Rally on the cryptocurrency market resumed after a brief pause. Bitcoin gains over 5% and climbs above $66,000 mark for the first time since mid-November 2021. The most famous cryptocurrency is trading just 3-4% below its all-time highs reached in early-November 2021. A still-strong demand for Bitcoin ETFs is supporting sentiment towards digital assets. Continued gains on cryptocurrency market are providing fuel for share price gains on crypto-linked stocks.

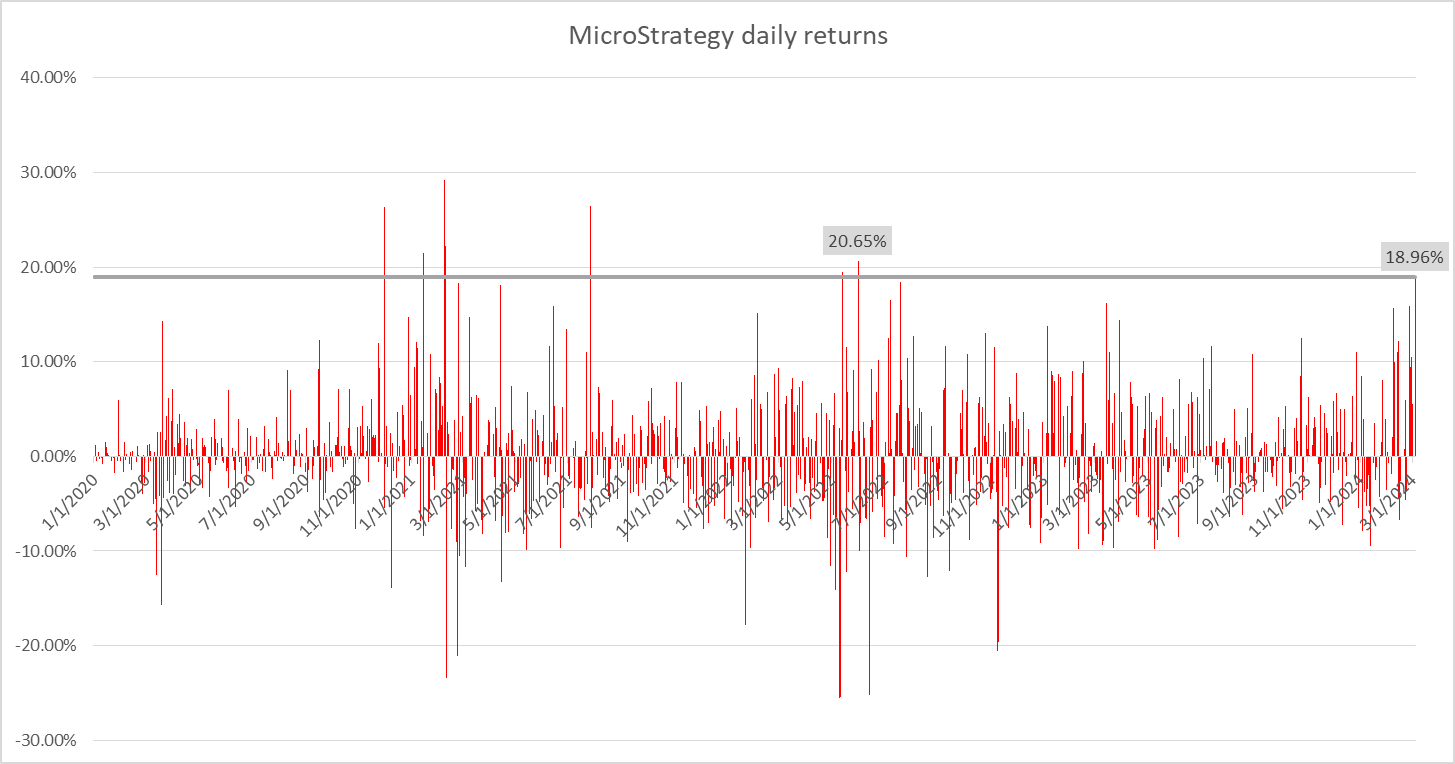

MicroStrategy (MSTR.US) is an outperformer among US crypto stocks today, with company's share price surging around 19% at press time. If maintained until the end of today's trading, this would be the biggest single-day jump for the stock since late-May 2022. While MicroStrategy is the US business intelligence company, it is mostly associated with its massive Bitcoin holdings, which now amount to around 193 thousand Bitcoins.

MicroStrategy (MSTR.US) surges around 19% and has even briefly traded above 2021 highs today. Source: xStation5

MicroStrategy (MSTR.US) surges around 19% and has even briefly traded above 2021 highs today. Source: xStation5

MicroStrategy makes the biggest single-day jump since late-May 2022. Source: Bloomberg Finance LP, XTB Research

MicroStrategy makes the biggest single-day jump since late-May 2022. Source: Bloomberg Finance LP, XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street