-

US indices finished yesterday's trading higher after a volatile session. S&P 500 gained 0.45%, Nasdaq moved 1.04% and Russell 2000 added 0.56%. Dow Jones was a laggard and closed 0.09% lower

-

Indices from Asia-Pacific traded mixed today - S&P/ASX 200 dropped 0.1%, Kospi added 0.2%, Nifty 50 gained 0.2% and Nikkei traded flat. Indices from China traded slightly lower

-

DAX futures point to a slightly higher opening of the European cash session

-

Chinese CPI inflation slowed from 0.7 to 0.1% YoY in April (exp. 0.3% YoY). PPI inflation plunged further into negative territory, dropping from -2.5% to -3.6% YoY (exp. -3.2% YoY)

-

Major US banks see an increased chance of FOMC rate pause at the June meeting, following yesterday's CPI data. Wall Street Journal insider suggest that FOMC may keep rates unchanged throughout the summer

-

According to Nikkei report, Dai-iChi Life Insurance and Nippon Life Insurance - two major Japanese insurers, plan to cut holdings of US Treasuries and instead increase holdings of Japanese government bonds

-

Summary of Opinions from BoJ April meeting showed that Bank plans to continue with current easy monetary policy amid uncertainty over condition of the global economy

-

Australian Treasurer Chalmers said his country aims to stabilize relationship with China

-

Energy commodities trade higher with oil gaining 0.8% and US natural gas prices adding 0.2%

-

Precious metals trade slightly higher - gold gains 0.1%, platinum and palladium add 0.3% each while silver drops 0.1%

-

NZD and JPY are the best performing major currencies while CHF and CAD lag the most

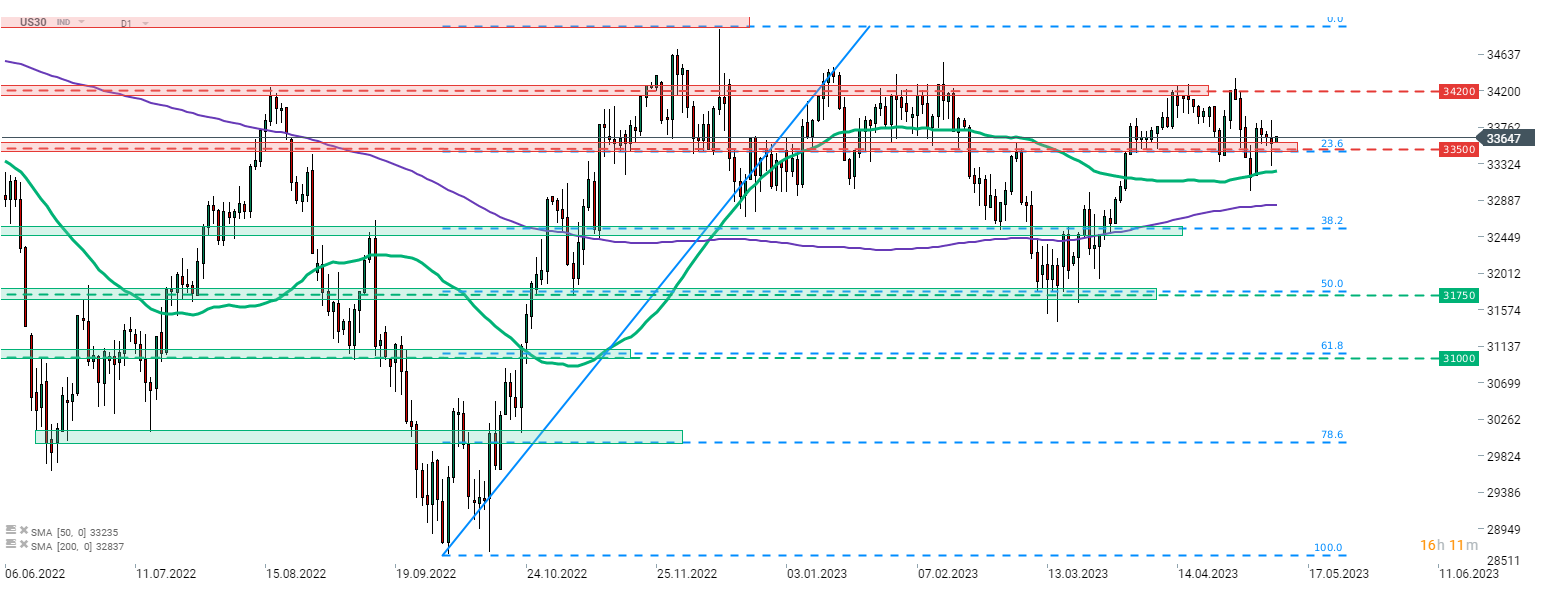

Dow Jones (US30) was a laggard among major Wall Street indices yesterday and dropped around 0.1% in cash trading. Nevertheless, US30 bulls managed to defend support zone ranging above 33,500 pts mark and 23.6% retracement, and small gains can be spotted on this market today. Source: xStation5

Dow Jones (US30) was a laggard among major Wall Street indices yesterday and dropped around 0.1% in cash trading. Nevertheless, US30 bulls managed to defend support zone ranging above 33,500 pts mark and 23.6% retracement, and small gains can be spotted on this market today. Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

Mixed sentiments on Wall Street amid Iran war🗽Oracle shares surge 10%