-

US indices finished yesterday's trading with a big drop. S&P 500 dropped 2.38%, Dow Jones moved 1.94% lower while Nasdaq slumped 2.75%. Russell 2000 dropped 2.12%

-

Indices from Asia-Pacific follow the US lead and also trade lower. Nikkei drops 1.3%, S&P/ASX 200 trades 1.0% lower and Kospi declined 1.1%. Equities in China traded higher

-

DAX futures point to a lower opening of the European cash session

-

Deterioration in risk moods is reasoned with the pandemic situation in China, where lockdown started to be reimposed in Shanghai and mass testing will be conducted

-

Oil continues a pullback started yesterday. Brent and WTI trade around 0.3% lower on the day and around $1 above session lows

-

Chinese CPI inflation remained unchanged at 2.1% YoY in May (exp. 2.2% YoY). PPI inflation decelerated from 8.0% to 6.4% YoY (exp. 6.5% YoY)

-

Small gains can be spotted on the cryptocurrency market today. Ethereum trades 0.2% lower and slightly below $1,800. Bitcoin trades flat in the $30,000 area

-

Precious metals are trading a touch lower with palladium being exception (+0.8%)

-

NZD and JPY are the best performing major currencies while USD and CAD lag the most

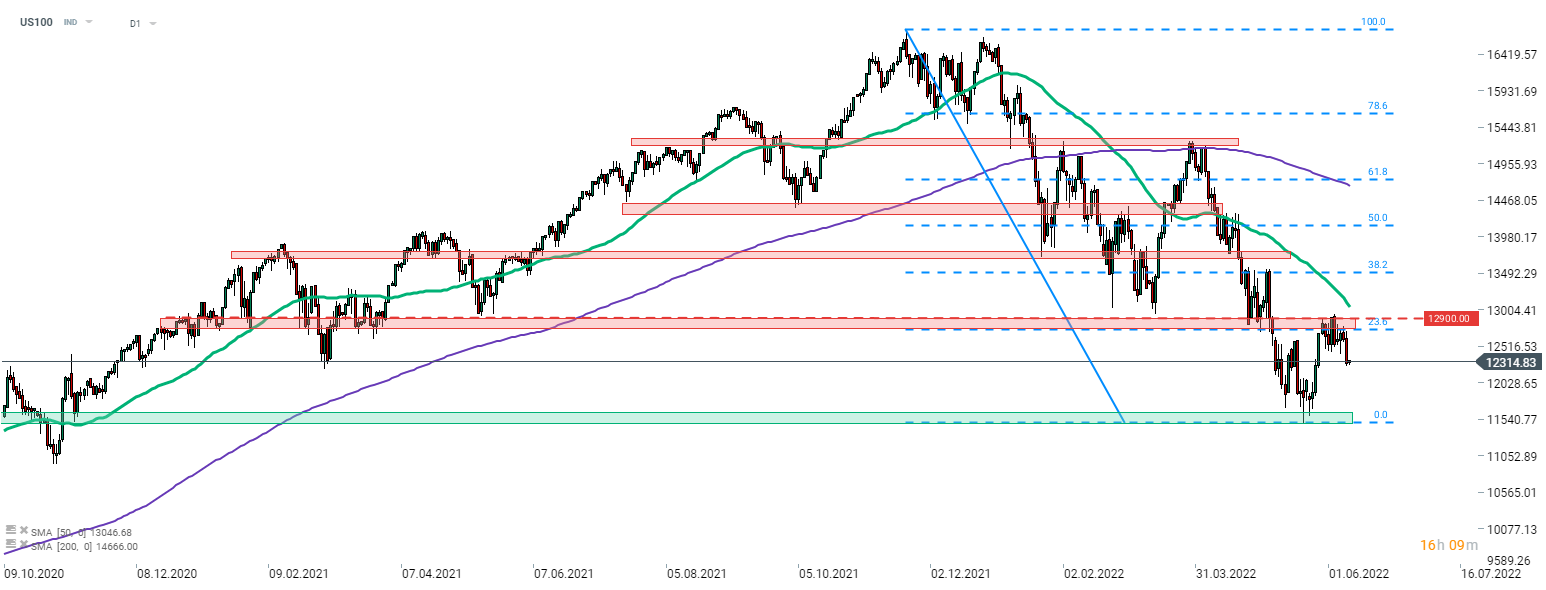

Nasdaq-100 (US100) failed to break above the resistance zone marked with 23.6% retracement (12,900 pts area) and launched a pull back, which accelerated yesterday. A move back towards recent lows below 12,000 pts cannot be ruled out. Source: xStation5

Nasdaq-100 (US100) failed to break above the resistance zone marked with 23.6% retracement (12,900 pts area) and launched a pull back, which accelerated yesterday. A move back towards recent lows below 12,000 pts cannot be ruled out. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers