Lyft (LYFT.US) stock rose more than 4.5% during today's session after ride-hailing reported quarterly earnings of 9 cents per share, slightly beating analysts’ expectations of 8 cent per share. Revenue in Q4 increased 70% YoY to $970 million, topping analysts’ estimates of $940.1m, closing a year in which Lyft's sales were up 36% from 2020 levels. Company's net loss narrowed to $259 million in the quarter, and adjusted EBITDA for all of 2021 was $92.9m, marking the first time the company achieved its profitability target on a full-year basis.

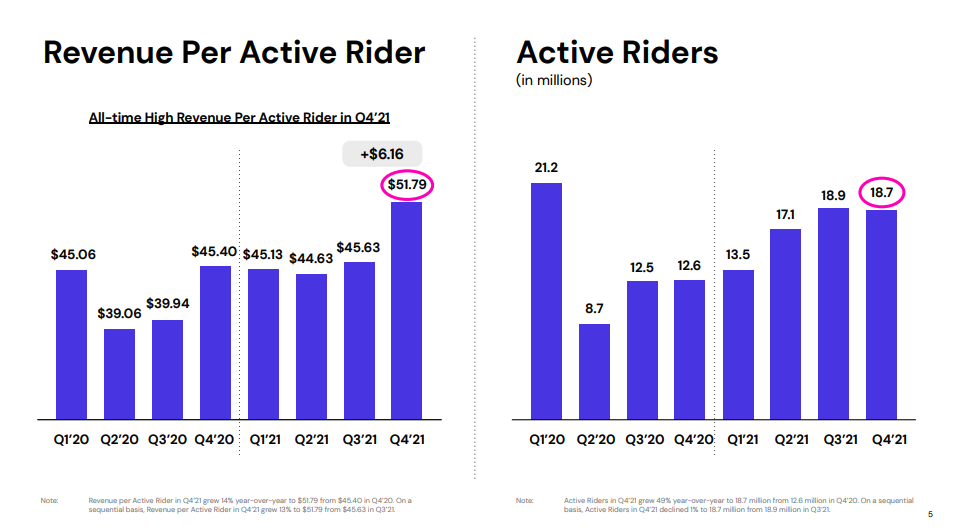

However active rider counts decreased slightly to 18.7 million and still remain below pre-pandemic levels, while revenue per active rider jumped 14% to $51.79. Nevertheless compared to same period last year, number of active riders increased nearly 50%, which is a sign that client's demand continues to recover. Lyft President John Zimmer attributed a small dip in quarter-over-quarter ridership growth to seasonality and a less busy New Year’s Eve.

Screenshot of company's active riders and revenue per active rider for 2020 and 2021, taken from Lyft’s investor deck via TechChurch

Screenshot of company's active riders and revenue per active rider for 2020 and 2021, taken from Lyft’s investor deck via TechChurch

For the current quarter company expects revenue in the region between $800 million and $850 million a notable 15% decline from prior quarter levels that new CEO Elaine Paul put down to the lingering impact of the Omicron surge on ride demand. Analysts expected guidance of $989.9 million, per StreetAccount. Lyft also expects rides to decline slightly quarter-over-quarter, however no specific figures were provided.

Lyft (LYFT.US) stock extended gains following the release of quarterly results. Price bounced off the support at $39.30 which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. If current sentiment prevails, next target for buyers is located at $47.37 and is marked with upper limit of the 1:1 structure. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡