European Central Bank is set to announce monetary policy decisions on Thursday at 12:45 pm BST. Interest rates are expected to be left unchanged. However, things are less obvious when it comes to asset purchases. European Central Bank conducted an 18-month long policy review, which has led to a revision of the Bank's inflation goal. On top of that, ECB President Lagarde hinted that changes may also be made to forward guidance. Markets began to speculate that ECB may be warning markets that its policy is about to become more accommodative. Having said that, the statement itself may be interesting but explanations offered by Lagarde during a presser at 1:30 pm BST are likely to draw significant attention as well.

Inflation goal

ECB announced results of its strategy review on Thursday, July 8. Bank will no longer pursue an inflation "below, but close to 2%" and instead will follow a 2% goal with commitment to symmetry. What does this mean? ECB will aim to achieve a 2% inflation goal and perceive both positive and negative deviations as equally undesirable. Nevertheless, transitory deviations from the target will be allowed. As the ECB has been struggling to achieve its previous goal for years, markets began to speculate that the new target may pave the way for a more accommodative monetary policy, which - at least in theory - should boost price growth.

Forward guidance

ECB President has also hinted recently that the Bank may make changes to its forward guidance during the upcoming meeting. The question remains - which one? ECB forward guidance on rates is that they will stay low until inflation goal is achieved and it looks unlikely that the Bank will change its approach. ECB forward guidance on pandemic purchases assumes that PEPP will run until the end of March 2022. Given that virus cases are on the rise and change to inflation goal, ECB may be readying the market for a change here - possibly a slower phasing out of PEPP. Finally, forward guidance on Asset Purchase Programme (APP) assumes it will run for as long as necessary to ensure accommodative impact of policy rates. This one is the most vaguely written and some market participants speculate that ECB may want to somehow link it to the inflation target.

Market reaction

While ECB itself did not offer much hint on the direction of changes to forward guidance, markets seem to be sure that it will be a dovish tilt, rather than a hawkish one. The ECB has effectively increased its inflation target and the fact that it has struggled to achieve the previous one in recent years, hints that the Bank wants to make its policy somewhat more loose rather than tight. If this is so, the euro could come under pressure and stocks could benefit.

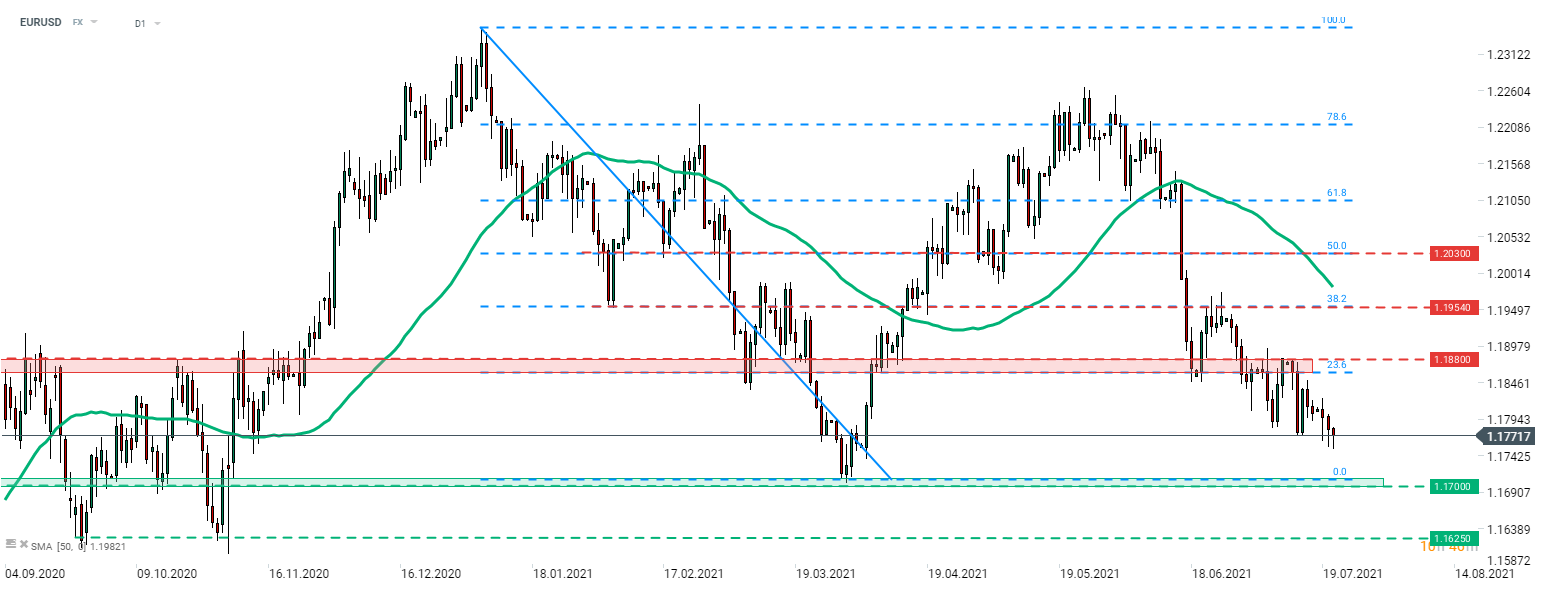

EURUSD has been trading lower recently and has reached a fresh 3-month low this week. The pair is slowly approaching a support zone ranging above the 1.1700 handle. The area is marked with lows from the end of March 2021. A point to note is that the pair has painted a clear, downtrend structure over the past few weeks so sentiment change may require a break above the latest lower low in the 1.1880 area.

Source: xStation5

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

Economic calendar: Eurozone CPI and central bankers speeches in focus

🚨 EURUSD deepens decline, falls to key support zone

Morning wrap (03.03.2026)