Minutes from the September FOMC meeting showed that there was a debate about when it is appropriate to end policy easing. A few bankers judged that market were pricing too much easing from the Fed side. Several members suggested that Fed should clarify when easing would end. Except that, minutes showed that several members wanted to keep rates steady. That may indicate that some members supported cut in September but they not willing to continue loosening monetary policy this year further

These remarks seem to be a little hawkish and show that there is a split in the committee. Nevertheless it is worth to mention that the situation has changed dramatically since the September meeting. Additionally many members cited inflation in justifying September rate cut which should put focus on inflation data tomorrow. We should notice that market currently is pricing about 1.5 cut this year. EURUSD is steady after the publication and treasuries pare declines. Wall Street remains high today.

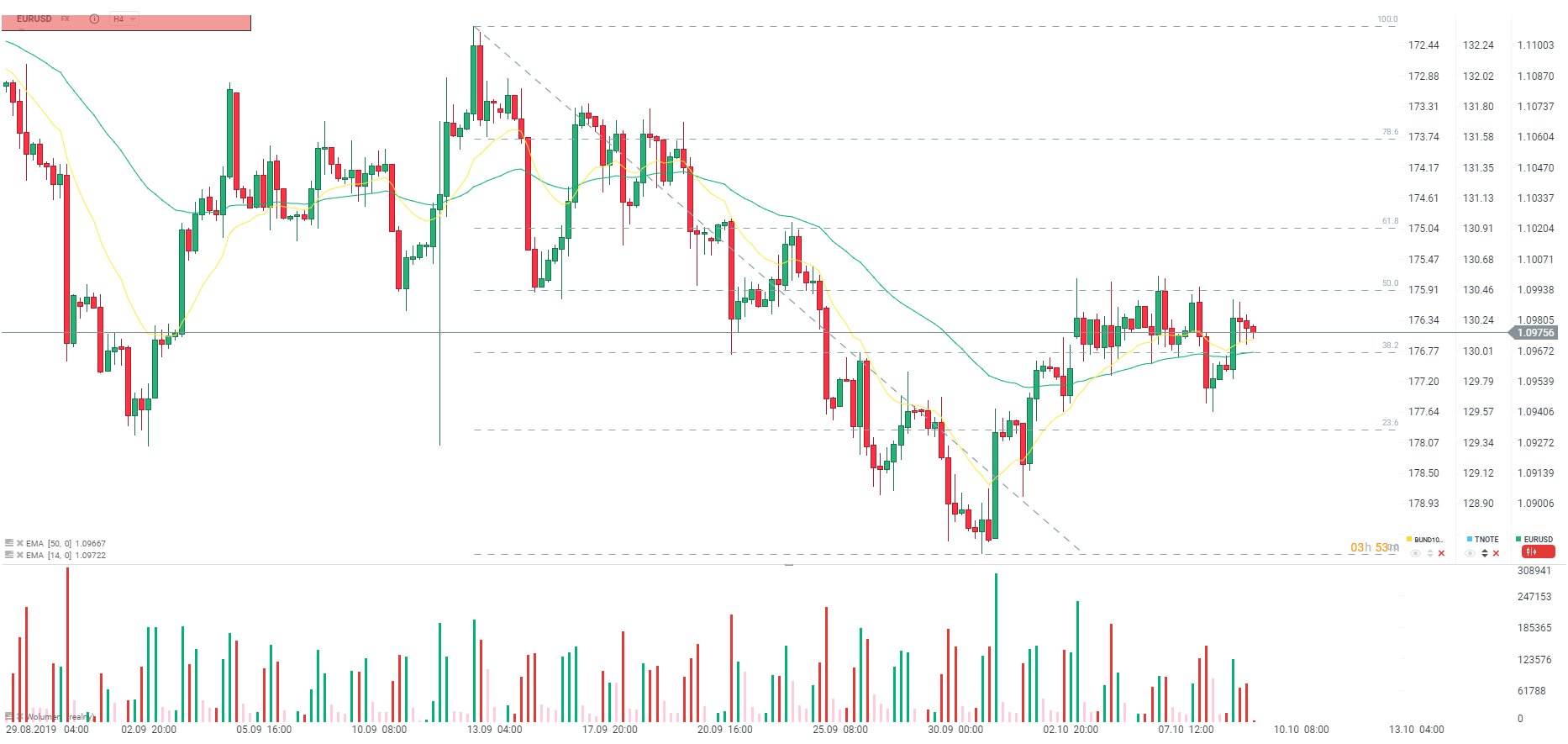

EURUSD is steady after FOMC minutes publication. Source: xStation5

EURUSD is steady after FOMC minutes publication. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)