-

US indices finished yesterday's trading little changed as post-CPI euphoria failed to last. S&P 500 gained 0.03%, Dow Jones moved 0.15% higher and Nasdaq added 0.12%. Russell 2000 dropped around 0.5%

-

Indices from Asia-Pacific are trading lower today - S&P/ASX 200 and Kospi drop 0.3%, Nifty 50 trades 0.4 lower and indices from China drop over 1%. Japanese stock exchanges were shut for Mountain Day holiday

-

DAX futures point to a lower opening of the European cash session today

-

Fed Harker said that Fed is making progress in inflation fight. This is another rather dovish remark from usually hawkish Harker after he said that Fed may hold rates unchanged at September meeting earlier this week

-

RBA Governor Lowe said that the Bank expects CPI to be around 3.25% by the end of next year and to return to 2-3% target by late-2025. Lowe said that getting to inflation target in 2024 would require significant rate hikes and this is not in national interest

-

ECOWAS, group of countries from West Africa, activated its standby force as the risk of military intervention in recently coup-hit Niger increases. Earlier, ECOWAS gave Niger's military junta 7-day deadline to restore democratic order but it was not met

-

New Zealand manufacturing PMI dropped from 47.4 to 46.3 in July - this was the fifth month when the index sits below 50 pts threshold

-

Major cryptocurrencies trade lower - Bitcoin and Dogecoin drop 0.2% while Ethereum declines 0.1%.

-

Energy commodities trade a touch lower - oil drops 0.1% while US natural gas prices are down 0.2%

-

Precious metals gain - gold and silver trade 0.1% higher, platinum adds 0.7% and palladium rallies 1.5%

-

GBP and EUR are the best performing major currencies while NZD and USD lag the most

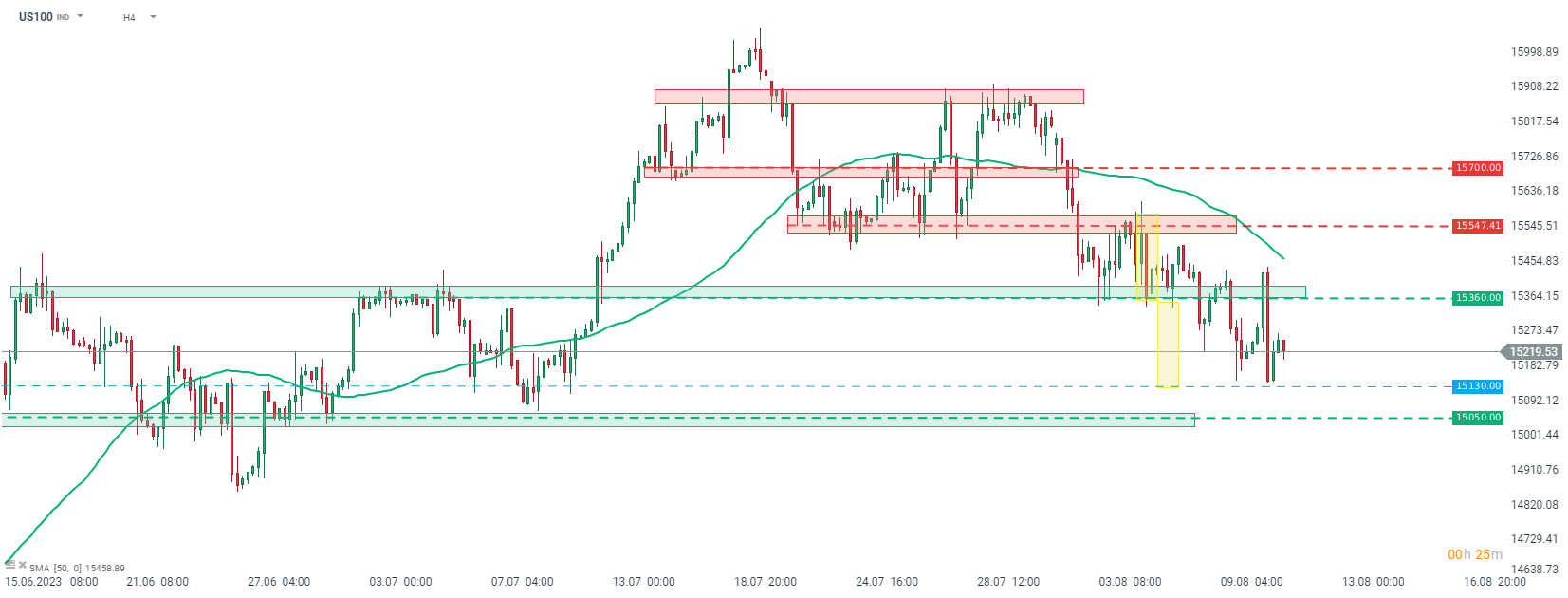

US100 reached the textbook range of the downside breakout from the recent trading range and tried to recover later on. However, index failed to break back above 15,360 pts zone yesterday and another wave of selling began. Source: xStation5

US100 reached the textbook range of the downside breakout from the recent trading range and tried to recover later on. However, index failed to break back above 15,360 pts zone yesterday and another wave of selling began. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report