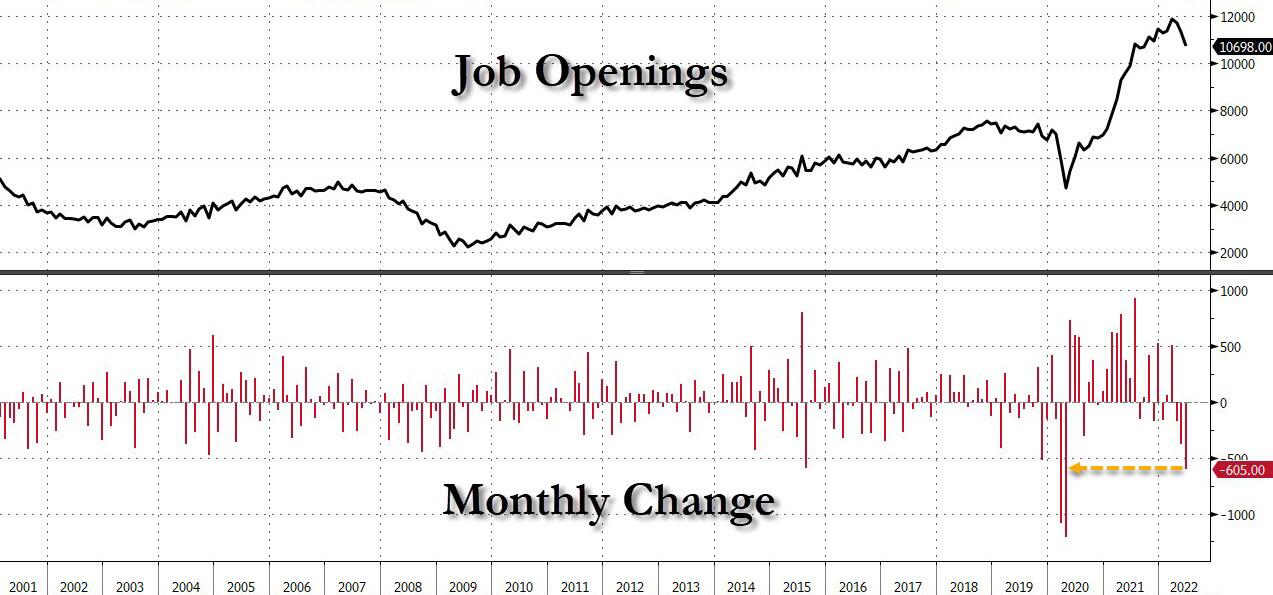

The number of job openings in the US fell by 605,000 from a month earlier to 10.7 million in June, the lowest in nine months, while analysts expected a reading of 11 million. It was the third consecutive drop in job openings after a record level in March. The largest decreases in job openings were in retail trade (-343,000), wholesale trade (-82,000), and in state and local government education (-62,000).

In June JOLTS report recorded the third biggest decline on record. Source: Bloomberg

Such a sharp decline only boosts recession fears. According to Head of Nordea Market Strategy Mikael Sarwe" the previous times job openings fell this much from the highs, the US entered a broader NBER recession". He also pointed out that the number of job openings is still elevated, therefore only time will tell whether this is a correct signal.

When the JOLTS number fell at such a similar rate in previous years, it always heralded problems for the US economy. Source: Macrobond and Nordea via Twitter/ Mikael Sarwe @MikaelSarwe

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: Final US UoM consumer sentiment drops🗽Inflation expectations higher

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!

BREAKING: US CPI data lower than expected 📈US100 gains