-

Stocks in Asia are trading lower at the beginning of a new week amid increase in risk aversion. Nikkei dropped almost 0.5%, Kospi moved 0.9% lower and indices from China plunged. S&P/ASX 200 added 0.4%

-

DAX futures point to a higher opening of the European session

-

Oil rallies with Brent jumping above $70 per barrel. Saudi export port and production facilities have been targeted by a drone and missile attack over the weekend with Iran-backed Houthi being named as the aggressor. Saudi Arabia said that there were no injuries or major property damage

-

US Senate passed $1.9 trillion stimulus deal. However, some amendments were added and now the bill will head back to the House (vote expected on Tuesday)

-

Fed interest rate hike is fully priced in for December 2022

-

According to New York Times, United States plans to retaliate against Russian hackers by targeting networks used by Russian intelligence and military

-

Chinese imports increased 22.2% YoY in February (exp. 15% YoY) while exports rose 60.6% YoY (exp. 37.5% YoY)

-

Bitcoin recovered and tested the $51,500 mark over the weekend. However, coin was unable to break above it and price pulled back below $50,000

-

Precious metals gain with silver being top performer and platinum being top laggard. Industrial metals trade lower while agricultural commodities gain

-

AUD and USD are the best performing major currencies while CHF, EUR and NZD lag the most

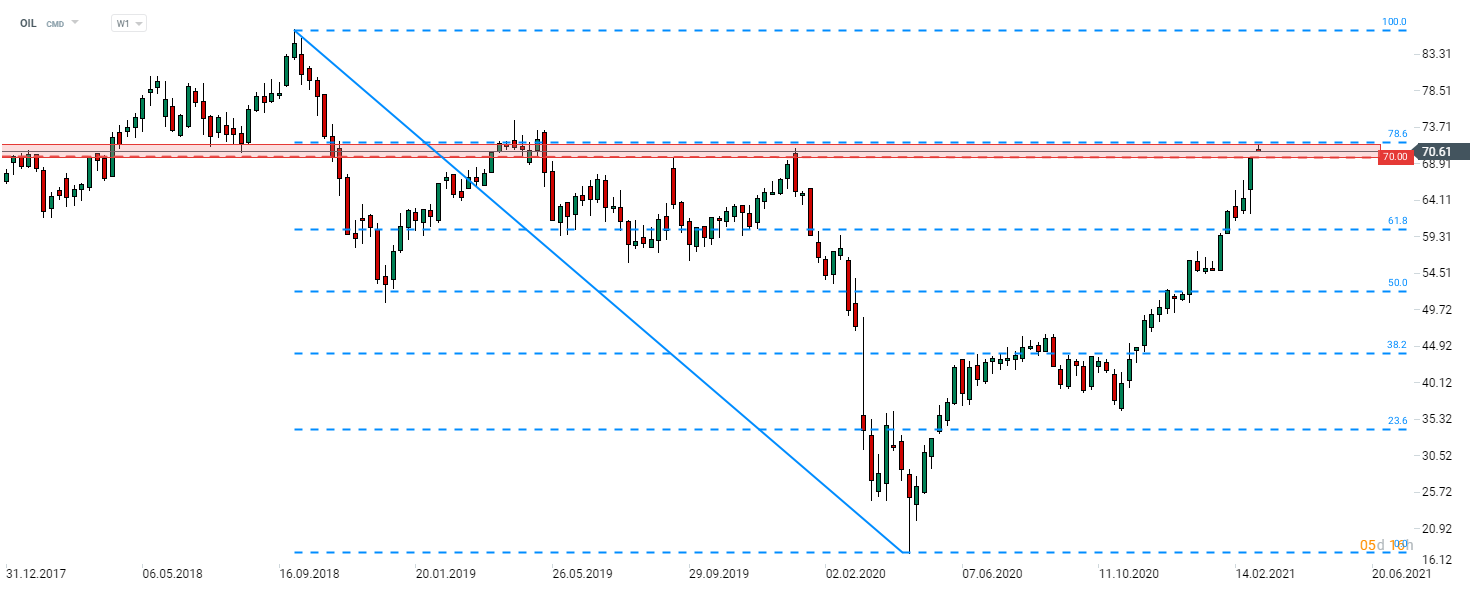

Oil launched a new week with a big bullish price gap following attacks on Saudi oil facilities. Brent (OIL) opened above $70 per barrel and reached the highest level since May 2019. Major resistance zone ranges between $70 mark and 78.6% retracement of the downward move started in October 2018 ($72). Source: xStation5

Oil launched a new week with a big bullish price gap following attacks on Saudi oil facilities. Brent (OIL) opened above $70 per barrel and reached the highest level since May 2019. Major resistance zone ranges between $70 mark and 78.6% retracement of the downward move started in October 2018 ($72). Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74