ECB policymaker Peter Kazimir expressed skepticism about making a decision on an interest rate cut in October based on just one favorable inflation report. While he did not rule out a rate cut at the next meeting, he emphasized that key data will come in December, which will provide more certainty for future policy decisions. Kazimir also mentioned that he is not currently concerned about the ECB undershooting its 2% inflation target.

Despite this, the market is currently pricing in nearly a 96% chance of a 25 basis point rate cut by the ECB at the next meeting on October 17, and a 100% chance of a similar cut at the December 12 meeting.

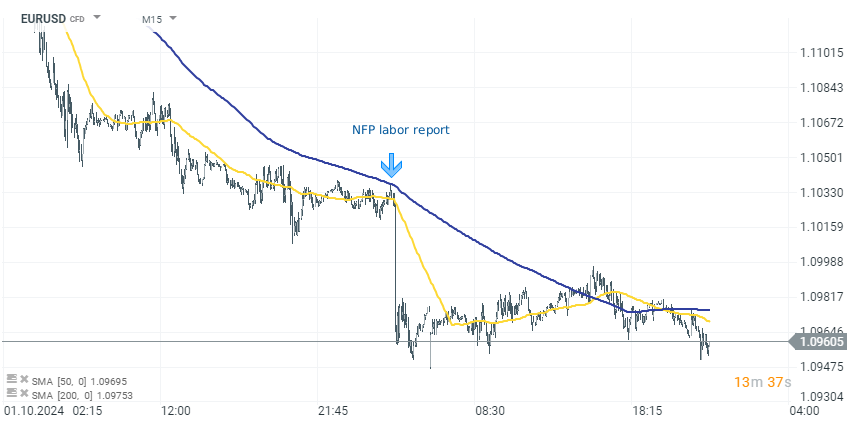

EURUSD (D1 interval)

EURUSD is down 0.23% today to a level of 1.09500. However, the decline is more due to the strengthening of the dollar rather than a drop in the value of the euro. The dollar index is up 0.27% today, with USD being one of the stronger G10 currencies.

Source: xStation 5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)