Intel (INTC.US) stock fell more than 5% despite the fact that the biggest chipmaker posted strong quarterly figures. Company earned $1.39 per share, while analysts expected earnings of $1.15 down. Revenue of $18.57 billion also topped market estimates of $17.90 billion. However second-quarter profit forecast fell short of expectations, even as company raised its annual sales outlook. Reporting for the first time under new CEO Pat Gelsinger, the company said it expects to earn only $1.05 a share, rather than the $1.09 average forecast. This is due to significant expenses to get production operations back on track, which will help Intel catch up with rivals thanks to faster chips.

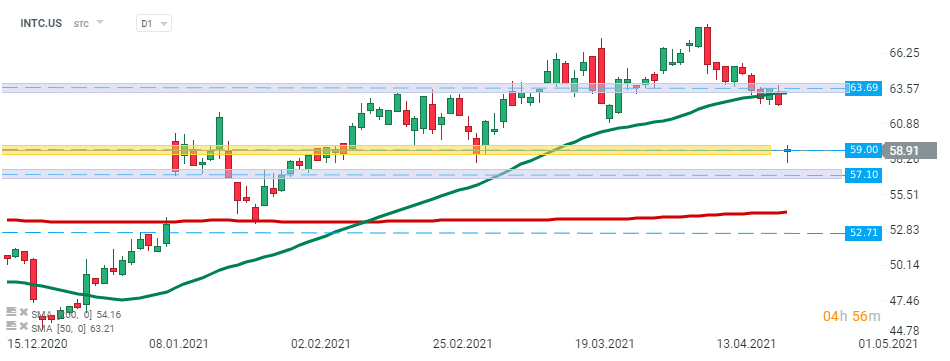

Intel (INTC.US) stock launched today’s session with a bearish price gap after the chipmaker reported disappointing guidance for the current quarter. Source: xStation5

Intel (INTC.US) stock launched today’s session with a bearish price gap after the chipmaker reported disappointing guidance for the current quarter. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026