-

Indices from Asia-Pacific traded higher at the start of a new week. Nikkei gained 0.6%, Kospi added 0.4% and indices from China traded up to 2% higher. S&P/ASX 200 was a laggard and dropped 0.5%

-

DAX futures point to a higher opening of today's European cash session

-

Pandemic situation in China continues to improve. Indoor dining will be allowed in Beijing starting from today while traffic bans will be remove in most areas of the city

-

US President Biden is expected to sign executive order to boost domestic production of solar panels and other clean energy project

-

Rebels in the Conservative party are expected to launch a no confidence vote in UK Prime Minister Boris Johnson

-

EU is reportedly readying the seventh package of sanctions against Russia

-

Oil is trading higher at the beginning of a new week after Saudi Aramco increased prices for Asian delivery by more than expected. Prices for European customers were also increased but in-line with expectations. Prices for US deliveries were left unchanged

-

United States will allowed Italian Eni and Spanish Repsol to purchase Venezualan oil without breaching sanctions

-

The largest oil field in Libya resumed operations after it was shut down since April due to protests. Oil production at the field is around 300k bpd

-

EU Commissioner Gentiloni said that EU members will be allowed to use funds from post-pandemic recovery fund to increase their LNG capacity

-

North Korea fired 8 ballistic missiles into the East Sea on Sunday. South Korea responded by firing 8 of its own ballistic missiles into the East Sea

-

Cryptocurrencies trade higher. Bitcoin rallies 4% while Ethereum trades 3.2% higher

-

Precious metals advance. Palladium is a top performer, gaining 3.2%, followed by silver with a 1.4% gain

-

JPY and EUR are the best performing major currencies while AUD and NZD lag the most

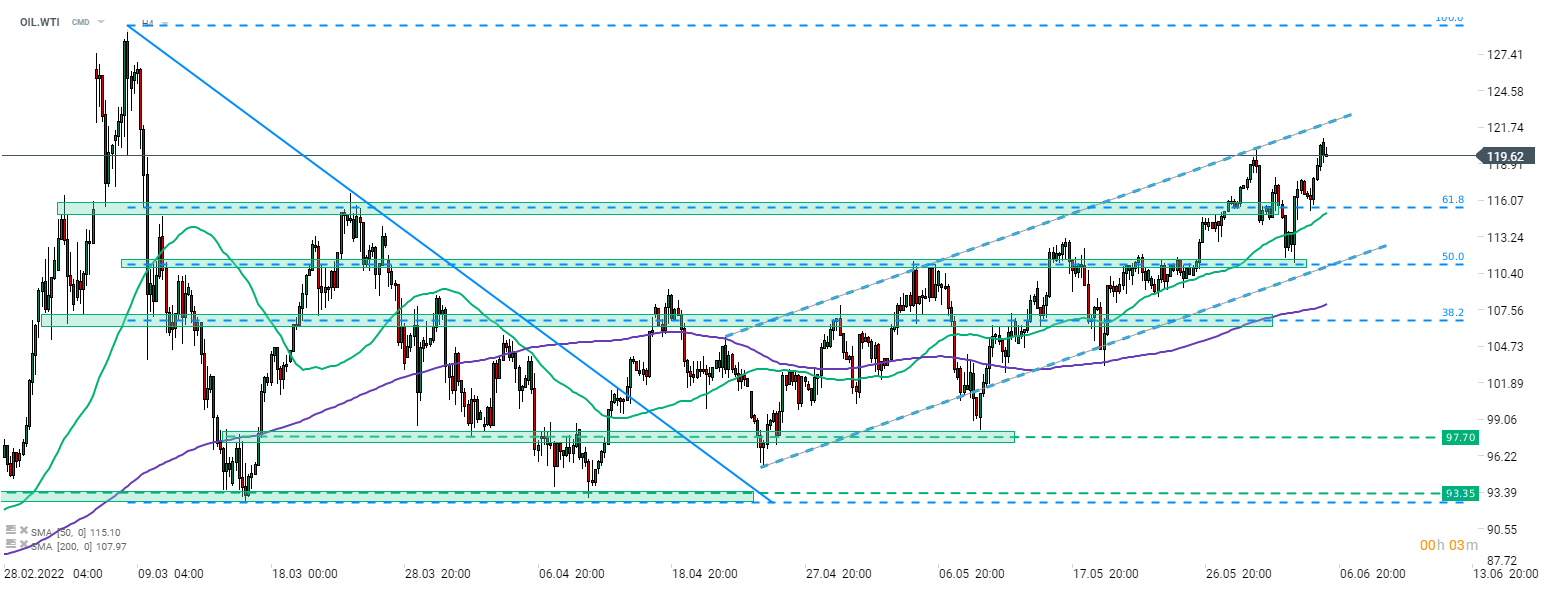

Oil recovered from a recent pullback and trades at the highest level in almost 3 months. WTI (OIL.WTI) climbed above $120 per barrel but halted advance in the $121 area later on, slightly below the upper limit of the upward channel. Source: xStation5

Oil recovered from a recent pullback and trades at the highest level in almost 3 months. WTI (OIL.WTI) climbed above $120 per barrel but halted advance in the $121 area later on, slightly below the upper limit of the upward channel. Source: xStation5

Morning wrap (10.03.2026)

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!