-

US indices finished yesterday's trading mixed. S&P 500 dropped 0.03%, Nasdaq declined 0.25% and Dow Jones gained 0.20%. Russell 2000 dropped 0.72%

-

Trading in Asia was muted as China and Japan were off for holiday. S&P/ASX 200 declined 0.1%

-

DAX futures point to a flat opening of the European session

-

Joe Biden spoke with China's Xi on phone. Leaders agreed that cooperation is better than confrontation. Biden said that he will work with China when it benefits the United States

-

United States will review trade policy with China

-

Fed Chair Powell said that the outlook for the jobs market is still bleak with the real unemployment rate being close to 10%. He said that rates will remain low

-

United States are willing to work with the European Union to resolve Airbus-Boeing dispute once new US Trade Representative takes office

-

Janet Yellen said that she is supportive of digital assets but high misuse risks remain a problem

-

Precious metals and agricultural commodities pull back. Oil trades flat

-

Bitcoin trades near $44,500

-

CHF and USD are the weakest major currencies while AUD and NZD are top performers

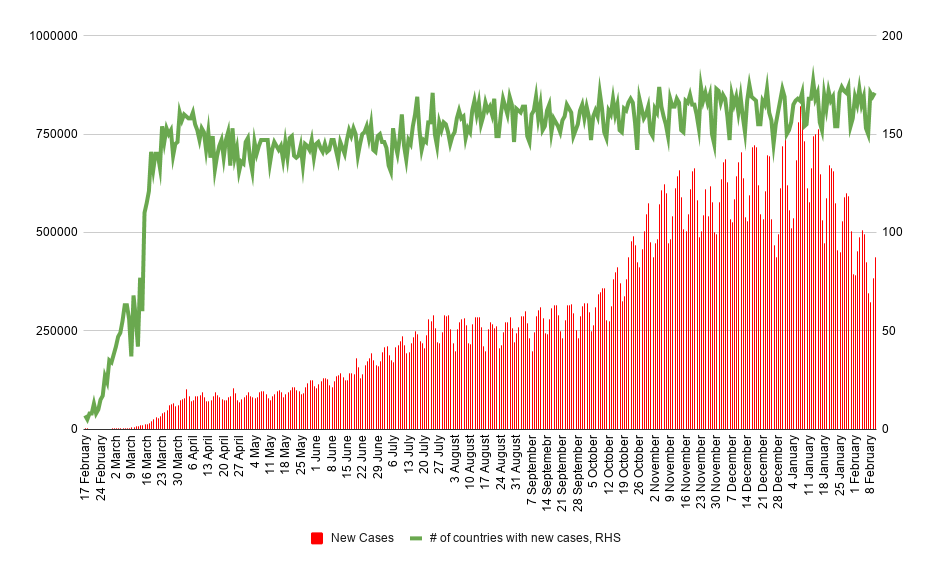

Almost 440 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Almost 440 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report