Today, five major U.S. banks are releasing pre-session results for Q3 '22. Here are the highlights:

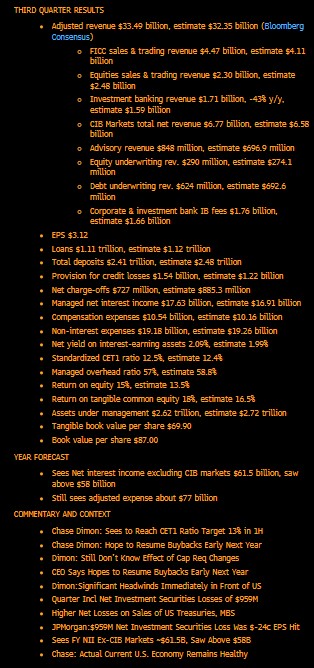

JPMorgan (JPM.US)

Results:

Source: Bloomberg

Yesterday's session result: 5,56

Result today (pre-market): 2.20%

Forecasts:

Earnings per share (EPS): $2.88USD

Revenue: $32.09 billion

Comment:

The so-called Whisper number, or the unofficial "Street" view of earnings, says EPS at $3.03/share. The company's earnings momentum has slowed over the past three quarters, which is not conducive to the strategy of investors interested in growth companies (growth). The stock is attractively valued, as the P/E ratio is only 9, a reading below the S&P500 valuation which may represent a long-term investment opportunity for value investors (value).

The bank's investment banking business segment may remain weak due to the slowdown in the IPO market . Chief Operating Officer Daniel Pinto expected investment banking fees to fall 50% y/y in the third quarter, following a 60% decline in the second quarter. The bank also increased its "black hour" reserves by $1.1 billion from $1.5 billion in the first quarter to cover the risk of loan defaults, suggesting that rising rates and a deteriorating economy are increasing the cost of banks' bad debt risks.

Overall, JPMorgan's bottom line may not be as bad as previously forecast, and the earnings surprise could provide an opportunity for the world's largest investment bank to rebound.

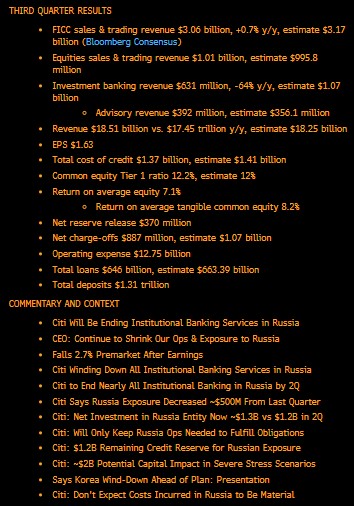

Citigroup (C.US) Source: Bloomberg

Source: Bloomberg

Yesterday's session result: 5.17%

Performance today (pre-market): 0.28%

Forecasts:

Earnings per share (EPS): $1.42

Revenue: $18.25 billion

Comment

Consensus suggests that the bank may not perform as strongly as in the previous quarter. The bank also set aside provisions of $1.3 billion to cover loan losses.

Wells Fargo & Company (WFC.US)

Source: Bloomberg

Yesterday's session result: 4.62%

Performance today (pre-market): 1.61%

Forecasts:

Earnings per share (EPS): $1.09

Revenue: $18.77 billion

Comment:

The current environment of rising interest rates is generally good for bank stocks. That's because banks' earnings are highly correlated with how they invest deposits relative to the interest they pay consumers on those deposits, which is called the spread. However, the mere prospect of higher interest rates hasn't stopped Wells Fargo shares from falling along with the overall market. Putting aside the fact that the bank recently passed the Fed's stress test and raised its quarterly dividend by 20%, the market is discounting Wells Fargo's tangible book value relative to a peer group that boasts fewer deposits and loans. With an improved balance sheet due to several cost-saving initiatives, it still has $20 billion in share buybacks to make.

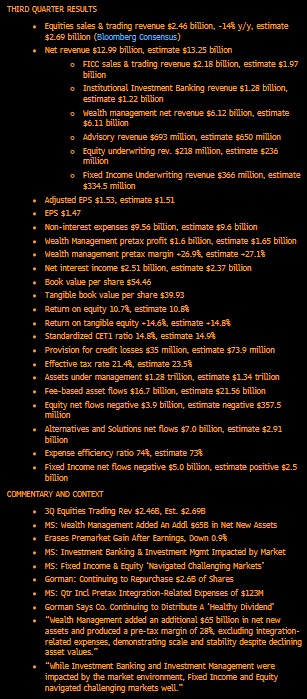

Morgan Stanley (MS.US)

Source: Bloomberg

Source: Bloomberg

Yesterday's session result: 3.55%

Performance today (pre-market): - 3.1%

Forecasts:

Earnings per share (EPS): $1.51

Revenue: $13.3 billion

Comment

As with other banks, earnings growth has slowed over the past two quarters, which is a negative factor. From the point of view of value investors, the stock may be attractively valued, as the P/E ratio is only 10, which is below the S&P 500 and many other stocks in the market.

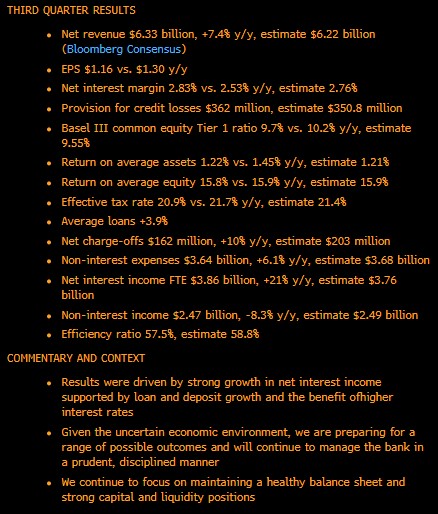

US Bancorp (USB.US)

Source: Bloomberg

Yesterday's session performance: 5.78%

Performance today (pre-market): 0.00%

Forecasts:

Earnings per share (EPS): $1.17

Revenue: $6.24 billion

Comment:

The bank's margins and interest income are mostly driven by interest rate hikes. According to the latest Fed data, loan growth in the quarter remained decent, with commercial and industrial, mortgage and consumer loan volumes declining slightly in July and August compared to the second quarter. Encouragingly, commercial real estate loan growth accelerated in the third quarter. This likely supported US Bancorp loan balances, which account for 50% of commercial loans.

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales