-

Indices from Asia-Pacific traded mixed today. Nikkei gained 0.5% while S&P/ASX 200 dropped 0.3%. Liquidity was thinner due to market holidays in China and South Korea

-

US and European index futures dropped at the start of a new week but have recovered the majority of the drop since. DAX futures trade around 150 pts below Friday's cash close

-

Telegraph reports that vote on cutting UK income tax rate for high earners from 45 to 40% will be postponed until sources of financing are presented in budget in late-November

-

BBC reports that whole idea of tax cut for high earners may be dropped

-

S&P maintained 'AA' rating on the UK debt but changed outlook from "stable" to "negative"

-

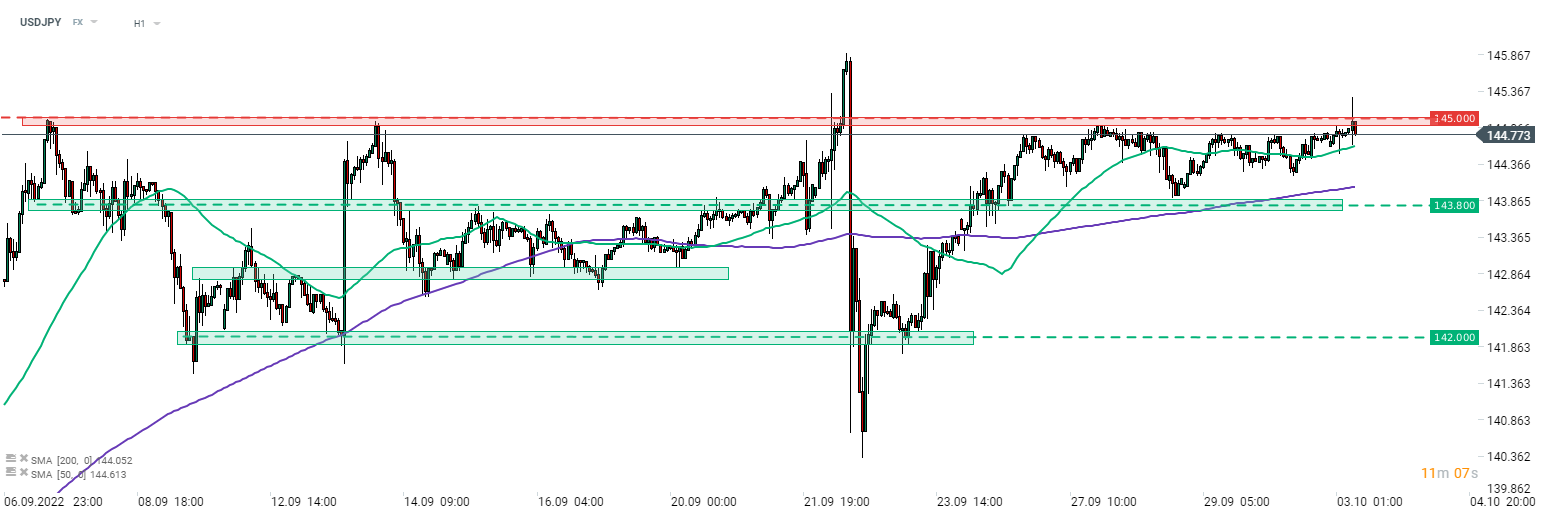

Japan's finance minister Suzuki repeated that authorities are monitoring FX moves and will respond if necessary. USDJPY jumped above 145.00 today, a level that trigger intervention two weeks ago

-

Oil is trading higher at the beginning of a new week amid media chatter that OPEC+ may cut output this week by 1 million bpd or 1.5 million

-

Precious metals gain as the US dollar rally is taking a pause this morning. Gold and platinum gain 0.2% while silver is rallying 2%

-

AUD and NZD are the best performing major currencies while JPY and USD lag the most

-

Cryptocurrencies are pulling back. Bitcoin trades 0.2% lower, Ethereum drops 0.7% while Ripple slides over 4%

USDJPY jumped above a key 145.00 resistance zone this morning, leading to a verbal intervention from finance minister Suzuki. The pair pulled back slightly since but remains near recent highs. Source: xStation5

USDJPY jumped above a key 145.00 resistance zone this morning, leading to a verbal intervention from finance minister Suzuki. The pair pulled back slightly since but remains near recent highs. Source: xStation5

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Three markets to watch next week (27.02.2026)

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨

Chart of the Day: EURUSD in Consolidation Ahead of Macro Data from Europe and the US