Microsoft (MSFT.US) is scheduled to publish its fiscal-Q4 2023 financial report (April-June 2023 period) after the close of the Wall Street session today. Let's take a quick look at what market expects and what to focus on!

What market expects from Microsoft in fiscal-Q4 2023?

Microsoft is expected to report a fiscal-Q4 2023 financials today after Wall Street closes. Company is expected to report growth in two key segments - Productivity & Business Processes and Intelligent Cloud - although pace of expansion is likely to slow. More Personal Computing segment is expected to report a year-over-year drop in sales.

-

Revenue: $55.5 billion expected (+6% YoY)

-

Productivity & Business Processes: $18.1 billion (+9% YoY)

-

Intelligent Cloud: $23.8 billion (+13.9% YoY)

-

More Personal Computing: $13.6 billion (-4.9% YoY)

-

-

Total Microsoft cloud revenue: $30.1 billion (+20.4% YoY)

-

EPS: $2.55 ($2.24 in fiscal-Q4 2022)

-

Net Income: $19.04 billion (+13.7% YoY)

-

Operating Income: $23.27 billion (+13.3 YoY)

-

Capital Expenditure: $7.85 billion

-

Revenue growth at constant currency: +8.5%

-

Gross margin: 69.4%

Microsoft's financial snapshot. Source: XTB Research

Focus on AI, margins and fiscal-2024 outlook

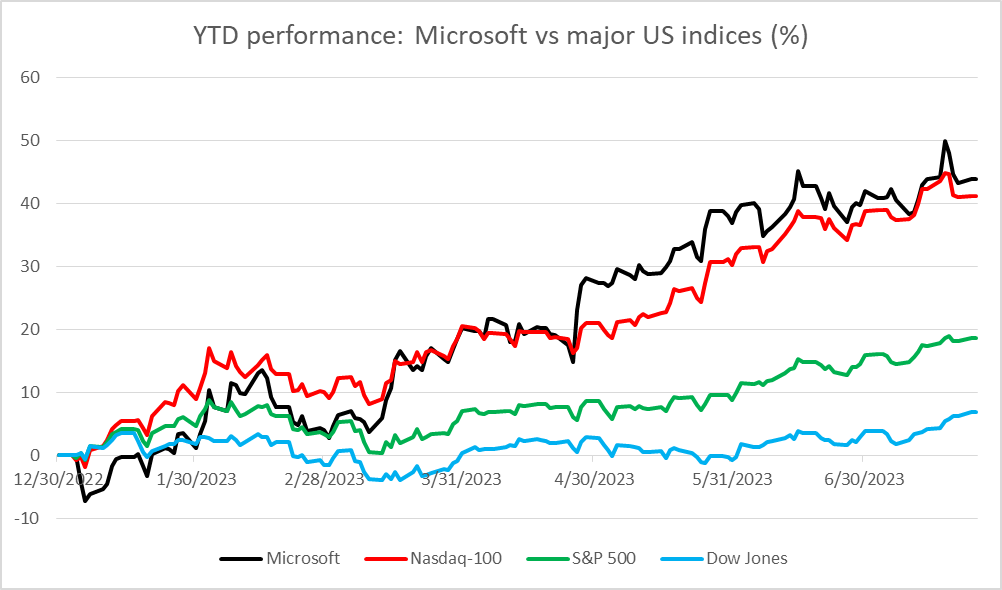

Artificial Intelligence (AI) is a new fever in the tech sector but also outside of it. Investors saw AI as an opportunity and AI-related stocks rallied earlier this year. Microsoft is no exception and while the company did not experience as big of a rally as, for example, Nvidia did this year, share price of Microsoft is up over 40% year-to-date.

Executives at Microsoft struck an upbeat note on AI and said that the company is poised to integrate AI into its business portfolio and benefit from it. However, there is also a concern that increase in AI workloads may depress margins in Microsoft's cloud business. Having said that, one cannot rule out that Microsoft's management will announce some kind of increased cost controls for the current fiscal year (July 2023 - June 2024). Also, investors will pay close attention to revenue growth in Microsoft's cloud business as total cloud revenue is seen growing by around 20% YoY, down from 25% YoY growth recorded in a year ago quarter. Last but not least, as this will be the release for the final quarter of fiscal year 2023, Microsoft will also publish financial forecasts for fiscal-2024 and those could be the main driver for the stock, rather than quarterly earnings for April-June 2023 period.

Microsoft has outperformed all major Wall Street indices so far this year. Source: xStation5

Microsoft has outperformed all major Wall Street indices so far this year. Source: xStation5

A look at the chart

Taking a look at Microsoft chart (MSFT.US) at D1 interval, we can see that the stock has reached fresh all-time highs recently but the upward move was halted after reaching $366 area. Downward correction was launched and that stock is now trading around 5% below recent ATH. A point to note is that pullback looks to have been halted by the $342.50 resistance zone, marked with late-2021 highs. Solid earnings, especially promising fiscal-2024 outlook, could provide fuel for the stock to resume moving higher and look towards fresh all-time highs.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡