- US Core inflation picks up

- UK labour market backs up GBP

- China trade remains sluggish

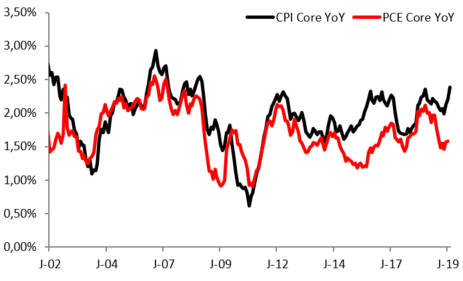

US – is growing inflation a sign of economic strength?

A release of the US inflation data was a bit overshadowed by the ECB meeting but it sure helped push EURUSD towards 2019 lows before the tiering details fueled the rally on the pair. When the Fed meets next week they will need to consider if core inflation above 2% and rising is a sign of robust demand or a tendency that will actually undermine purchasing power going forward. That inflation measure ticked up to 2.4% y/y on higher healthcare and recreation costs and normally that would prevent the central bank from cutting rates. However, core CPI is way above the PCE (more spending oriented measure) which the Fed targets. This dilemma will likely only become more serious: as tariffs bite inflation could increase further without necessarily reflecting buoyant consumer (which seems to be the case so far as retail sales data suggests but can fade in coming months).

Higher core inflation was often present towards the end of expansion cycle. Source: Macrobond, XTB Research

Higher core inflation was often present towards the end of expansion cycle. Source: Macrobond, XTB Research

Key economic event next week: FOMC decision (Wednesday, 7pm BST)

Europe – UK wage growth picks up, GBP gains

That’s been another strong week for the GBP. After clearing the stops below the 1.20 the GBPUSD has formed a double bottom and really sparked higher, now breaking 1.24 level. Yes’ it’s been mostly declining risk of Hard Brexit but the economic data also help. Wage growth was at 4% y/y – way above the expectations and the highest level of this decade. This means that if there’s solution to the Brexit uncertainty Bank of England might be one of the few central banks where the next move is hike, not cut.

GBPUSD has cleared the 1.24 resistance and the bulls look towards 1.2550 and 1.2770. Source: xStation5

GBPUSD has cleared the 1.24 resistance and the bulls look towards 1.2550 and 1.2770. Source: xStation5

Key economic event next week: UK CPI (Wednesday, 9:30am BST), Bank of England decision (Thursday, 12:00pm BST)

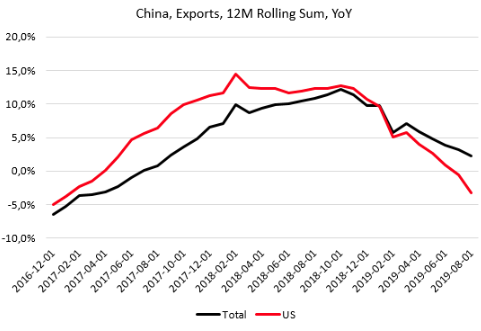

Asia – Trade talk to dominate data

The Chinese trade data was published over the weekend and actually raised slowdown concerns that were quickly dispelled on the markets by a growing trade-talk hype. Having said that one can see that growth momentum in Chinese exports remains negative and any kind of tariff relief would help from that perspective. The question here is: how much will China want to bend now in a hope to get much softer deal from Democrats if they win next year.

After removing monthly volatility, it’s clear that the Chinese exports keeps struggling. Source: Macrobond, XTB Research

After removing monthly volatility, it’s clear that the Chinese exports keeps struggling. Source: Macrobond, XTB Research

Key economic event next week: Chinese monthly data (Asian session on Monday)

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: Final US UoM consumer sentiment drops🗽Inflation expectations higher