-

Oil launched new week's trading with a big bullish price gap after OPEC countries announced voluntarily output cuts over the weekend

-

OPEC countries pledged to cut over 1 million barrels of daily output, with Saudi Arabia being responsible for over half a million

-

Brent and WTI erased part of the gains but still trade around 5% higher on the day

-

Output cut came as a surprise as media reports prior to the weekend hinted that OPEC+ JMMC will likely recommend to keep output unchanged at a meeting today

-

Indices from Asia-Pacific traded mixed today - Nikkei and S&P/ASX 200 gained 0.5% each while Kospi dropped 0.2% and Nifty 50 traded 0.1% lower. Indices from China traded up to 1.2% higher

-

European and US index futures trade slightly below Friday's cash closing prices

-

Goldman Sachs updated oil price forecasts following a surprise OPEC output cut. The Bank now expects Brent price of $95 per barrel in December 2023 ($90 prior) and $100 per barrel in December 2024 ($97 prior)

-

ECB De Guindos said that while headline CPI in euro area is likely to fall this year, core inflation will likely stay firm. ECB members said that European banking sector is robust and that there is ample liquidity in the sector

-

Fed's Waller said that recent data shows that inflation can be brought down with causing damage to the labor market

-

Chinese Caixin manufacturing PMI dropped from 51.6 to 50.0 in March (exp. 51.7)

-

Australian building permits increased 4.0% MoM in February (exp. -2.6% MoM)

-

Cryptocurrencies are trading lower. Bitcoin drops 1%, Ethereum trades 0.4% lower while Dogecoin and Ripple dip 1.8%

-

Precious metals are pulling back amid USD strengthening - gold and platinum trade 0.9-1.0% lower while silver drops almost 2%

-

USD and JPY are the best performing major currencies while NZD and EUR lag the most

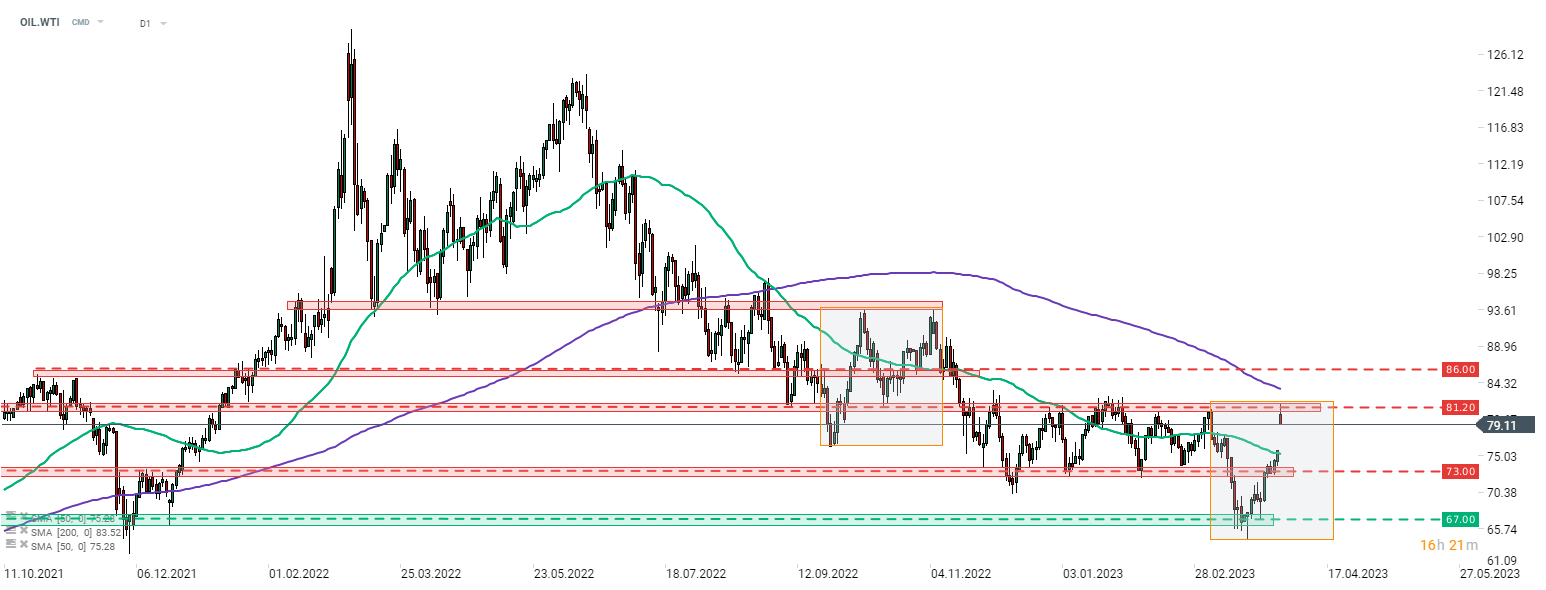

A surprise output cut from OPEC triggered a spike on the oil market. WTI (OIL.WTI) launched a new week near the $81.20 resistance zone, marked with the upper limit of previous trading range as well as the upper limit of the Overbalance structure. However, bulls failed to break above it on the first attempt. Source: xStation5

A surprise output cut from OPEC triggered a spike on the oil market. WTI (OIL.WTI) launched a new week near the $81.20 resistance zone, marked with the upper limit of previous trading range as well as the upper limit of the Overbalance structure. However, bulls failed to break above it on the first attempt. Source: xStation5

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

🚩Silver loses 3%