- Asia-Pacific indices traded mixed today after Wall Street's better performance on Monday. The Nikkei rose 0.8%, S&P/ASX 200 declined 0.5%, Kospi with no change and Nifty 50 fell 0.3%. In contrast, Chinese indices traded slightly higher

- The Australian AUD rose after the country's central bank surprised markets by boosting interest rates above expectations to battle inflation

- The RBA increased Australian OCR to 4.1% versus forecasted 3.85% and previously 3.85%

- The board is steadfast in its goal to return inflation to target, further tightening by is dependent on how inflation and the economy progress, but may be required

- Labour market conditions in Australia have softened but remain extremely tight

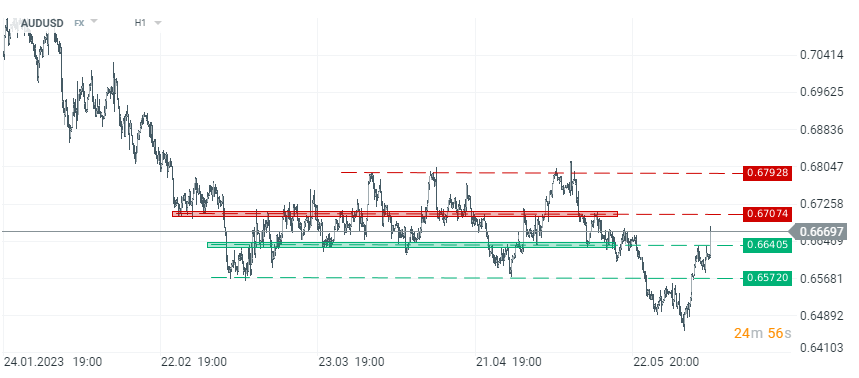

- AUDUSD rose 0.9% to 0.6675 after an unexpected rate hike to 4.1% from 3.85%

- Futures for US benchmarks were stable after tech stocks led the S&P 500 lower on Monday, with Apple wiping out gains of up to 2% as investors weighed the possibilities of a new mixed-reality headset

- Chevron and Exxon Mobil both fell after earlier rallying on higher oil prices following Saudi Arabia's supply cut

- Morgan Stanley research set a year-end target for US500 to 3,900 points. Earnings per share for the S&P 500 are set to drop 16% this year, anticipates that S&P 500 earnings per share will come in at $185, compared with a median $206 prediction

- According to Morgan Stanley a deteriorating liquidity backdrop is likely to put downward pressure on equity valuations over the next three months

- the Federal Reserve is expected to hold rates steady in June while keeping the door open for future hikes

- Precious metals trade mixed - gold drop while silver, platinum and palladium gain

AUDUSD, H1 interval, source xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS