Labor Day is celebrated on different days around the world, but in many cases it falls on the beginning of May. Consequently, markets may behave restlessly in times of limited volume. For starters, it is worth paying attention to the pair of EURUSD, which bounced off the downtrend line and is trying to stay above the 1.20 level:

Despite defending the support, the dollar has remained strong since the end of the previous week. Source: xStation5

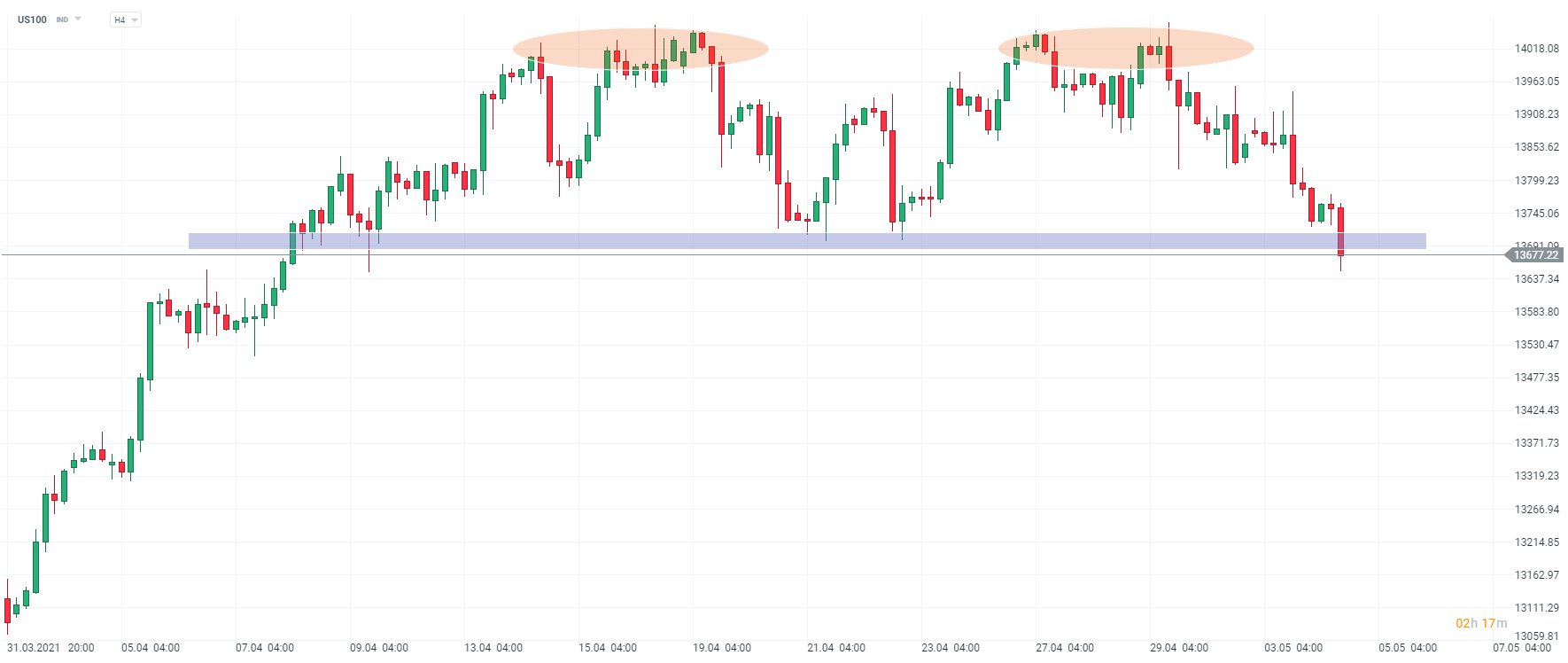

Yesterday's rebound on Wall Street was only partial, as after the session the contracts moved south again. As you can see, we can even talk about a double or triple top on the US100:

In case of closing below the key support zone, the range of the pattern is around 13333 points. Source: xStation5

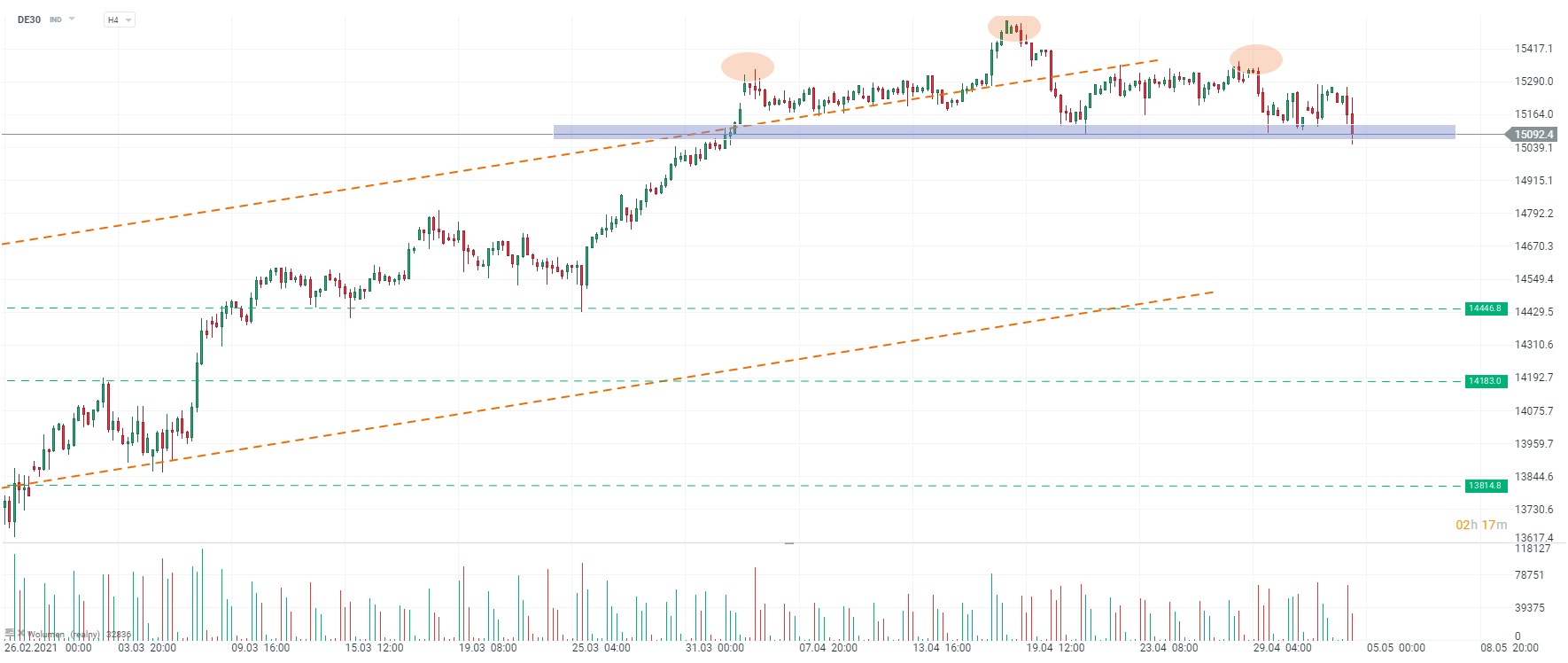

Despite quite a good session in Europe, the German DAX is doing poorly. DE30 contracts have the potential to break below the neckline of the head to shoulders formation. Nevertheless, the support is quite strong and the DAX is rising from around 15,000 points.

If the DE30 breaks through the neckline and supports at 15,000 then the next target for sellers is located around 14,650 points. Source: xStation5

Market overview: PMI shapes European markets🚨

Chart of the day: EURUSD under pressure after PMI data! 📉

BoJ maintains rates despite hawkish shift in outlook. What next for the USDJPY?

Morning wrap (23.01.2026)