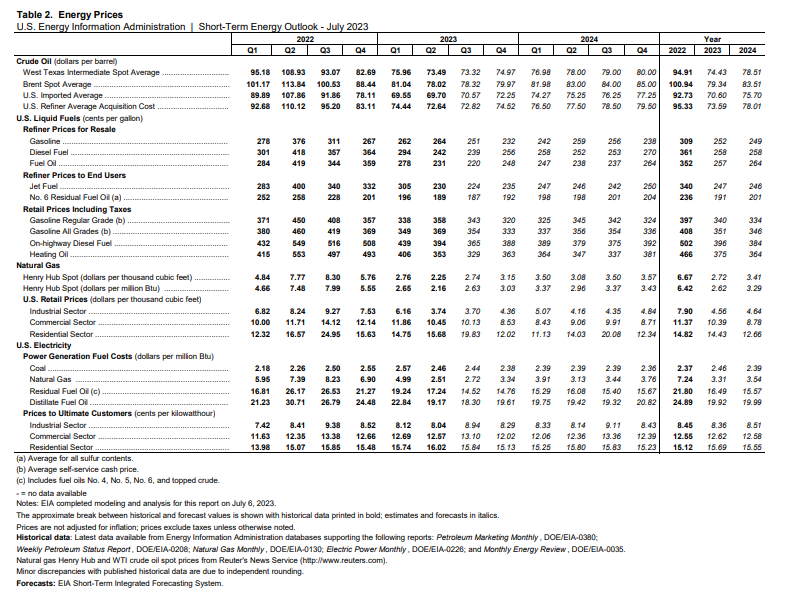

Furthermore, the EIA has raised its oil demand forecasts for 2023 and notified that, according to their models, prices of the BRENT variety will settle around $78 per barrel (for July) and $80 per barrel (in the fourth quarter of 2023). Production forecasts for 2023 have been revised downwards (now: 670,000 barrels per day; previously: 720,000 barrels per day).

Source: EIA

Source: EIA

OIL.WTI quotations have recently been stuck in a broad consolidation, stretching between support at $67 and resistance at $74.70. However, since the end of June, the price of this energy commodity has jumped more than 10% upwards, and the upper limit of the aforementioned consolidation range is currently being tested. In the event of an upward breakout, the next target for buyers will become the resistance at $75.95, followed by the steepness at $19.25.

OIL.WTI quotations have recently been stuck in a broad consolidation, stretching between support at $67 and resistance at $74.70. However, since the end of June, the price of this energy commodity has jumped more than 10% upwards, and the upper limit of the aforementioned consolidation range is currently being tested. In the event of an upward breakout, the next target for buyers will become the resistance at $75.95, followed by the steepness at $19.25.

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

Cocoa bear market? 📉 Weak European grindings and solid African harvests drive prices

🚨Silver slides 1.5% - is the uptrend at risk?