Retail sales rose modestly last month, however rising prices for food, gasoline and other basic products took a big share of consumers' wallets. The report from the Commerce Department showed that retail sales increased 0.5% MoM in March, below an upwardly revised 0.8% rise in February and analysts estimates of 0.6%. Sales at gasoline stations recorded the biggest increase (8.9%), but excluding those receipts, sales fell 0.3%. Other gains were seen in sales at general merchandise stores (5.4%); electronics and appliances stores (3.3%); sporting goods, hobby, musical instrument (3.3%); clothing (2.6%); food and beverages stores (1%); food services and drinking places (1%); miscellaneous stores (0.8%); furniture (0.7%) and building materials and garden equipment (0.5%). In contrast, sales went down at nonstore retailers (e-commerce which fell -6.4%) and motor vehicle and parts dealers (-1.9%). Retail sales excluding autos rose 1.1% from a month earlier in March, following an upwardly revised 0.6% increase in February and slightly above market expectations of a 1.0% gain.

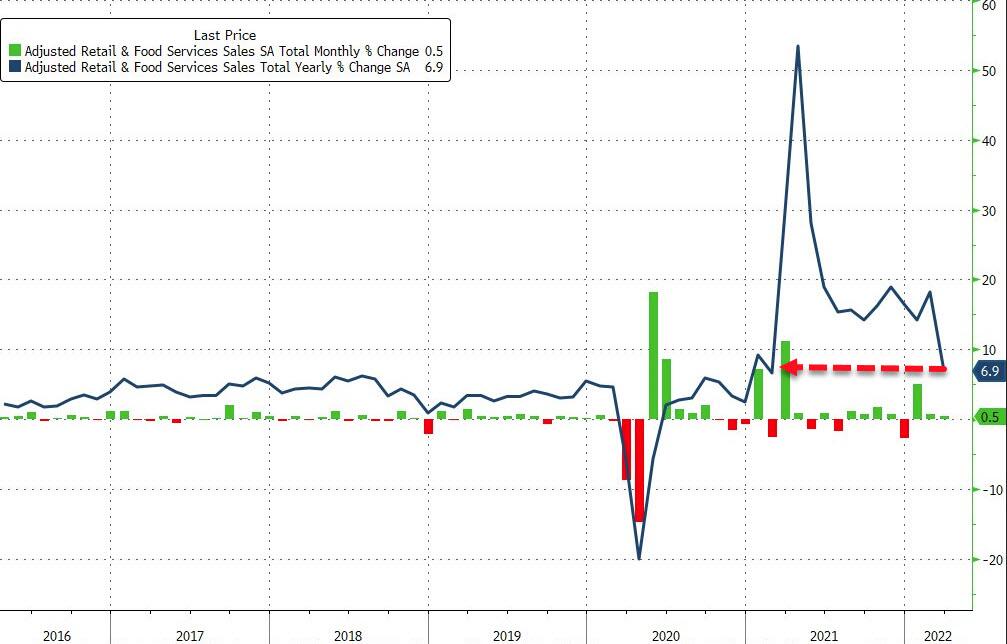

Retail sales rose 0.5% t in March, however on a yearly basis sales decelerated dramatically (up only 6.9% YoY - the lowest since Feb 2021). Source: Bloomberg via ZeroHedge

Retail sales rose 0.5% t in March, however on a yearly basis sales decelerated dramatically (up only 6.9% YoY - the lowest since Feb 2021). Source: Bloomberg via ZeroHedge

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appAt the first glance the report looks positive, however the "control" group, which excludes volatile components such as auto dealers, food service, building materials, gasoline and filters to the GDP calculation - unexpectedly fell 0.1% MoM, while analysts expected 0.1% MoM rise.

Also retail sales data is not adjusted for inflation. Once we reduce the headline data by CPI it turns out that today's reading is negative.

"Real" retail sales are negative for the second straight month. Source: Bloomberg via ZeroHedge

"Real" retail sales are negative for the second straight month. Source: Bloomberg via ZeroHedge