Macy’s (M.US) stock jumped more than 13.0% on Wednesday after the upscale department store chain posted better-than-expected Q3 profit and revenue figures. Company raised its annual earnings forecast on steady demand from wealthier shoppers.

-

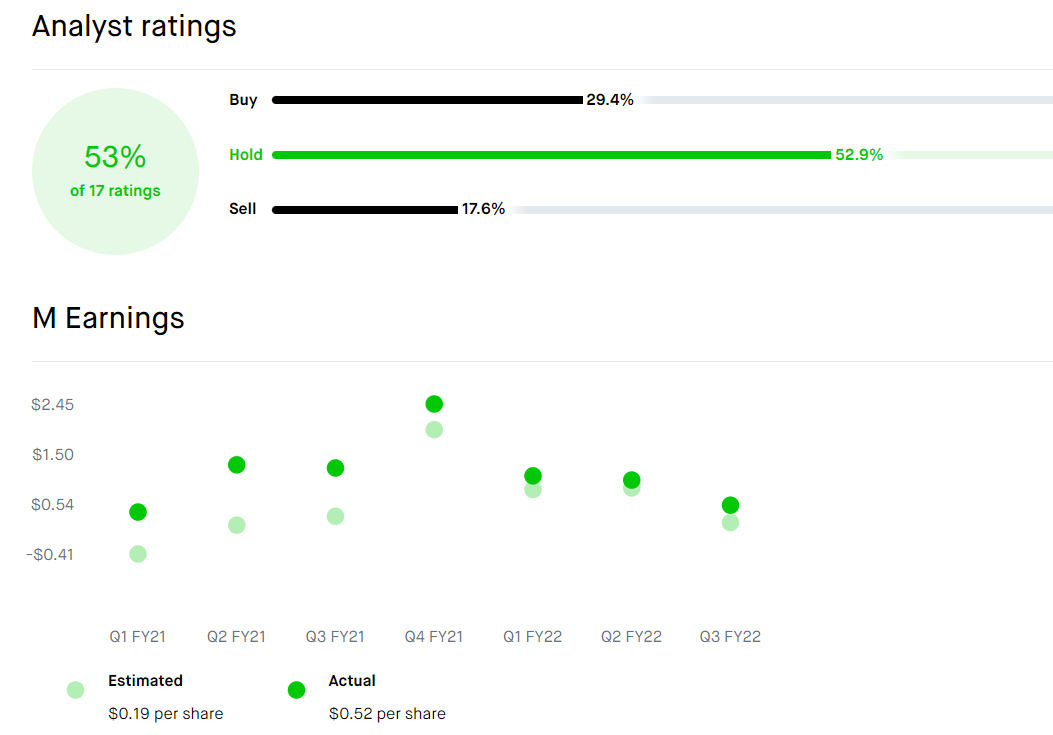

Company earned 52 cents per share, which is a 57% decline compared to the same period last year, however easily topped analysts’ estimates of 19 cents expected

-

Revenue dropped 3.9% to $5.23 billion, slightly above market estimates of $5.2 billion expected

-

Same-store sales fell 3.1%, less than analysts expected

-

For the 2022 financial year, company forecasts net sales in the region of $24.34 billion to $24.58 billion, with adjusted earnings in the range of $4.07 to $4.20 per share, significant improvement compared to earlier forecasts between $4.00 and $4.20 per share

-

“Our Polaris strategy is working. In the third quarter, we achieved solid top line results and a strong beat to our bottom line guidance. Macy’s brand position as a style and fashion source resonated with our customers, while luxury continued to outperform at Bloomingdale’s and Bluemercury,” said CEO Jeff Gennette.

-

Macy's plans to hire more than 40,000 seasonal workers during the holiday period, a sharp decline compared to nearly 80,000 workers last year -including permanent staff - which may indicate that the company expects lower turnover in its key quarter.

Earnings easily topped market estimates in Q3 2022, however have been gradually decreasing since Q4 2021. Source: https://robinhood.com/stocks/M/

Earnings easily topped market estimates in Q3 2022, however have been gradually decreasing since Q4 2021. Source: https://robinhood.com/stocks/M/

Macy’s (M.US) stock rose sharply on Thursday and is currently testing a major resistance zone around $22.40 which is marked with the upper limit of the 1:1 structure and upper limit o the ascending channel. Should break higher occur, upward move may accelerate towards resistance at $25.00, which coincides with 38.2% Fibonacci retracement of the bullish wave from March 2020. On the other hand, if sellers manage to regain control, nearest support to watch can be found at $21.10, which is marked with previous price reactions and 50.0% retracement. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records