-

US indices gained for the fourth day in a row. S&P 500 and Dow Jones added 1.95% each while Nasdaq rallied 2.59%

-

Moods are also upbeat in Asia. S&P/ASX 200 gains 0.8% while Kospi trades 0.1% higher. Nikkei closed 0.91% higher. Indices from China lag

-

DAX futures point to a lower opening of the European session

-

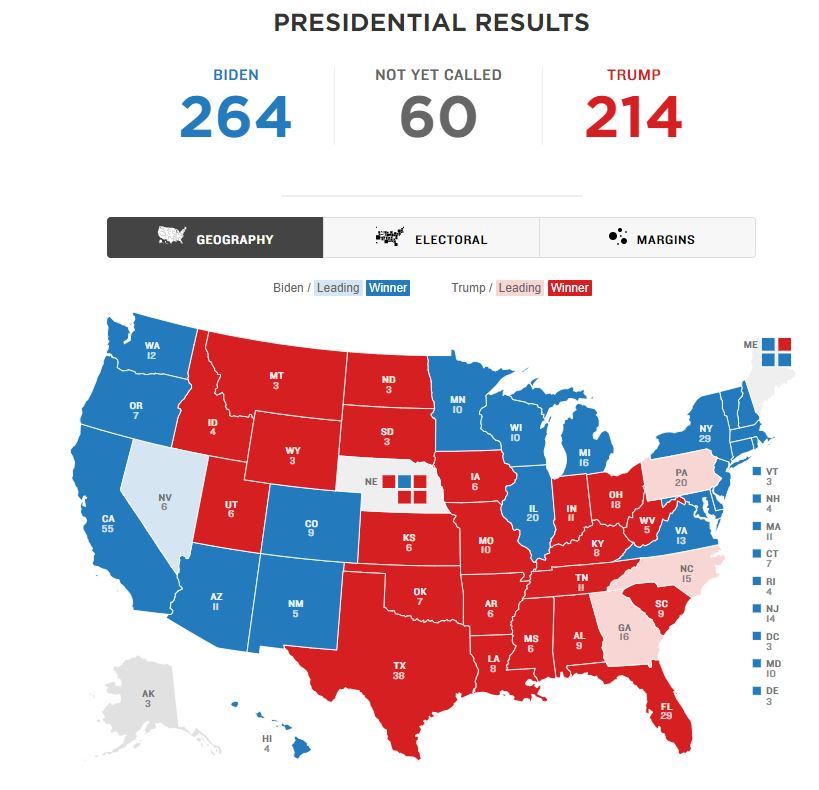

We still do not know who will be the next US president. Electoral vote count remains unchanged at 264-214 in favour of Biden

-

Winner has not been called yet in Nevada, Georgia, North Carolina and Pennsylvania. Some media outlets called Arizona for Biden while others say its still open contest

-

Biden has regained a lot of ground against Trump in Georgia and Pennsylvania

-

Trump's campaign launched a barrage of lawsuits but it is said that most of them have little to no basis

-

FOMC left rates and scale of QE programme unchanged at the meeting yesterday

-

New York Post reports that Vladimir Putin plans to step down from the office in 2021 on the back of health reason

-

Oil price is pulling back amid new round of lockdowns in Europe

-

United States reported a record 118k new coronavirus cases yesterday

-

Bitcoin trades at the highest level since the turn of 2017 and 2018

-

Japanese household spending dropped 10.2% YoY in September (exp. -10.7% YoY)

-

AUD and NZD are top moving major currencies while CAD and GBP lag the most

We still do not know the winner of US presidential elections but we will likely get to know him today. Source: NPR

We still do not know the winner of US presidential elections but we will likely get to know him today. Source: NPR

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers