JPMorgan (JPM.US), a major US investment bank, reported Q4 2022 earnings today ahead of the Wall Street session open. Bank managed to beat expectations in terms of net revenue and earnings as higher interest rate environment benefits banks. However, JPMorgan has trailed estimates in trading business with both equities and fixed income trading revenue coming in below market expectations. . Bank said that $2.29 billion in provisions for credit losses is made up of net $1.4 billion reserve build-up and $887 million net charge-offs. The Bank said that it may be able to resume stock buybacks this quarter but even this information did not offset negative impact of poor trading performance - stock is trading almost 3% lower in premarket trading today.

JPMorgan result highlights:

-

EPS: $3.57 vs $3.07 expected (+7% YoY)

-

Net Income: $11.01 billion (+6% YoY)

-

Net revenue: $35.57 billion vs $34.3 billion expected (+17% YoY)

-

Fixed income trading revenue: $3.74 billion vs $3.91 billion expected

-

Equities trading revenue: $1.93 billion vs $1.98 billion expected

-

Investment banking revenue: $1.39 billion vs $1.66 billion expected

-

Provision for credit losses: $2.29 billion vs $2.05 billion expected

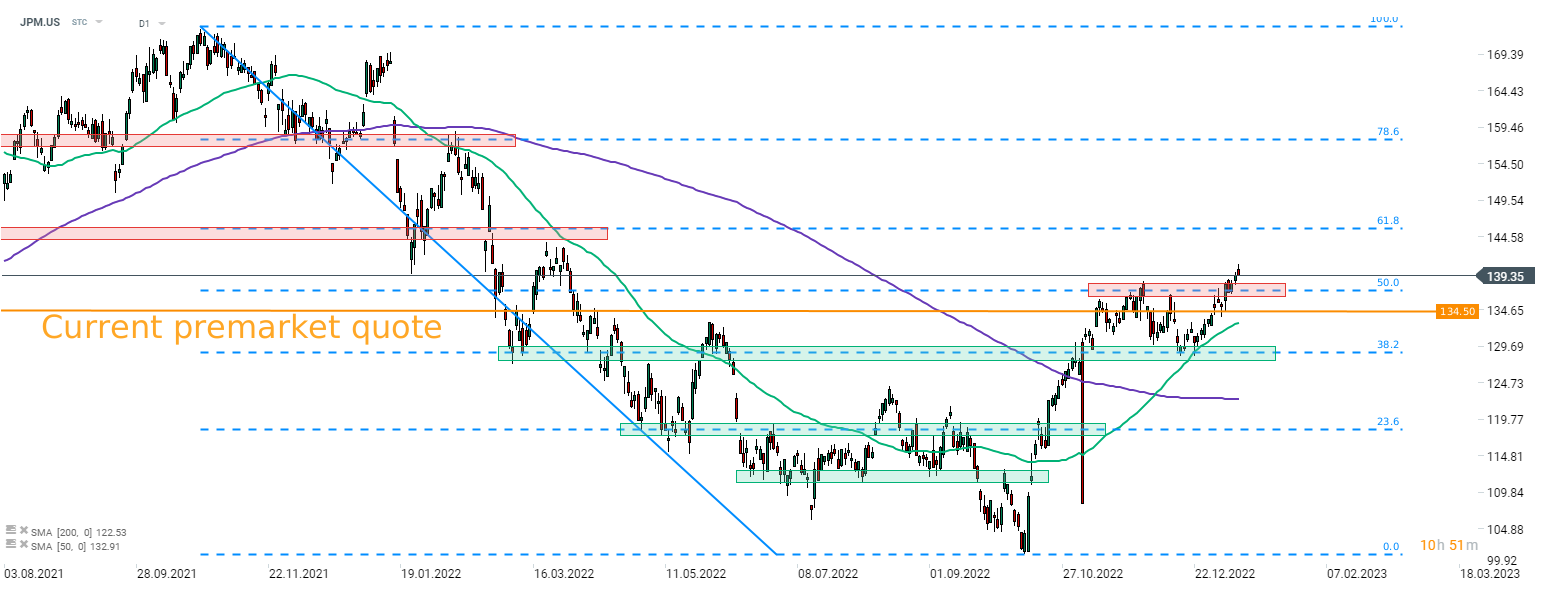

According to current premarket quotes, JPMorgan (JPM.US) is set to launch today's cash trading session with a bearish price gap. Stock is seen opening slightly below a recently-broken resistance zone marked with 50% retracement of the downward impulse started in late-October 2021. In case bulls fail to regain control, a pullback towards the support zone at 38.2% retracement ($128.50 area) cannot be ruled out.

JPM.US at D1 interval. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡