Micron Technology (MU.US) shares are losing more than 6% ahead of today's session opening after China's cybersecurity regulator said the company's products failed a cybersecurity review in the country. As reported in Beijing, Micron products sold in China caused security risks to the IT infrastructure of Chinese supply chains. This means that the use of the company's products will be banned from key infrastructure projects in the world's second-largest economy.

The whole affair has to do with the investigation into the security of Micron products launched by the CAC (China Cyberspace Administration) six weeks ago and the ongoing US-China technology war.

This information alone puts pressure on the company's shares in the short term. Nonetheless, it is worth remembering that the company announced last week that it would invest around 500 billion yen (US$3.6 billion) in technology development in Japan, which may suggest that the company is looking to move its manufacturing centres to other corners of the world.

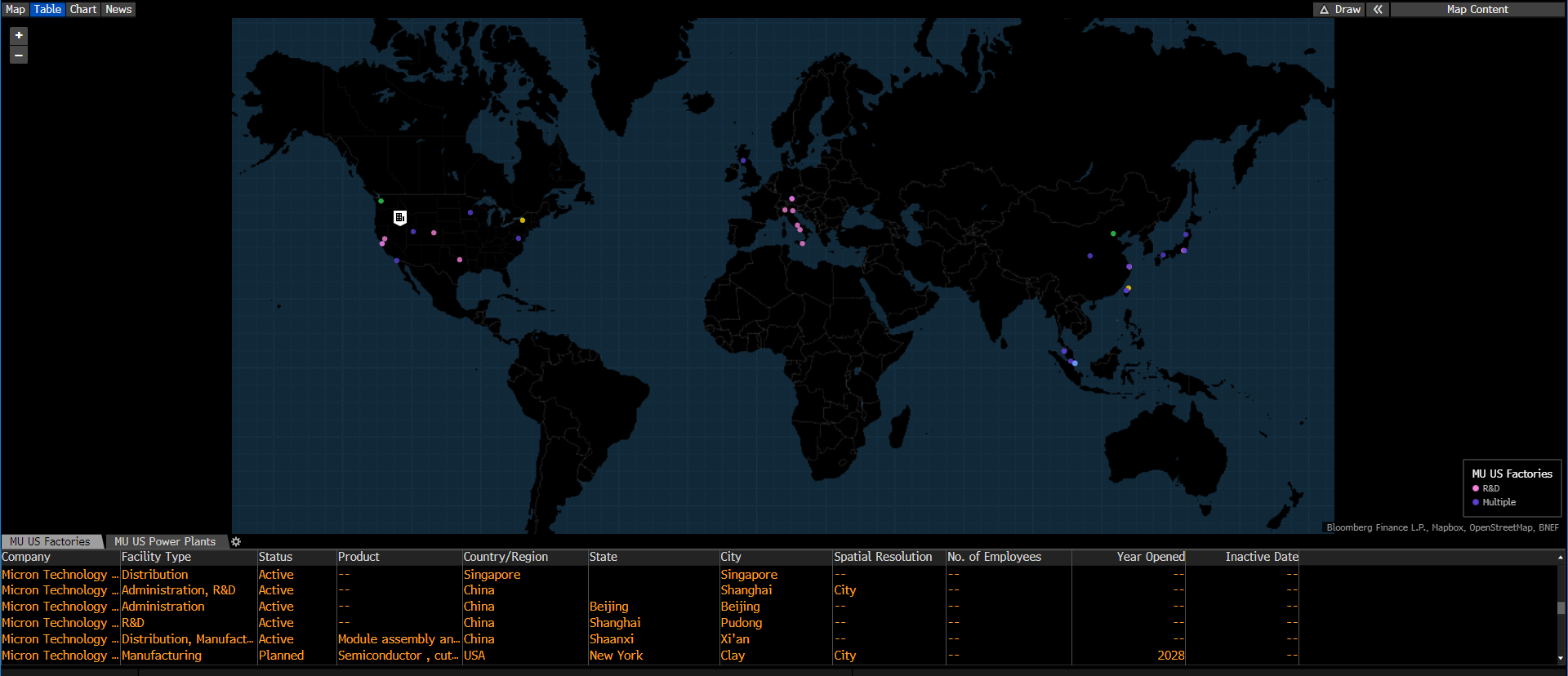

Map showing all of Micron's research, administration and operations centers. Source: Bloomberg

Map showing all of Micron's research, administration and operations centers. Source: Bloomberg

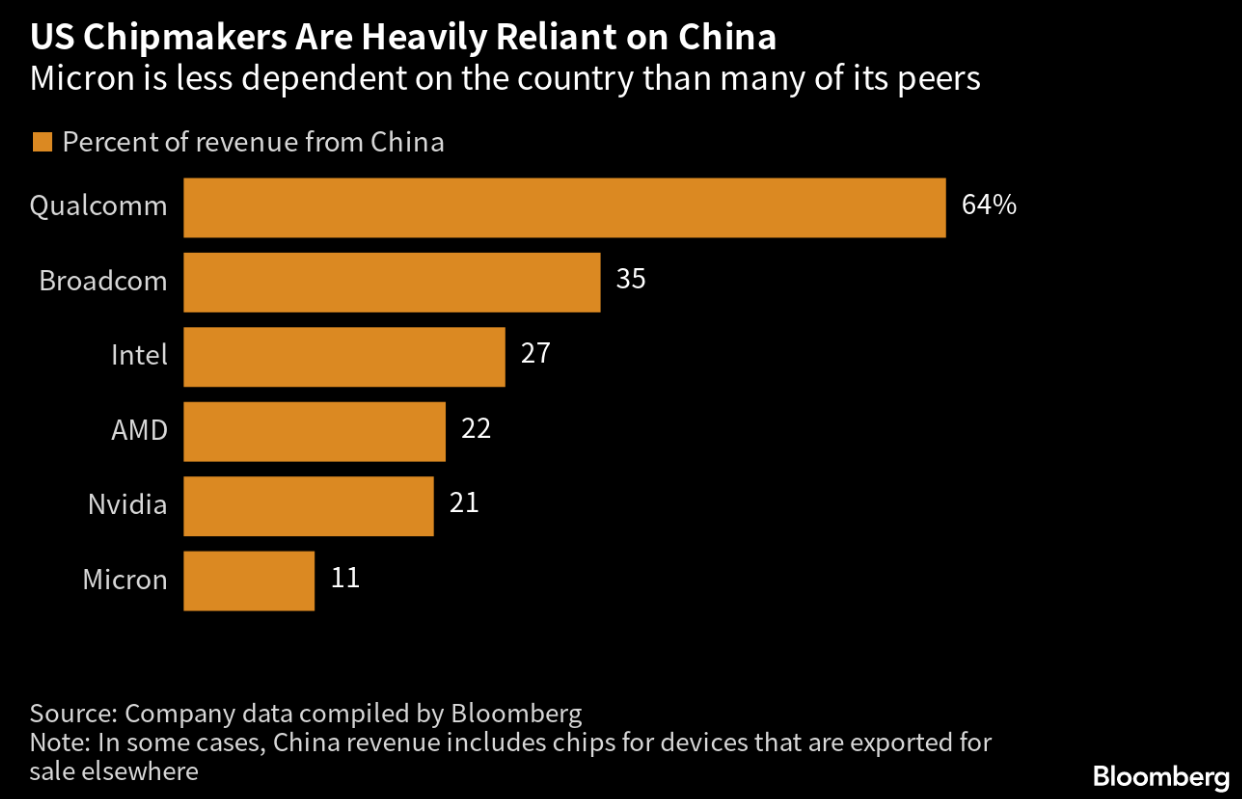

Micron itself, however, is not as dependent on China as other key US companies. Source: Bloomberg

Micron itself, however, is not as dependent on China as other key US companies. Source: Bloomberg

Micron Technology (MU.US) share price chart, D1 interval. The worrying news from China took the company's shares down to the levels of key support marked by local peaks, which were tested as many as 7 times! Source: xStation 5

Micron Technology (MU.US) share price chart, D1 interval. The worrying news from China took the company's shares down to the levels of key support marked by local peaks, which were tested as many as 7 times! Source: xStation 5

Daily summary: Alphabet shares support sentiments on Wall Street 🗽Oil, precious metals and crypto slide

Critical Metals at the center of speculation around Greenland 🔎

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

German industrial conglomerate to sell off troubled unit in India ❓Shares gain 5% 📈