Microsoft (MSFT.US) trades around 3% higher in premarket today. The gain comes after the release of fiscal-Q1 2024 (calendar Q3 2023) earnings report yesterday after the close of the Wall Street session. Company managed to post better-than-expected results in each of the three main segments.

Microsoft beats expectations across the board

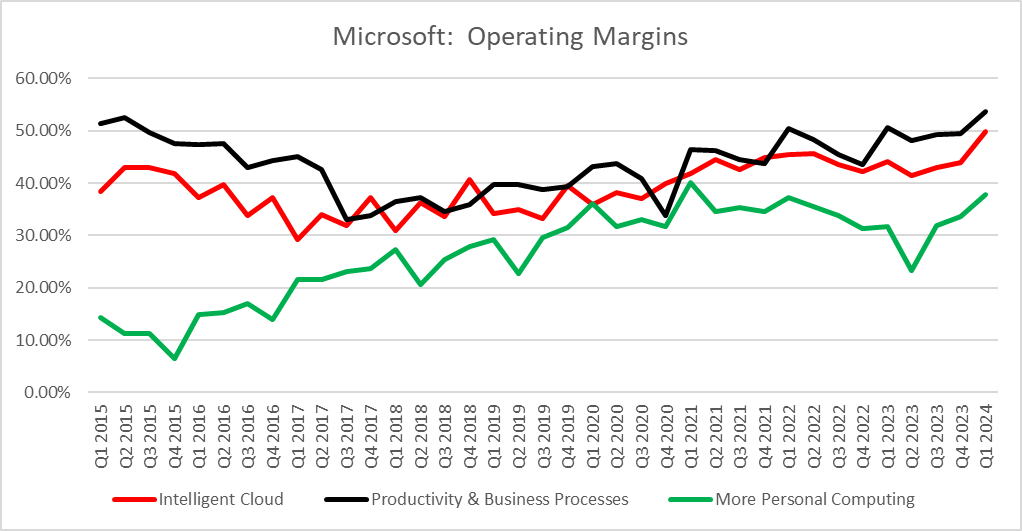

Earnings report for calendar Q3 2023 from Microsoft turned out to be better-than-expected across all key metrics. Sales in each of three major segments were higher than expected, and so were operating profits. Operating margins improved greatly even as the company continued to make heavy investments in the AI to capture new tech trends. Company reported a record total revenue while analysts expected a small quarter-over-quarter pullback while net income also reached a new record.

Company showed solid performance of Productivity & Business Processes as well as More Personal Computing segments but market attention was primarily focused on the cloud segment which is emerging as a key driver of Microsoft's growth.

Fiscal-Q1 2024 results

- Revenue: $56.52 billion vs $54.54 billion (+13% YoY)

- Productivity and Business Processes: $18.59 billion vs $18.29 billion expected

- Intelligent Cloud: $24.26 billion vs $23.61 billion expected

- More Personal Computing: $13.67 billion vs $12.89 billion expected

- Revenue growth at constant FX: 12% YoY vs 8.7% YoY expected

- Cloud revenue: $31.8 billion vs $31.19 billion expected

- Azure cloud growth: 29% vs 26% in fiscal-Q4 2023

- Operating income: $26.90 billion vs $24.12 billion expected (+25% YoY)

- Productivity and Business Processes: $9.97 billion vs $9.23 billion expected

- Intelligent Cloud: $11.75 billion vs $10.31 billion expected

- More Personal Computing: $5.17 billion vs $4.41 billion expected

- Operating margin: 47.6% vs 44.2% expected

- Productivity and Business Processes: 53.6% vs 50.5% expected

- Intelligent Cloud: 48.4% vs 43.7% expected

- More Personal Computing: 37.8% vs 34.2% expected

- Net Income: $22.29 billion vs $19.74 billion expected

- EPS: $2.99 vs $2.65 expected ($2.35 a year ago)

- Capital expenditures: $9.92 billion vs $9.25 billion expected

Source: Bloomberg Finance LP, XTB Research

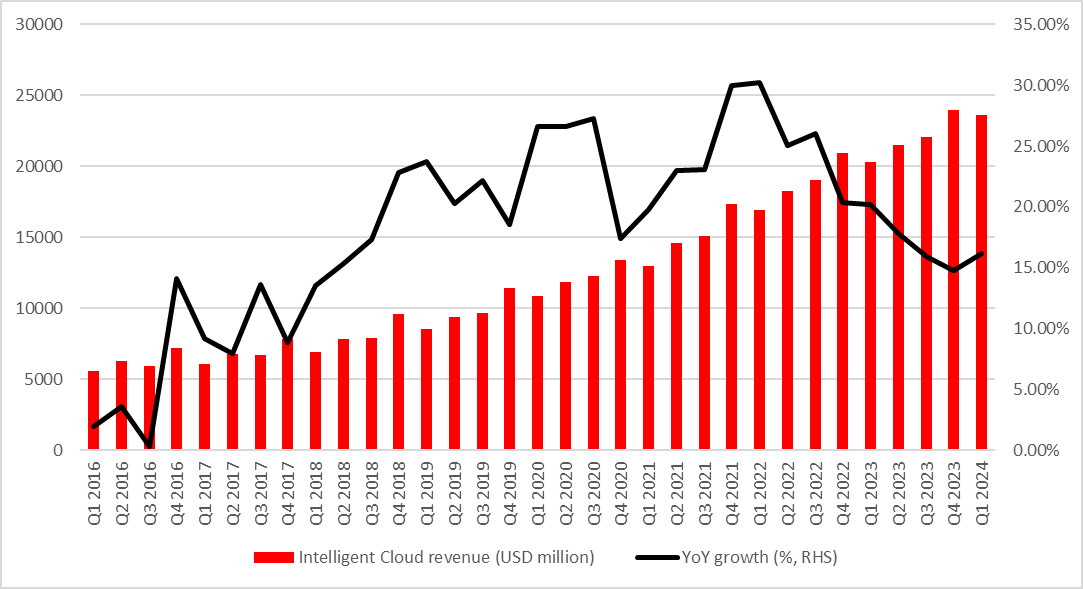

Solid performance of cloud segment

The attention in Microsoft earnings was mostly on performance of the cloud segment. Expectations pointed to a reacceleration in Intelligent Cloud segment sales growth and it indeed has accelerated to 14.7% YoY in fiscal-Q4 2023 (calendar Q2 2023) to 16.2% now. It was also another quarter in a row when Intelligent Cloud was the main driver of Microsoft's operating income. Generative AI is already contributing nicely to results and has added 300 basis points to Azure-cloud growth during the quarter. Strong results of Microsoft's cloud business show that it is emerging as a leader in the field, especially after Alphabet's cloud results disappointed.

Source: Bloomberg Finance LP, XTB Research

A look at the chart

Fiscal-Q1 2024 results from Microsoft were solid across the board so it should not come as a surprise that the company's stock launched today's trading higher. Microsoft (MSFT.US) launched today's cash session with an over-4% bullish price gap, reaching the highest level since late-July 2023. While part of this gain has been trimmed already, the stock continues to higher on the day and above the $336 resistance zone. A textbook range of the upside breakout from a recent trading range suggests a possibility of a move above $360 per share - area within a striking distance of the all-time highs reached in mid-July 2023.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡