- Cautious, data-driven approach to future rate cuts

- Confidence in ongoing disinflation process

- Optimistic outlook on eurozone recovery

ECB President Christine Lagarde emphasized a cautious, data-driven approach to monetary policy, indicating that further rate cuts will depend on incoming economic data. She highlighted the ECB’s ongoing efforts to address inflation and the need for flexibility, warning against any pre-set strategies for rate cuts. Despite recent disinflationary trends, Lagarde remains cautious, noting that while the ECB could ease its restrictive stance, any decisions would be made cautiously and based on evolving economic conditions.

Similarly, ECB Chief Economist Philip Lane expressed optimism about the eurozone's economic recovery, citing strong wage growth and ongoing disinflation as positive signs. While some data raised concerns about growth, Lane reaffirmed the ECB’s confidence in the overall recovery, ruling out a dramatic weakening of the economy. Both officials underscored the ECB's commitment to adjusting policy based on economic developments, focusing on managing inflation while supporting recovery.

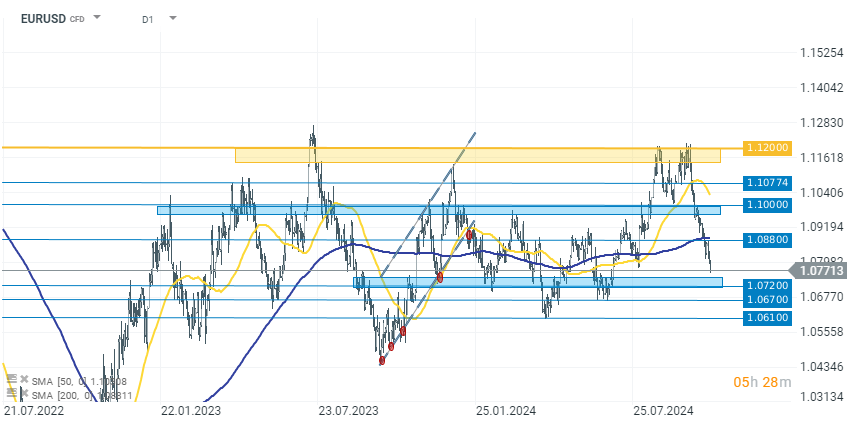

EURUSD (D1 interval)

Although the EUR is one of the stronger currencies today, demand for USD is even higher. As a result, the EURUSD pair is down 0.25% today, reaching 1.07700. As shown in the chart, the recent attempt to break above 1.1200 was unsuccessful, and since then, the rapidly strengthening dollar has pushed the EURUSD rate back down into the consolidation channel. The nearest support level for the current downward movement could be around 1.07200.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)