-

US indices finished yesterday's session with solid gains following positive vaccine news from Pfizer and BioNTech. S&P 500 gained 1.17%, Dow Jones jumped 2.95% and Russell 2000 surged 4.21%. Nasdaq slumped and finished 1.53% lower

-

Stocks in Asia are trading mixed. Nikkei and Kospi gain 0.2%, S&P/ASX 200 trades 0.6% higher but indices from China decline

-

DAX futures point to a lower opening of the European session. US futures erased all of the gains made on Pfizer/BioNTech announcement

-

Federal Reserve released Financial Stability Report yesterday. Central banks claims that impact of further monetary easing may be limited and that assets may see large decline if pandemic is not contained

-

Covid-19 antibody treatment developed by Eli Lilly received US approval for emergency use

-

Trial of the coronavirus vaccine developed by Chinese Sinovac was halted following the death of a participant in Brazil. However, death is said to be unrelated to vaccine

-

Japanese economy minister confirmed that another stimulus package is coming

-

Biden's team is considering legal action in case General Services Administration does not recognize his win and prevents transition

-

Precious metals lead gains on the commodity market. Agricultural commodities lag. Oil pulls back slightly

-

NZD and JPY are top moving majors while CAD and CHF lag the most

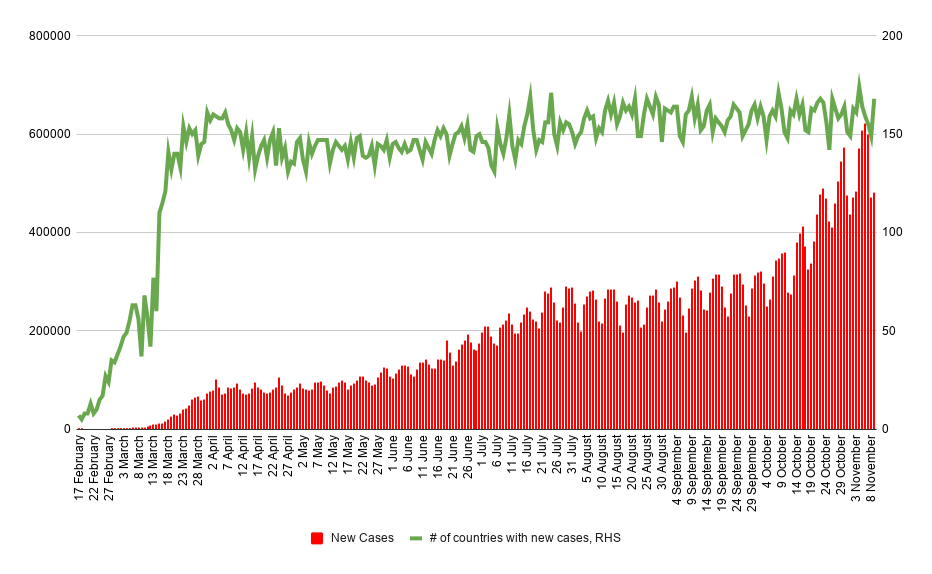

482,000 new coronavirus cases were reported yesterday. Source: worldometers, XTB

482,000 new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers